Energy: revision of the scenario in turbulent times

As a result of the deterioration in the expectations for the growth of oil demand, we have considered it appropriate to revise our baseline scenario for energy prices, although we are aware of the difficulty of incorporating the uncertain geopolitical scenario into the forecasts.

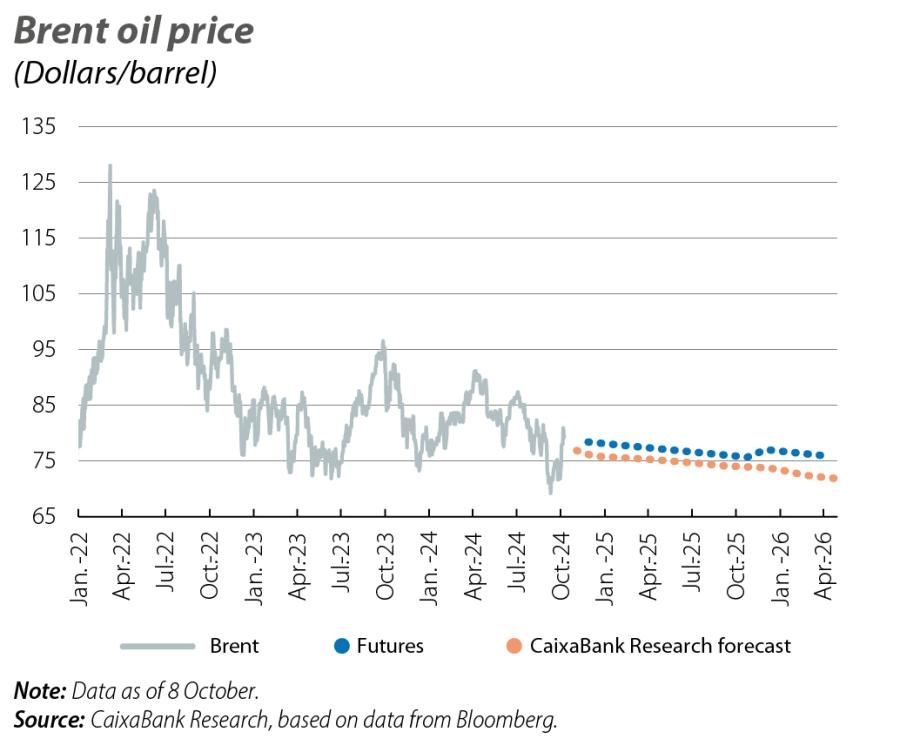

Since last July, commodity prices have fallen sharply,1 driven by the downward adjustment of global growth expectations. Brent crude oil deserves a special mention, as the price of a barrel has been subject to a surge in volatility. The combination of fears of lower global energy demand, in a context of uncertainty over the extent of the monetary easing in the US, triggered a surge in sales which drove down the price per barrel from 87 to 69 dollars, marking a three-year low.

Given this deterioration in the expectations for the growth of oil demand, with doubts surrounding the ability of supply to adjust to the new scenario, we have considered it appropriate to revise our baseline scenario for energy prices, although we are aware of the difficulty of incorporating the uncertain geopolitical scenario into the forecasts.

- 1The S&P Goldman Sachs Commodity Index (GSCI) fell by 8.8% between 1 July and 30 September.

The supply of crude oil will outpace its demand

The expectations of a boost to oil demand coming from China faded after the slowdown of its economic growth in Q2 2024 was confirmed (GDP grew by 4.7% year-on-year in Q2, down from 5.1% in Q1). This statistic highlighted the slump in oil consumption that is taking place in the country, with a cumulative decline of 9% up until August 2024 compared to the peak reached in September last year. Considering that China is the second largest oil consumer in the world (16.7 million barrels per day [b/d] in 2023), behind only the US, and that it is the world’s top net importer, this decline fuelled doubts about the growth rate of global oil demand in the short term.

