A year of challenges for an international economy further along in the cycle

The international economy showed remarkable resilience in 2024 and the available data suggest that world GDP may have grown slightly above 3%. The tailwinds that supported economic activity will likely continue to blow in 2025, albeit with less strength and in the face of significant challenges.

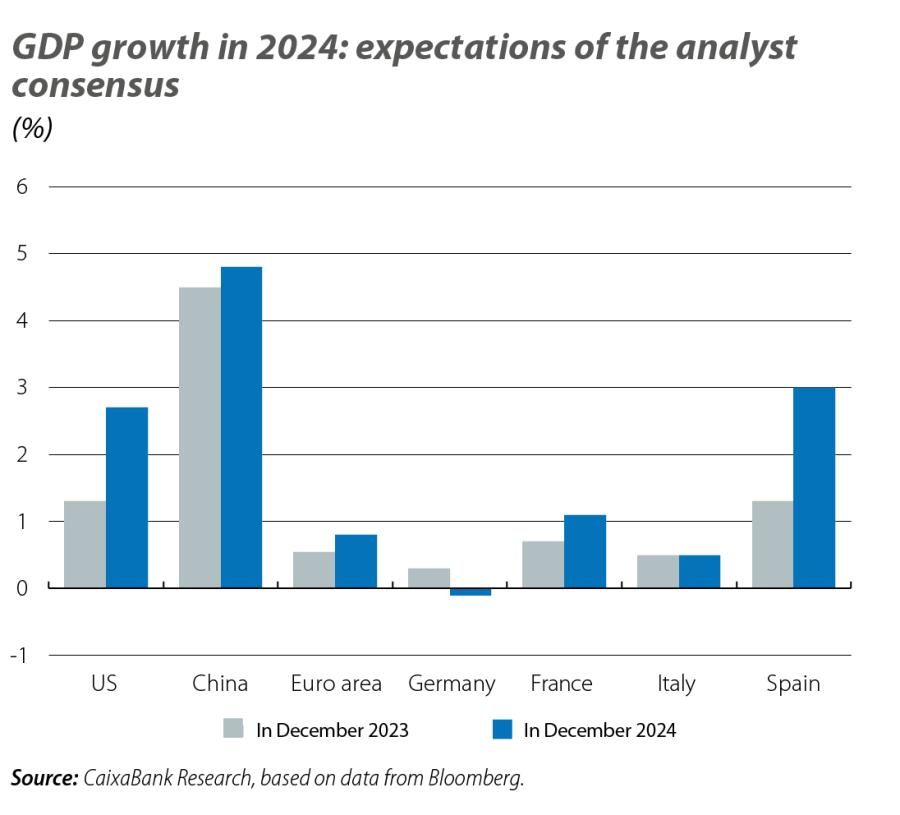

In 2024, the international economy showed remarkable resilience and the available data suggest that world GDP may have grown slightly above 3%. Economic activity was supported by the strength of the labour market, a certain recovery of household purchasing power and the prospect of an easing of financial conditions, in a year in which inflation continued to fall and ended close to, albeit still slightly above, the monetary authorities’ target. These tailwinds are likely to continue to blow in favour in 2025, albeit with less strength due to the maturity of the business cycle, while the risk map will continue to present significant challenges, especially in terms of geopolitical conflicts and tensions, and uncertainties surrounding trade policy. On the other hand, behind the global resilience lie significant regional disparities. In the US, activity remains strong and GDP growth is beating expectations, while in the euro area GDP is struggling to take off, weighed down by the weakness of the core economies. In China, meanwhile, the difficulties in the real estate sector and the weak performance of domestic demand continue to weigh on the economy, although the strength of the foreign sector is helping to maintain growth close to, albeit below, 5.0%.

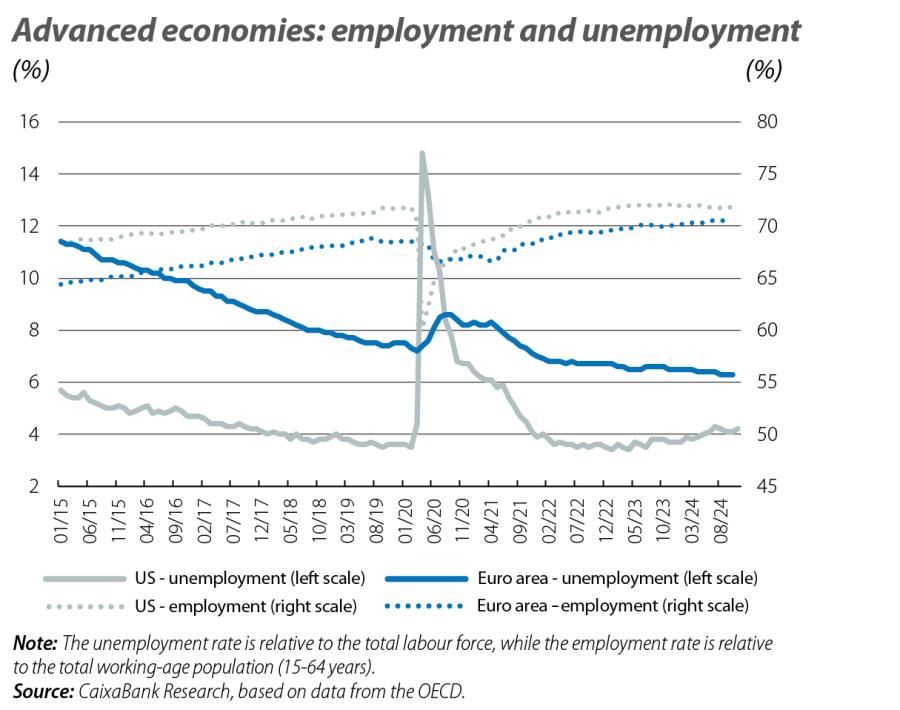

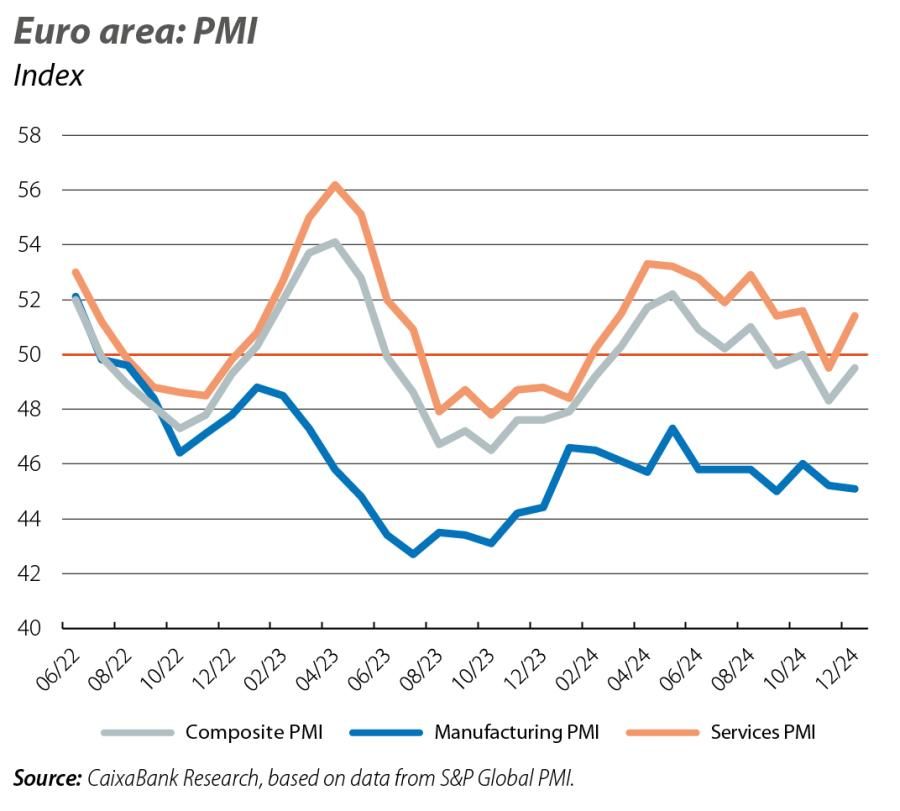

The latest indicators highlight both the supporting role played by the labour market and the prospect that this support could lose some momentum in the future. Both in the US and in the euro area there are low rates of unemployment (4.2% and 6.3%, respectively) and high levels of employment (slightly over 70% among the population aged 15 to 64). However, in the US, unemployment has accumulated an increase of 0.8 pps from its low point in 2023, while job creation has slowed from more than 250,000 new jobs per month at the beginning of the year to 130,000 on average in October and November (distortions related to hurricanes and strikes in those months make the average more informative than the volatile monthly statistics of +36,000 jobs in October and +227,000 in November). In the euro area, the rate of 6.3% represents the lowest unemployment rate in the historical series, but the sentiment indicators hint at a slowdown in job creation, both in the PMI indices (in December, the employment component hit a four-year low) and in the European Commission’s indicator (steadily decreasing in 2024 and with the latest figure for November standing slightly below the historical average).