On the back of this figure,2 and given the slim likelihood of the euro area or the US seeing an increase in the pace of their industrial activity growth in the coming months, the leading international energy organisations3 have revised downwards their estimated growth for oil demand for this year and next. On average, they expect demand to grow in 2024 by around 103.4 million b/d, which is some 200,000 b/d less than was expected in February.

The recent expansionary economic policy measures adopted by the Chinese authorities at the end of September,4 as well as the potential tailwind provided by the interest rate cuts in advanced economies, could have a positive impact on oil demand, but this will not be enough to boost its short-term growth rate.

On the other side of the coin, the global supply of oil is solid. The level of production by OPEC and its allies (currently 31.9 million b/d), which has been limited for almost two years now by internal agreements and voluntary cuts in order to keep the price per barrel above 80 dollars, suggests that we will see a steady increase during the course of 2025.5 The total supply could be increased if Saudi Arabia opts to try to maintain its current market share rather than pursue a high price target. In addition, the production of non-OPEC countries (the US, Canada, Brazil and Guyana, among others), which in the last eight months has grown by 3% to 70.9 million b/d, could continue to increase by a further 1.5 million b/d in 2025, according to estimates by the IEA. However, we believe that the oil market could begin to show signs of oversupply sometime around next summer, which would favour an easing of prices. The fact is that this increase in supply has also been anticipated in the structure of the crude oil futures curve, with the price spreads between shorter-term maturities narrowing.

Taking all these aspects into account, our current predictions have become outdated in this new context and we have decided to lower our forecasts for the price of the Brent barrel to an average of 80.4 dollars for 2024 (76 dollars in December) and 74.7 dollars for 2025 (73.5 dollars in December 2025).

However, these forecasts are subject to a high degree of uncertainty, given the heightened geopolitical risks of recent weeks. The escalation of the conflict between Israel and Hezbollah has raised fears that we could be witnessing the beginning of a wider war in the region involving more countries, including Iran.6 A war between Israel and Iran would directly affect the supply of crude oil, as well as distribution channels, triggering a surge in the price of the barrel and potentially even driving it temporarily as high as 100 dollars.

- 2See, «China’s slowdown is weighing on the outlook for global oil demand growth», IEA, September 2024.

- 3OPEC, IEA (International Energy Agency) and EIA (US Energy Information Administration).

- 4The latest package of measures adopted focuses mainly on new monetary easing measures, although at the time of writing the details of the fiscal stimulus package announced are still unknown. In addition, we believe that its impact on the demand for commodities, and in particular oil, will be modest and temporary, unless an exclusive plan for infrastructure development (a commodity-intensive sector) is announced.

- 5According to OPEC, starting in December this year and over the next 12 months, the cuts will be reversed, in line with an increase in production at the rate of 180,000 b/d each month.

- 6In terms of crude oil production, Iran is the third largest producer in OPEC (accounting for 12.2% of the total) and the fifth largest in the world (4.8% of the total). In addition, it controls the passage through the Strait of Hormuz, through which 21 million barrels pass daily, which is one fifth of the world’s consumption of crude oil and derivative products.

Gas prices set to stabilise

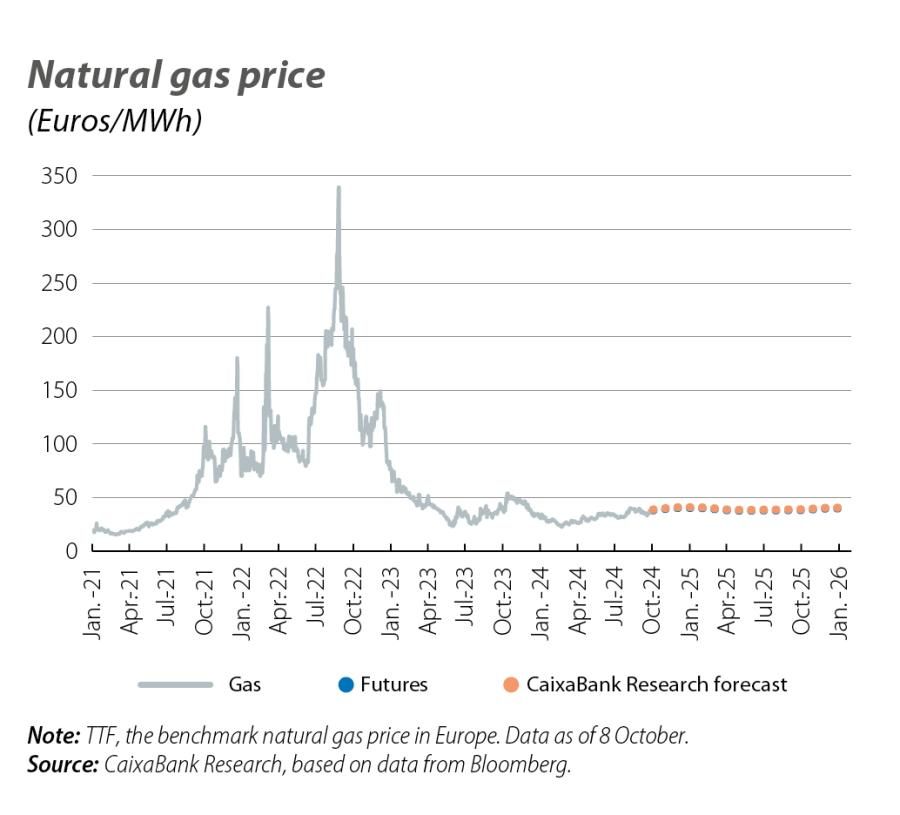

In the case of natural gas, since the summer the price of the Dutch TTF benchmark (the main measure used in the European market) has been subjected to upward pressures at the hand of rising demand from Asia and temporary constraints on the gas supply from some of the major producers (such as Australia and Norway), which have driven the price up to the 40 €/MWh mark. However, aspects such as mild weather in the northern hemisphere and the high level of strategic natural gas reserves in the EU7 have limited the price rally.

Looking ahead to the coming quarters, we believe that the demand for natural gas in Europe will remain rather weak. The rise in the use of renewable and nuclear energy, energy efficiency measures, milder temperatures and the sluggish pace of industry in many countries have resulted in a 3.2% year-on-year decline in gas consumption in the EU during the first half of this year,8 as well as a decline of –11% in imports of liquefied natural gas (LNG). Based on our economic growth scenario for the euro area,9 we estimate that these dynamics in gas demand will persist for much of the remainder of this year and throughout the next.

As for the supply of natural gas, we expect that it will remain fairly healthy. On the one hand, the total LNG stored on ships has been above the average of the last five years since the beginning of this year, which ensures the short-term supply. On the other hand, it is estimated that the LNG export capacity of the US and Qatar will increase significantly in the coming quarters (by more than 30 billion cubic meters in Q4 2024 in the case of the US) and that Australia’s terminals should be fully operational again by the end of the year. All these factors should help to offset the potential decline in natural gas flows entering Europe from Russia by land, starting from January 2025.10

All in all, we have revised our price forecasts upwards and now estimate that gas prices will remain between

37 and 42 €/MWh in Q4 2024, and at around 40 €/MWh for much of 2025.

In conclusion, and unless tensions in the Middle East continue to escalate and end up affecting trade flows through the Strait of Hormuz, the oil prices which we anticipate should serve as a lever for global growth, in addition to helping inflation to converge on the central banks’ targets and increasing the likelihood of a soft landing in their economies.

- 7EU strategic reserves stood at 94% of capacity at the end of September.

- 8According to data from the European LNG Tracker (update as of 24 September), IEEFA.

- 9See the Focus «Modest deterioration in the growth outlook for the international economy» in this same Monthly Report.

- 1031 December 2024 will mark the expiry of the five-year agreement for the transit of natural gas from Russia to Europe, which passes through Ukraine (this transportation route is over land and accounts for around 4.5% of the natural gas that is consumed in Europe). Ukraine’s refusal to renew the agreement would lead to the diversion of flows through Turkey and Azerbaijan, which could increase costs, as well as the volume of cubic metres in transit.