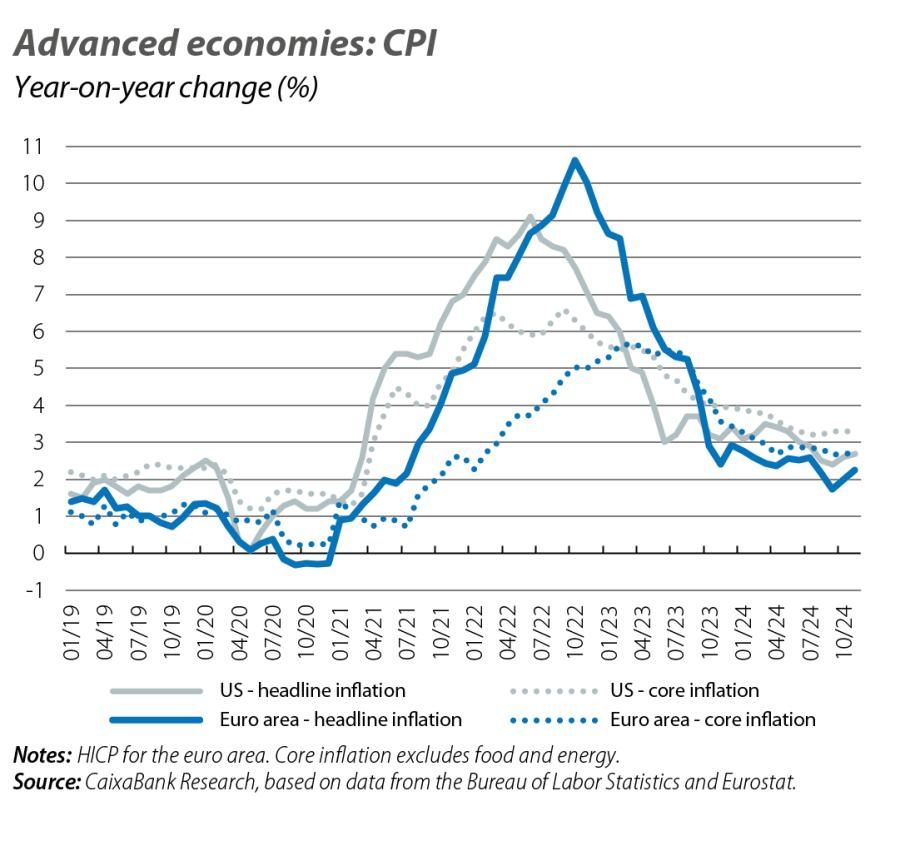

The widespread decline in inflation over the course of 2024 also supported economic activity, especially by helping the recovery of household purchasing power and paving the way for an easing of monetary policy. In the euro area, headline inflation closed the year at 2.4% in December, but most significant was the sustained decline in core inflation, which went from 3.4% in December 2023 to 2.7% in December 2024. Indeed, the inertia of the core index reinforces the confidence that inflation should sustainably settle at around the ECB’s 2% target this year. In the US, inflation also moderated during the year (headline CPI +2.7% in November 2024 vs. 3.4% in December 2023). However, in recent months fears have grown of greater stickiness in the underlying pressures, both due to the signals coming from the data (core inflation stable at 3.2%-3.3% since the summer, according to the CPI, and even with a slight rebound according to the Fed’s preferred index, the PCE, for which core inflation accelerated from 2.6% in the summer to 2.8% in November) and because of the inflationary nature of the economic policies proposed by the new Trump administration.

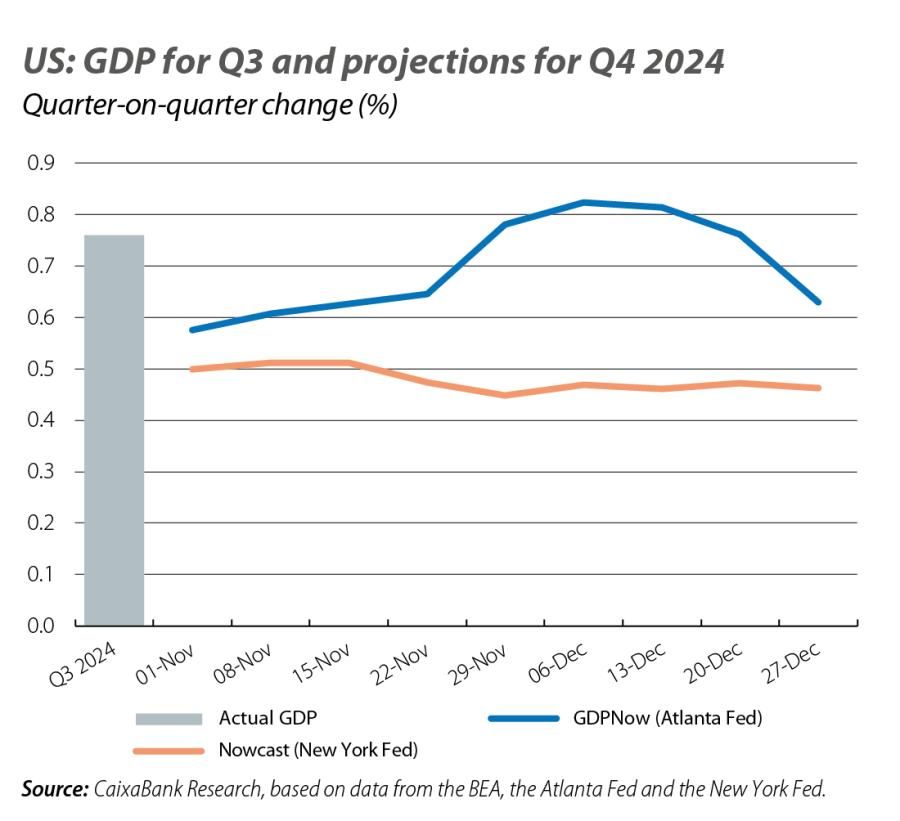

Household consumption continues to drive economic growth in the US and, after contributing 0.6 pps to the 0.8% quarter-on-quarter GDP growth recorded in Q3, the latest data suggest that consumption remains dynamic in the final quarter of the year. Thus, retail sales increased by 0.5% month-on-month in October and accelerated to 0.7% in November. Similarly, the composite PMI rose to 55.4 points in December, driven by the services sector (56.8), while the Q4 average (54.8) exceeded that of Q3 (54.3). With all this, and despite the weakness of the manufacturing sector (its PMI, at 49.4 points in December, remained in contractionary territory, while industrial production contracted by 0.4% month-on-month in October and by 0.15% in November), the GDP trackers suggest that the economy could grow by around 0.5%-0.6% quarter-on-quarter in Q4.

The composite PMI for the euro area improved in December, but failed to surpass the 50-point threshold that denotes positive growth in economic activity (49.6 vs. 48.3 in November). This was despite the stimulus that the Christmas campaign represents for the services sector (51.6 vs. 49.5 in November), while in manufacturing there are few signs of recovery (PMI stagnant at 45 points). The weak indicators are affecting the bloc’s two biggest economies, with the composite PMI for December in contractionary territory in both Germany (48.0) and France (47.5). In the case of Germany, other business sentiment and climate indicators reflect the same message of weakness: the Ifo business indicator fell in December to 84.7 points, marking its lowest level since May 2020, while the ZEW economic sentiment index for December revealed that over half of respondents expect no change in the current situation.

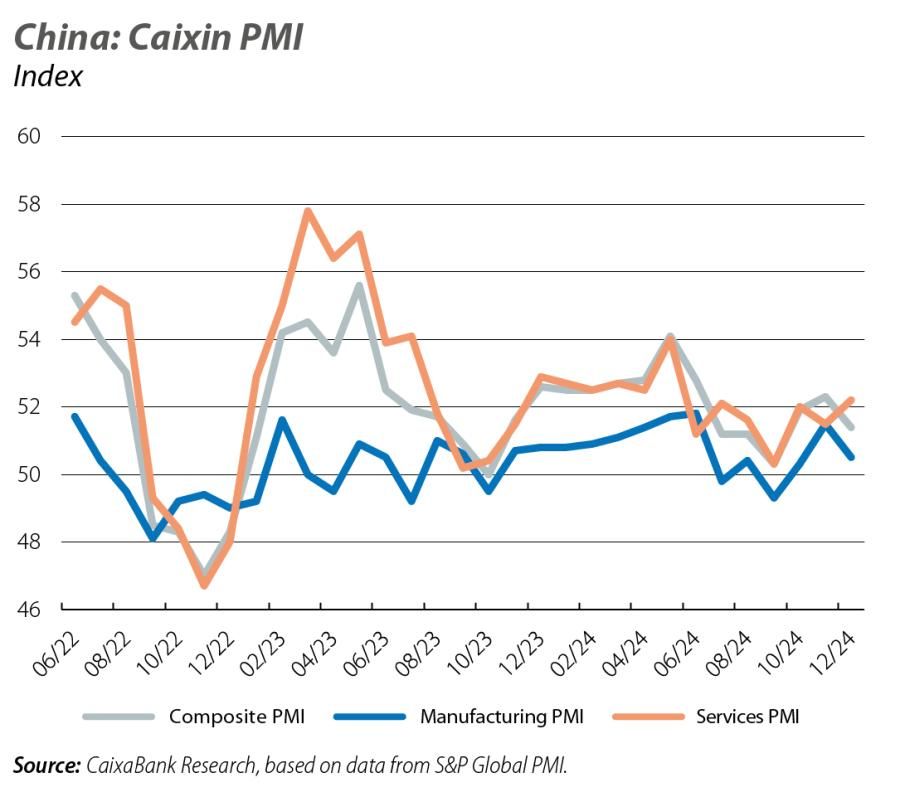

The continued buoyancy of the foreign sector, increased fiscal support and a slight improvement in the outlook for the real estate sector could lead to an acceleration of the Asian giant in the short term. The services PMI (Caixin) accelerated in December to 52.2 points (seven-month high), while the manufacturing PMI remained in expansionary territory (50.5 points, although it lost some steam compared to the 51.5 recorded in November). On the other hand, industrial production in November maintained a similar rate of expansion to that of previous months, registering a year-on-year growth rate of 5.4%, while retail sales once again reflected weakness in domestic demand, with year-on-year growth of 3.0% (vs. 4.8% in October, 2.7% in Q3). Investment, for its part, grew by 3.3% year-on-year to November (vs. 3.4% in the year to date up to October). This represents a slight slowdown, but investment remains high (in real terms), given the sharp falls in the prices of capital goods over the last few years.