Which of Spain’s sectors have been hardest hit by the slowdown of our trading partners?

The slowdown in exports has been one of the main sources of weakness in the Spanish economy in recent quarters. Manufacturing is particularly dependent on sales abroad and has been the epicentre of the deterioration in exports of goods.

The slowdown in exports has been one of the main sources of weakness in the Spanish economy in recent quarters. Manufacturing is particularly dependent on sales abroad and has been the epicentre of the deterioration in exports of goods as a result of the multiple hurdles that have emerged in recent years. Recently, the slowdown in our main European trading partners has placed an additional burden on the sectors that are most dependent on exports to Europe, notably agriculture, forestry and fishing, timber industry and machinery and equipment. In the case of services, revenues from abroad have performed somewhat better, as they are benefiting from the growing international appeal of Spain’s residential market and tourism sector, as well as the acceleration of the economy’s digitalisation process, which have provided a boost to international consulting, information and telecommunications services in recent years.

Spanish exports slowed in 2023

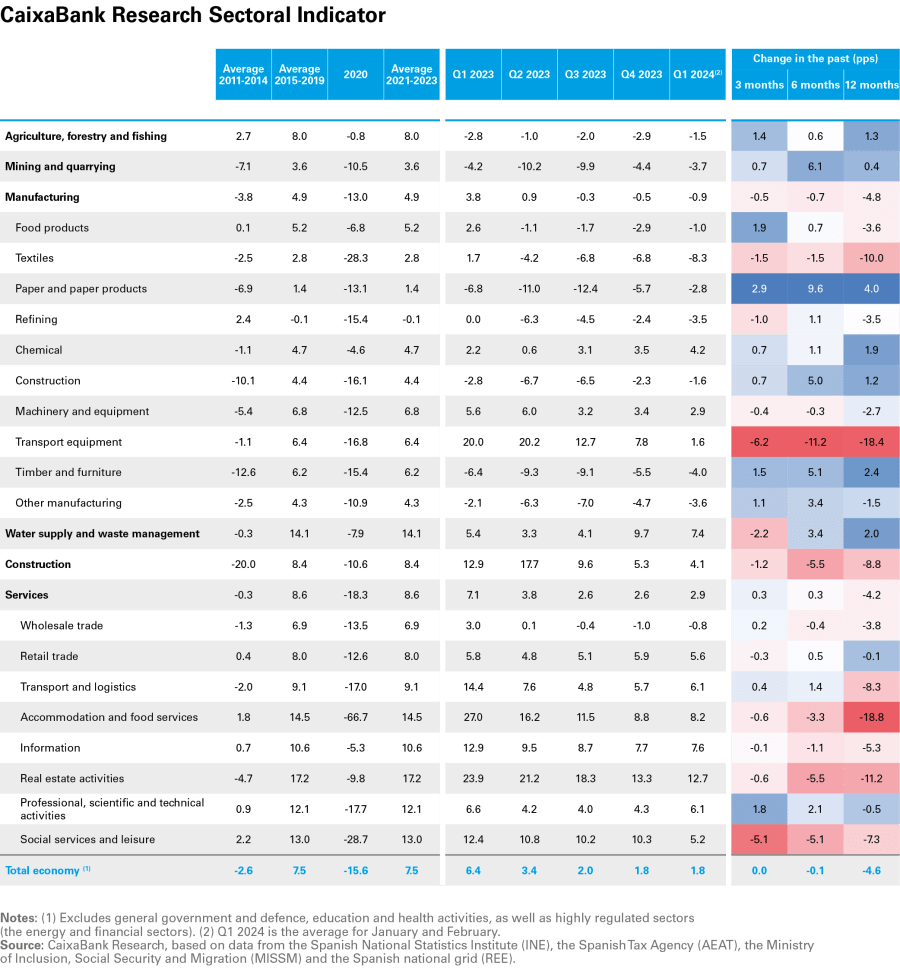

The slowdown in trade flows has been one of the main sources of weakness in the Spanish economy since Q2 2023. Specifically, the CaixaBank Research Sectoral Indicator, the workings of which we illustrate in more detail in the first article of this report, shows that the foreign sector was one of the main factors behind the loss of buoyancy in the economy over the past year, since more than 70% of the sectors analysed registered a deterioration in the indicators of their trade flows.23 On the other hand, data from the national accounts clearly show that the cooling of exports was concentrated in goods and products, which subtracted 0.5 pps from annual GDP growth following the positive contributions of the previous two years. On the other hand, services exports continued to grow significantly, consolidating the excellent figures recorded in 2022, with international tourist spending and exports of non-tourism services showing particular strength (with contributions of 0.3 pps to GDP growth in both cases).24

- 23For a more detailed account of the factors that have limited Spain’s economic growth in recent quarters, see the article on the economic environment in this very Sectoral Observatory «The resilience of the Spanish economy in 2023: a sector-based perspective through the lens of the new CaixaBank Research Sectoral Indicator».

- 24According to data from the national accounts, total exports in volume terms grew by 2.4% in 2023, driven by exports of services (12.3%) but weighed down by exports of goods (–1.7%).

With this reading of the aggregate economy as a starting point, in this article we begin by analysing which of Spain’s economic sectors are the most export-intensive and, therefore, may have been more affected by this slowdown of trade flows in 2023. Then, distinguishing between exports of goods and services, we analyse the impact of the slowdown of our main trading partners, disaggregated by sector.

Which of Spain’s economic sectors are most dependent on exports?

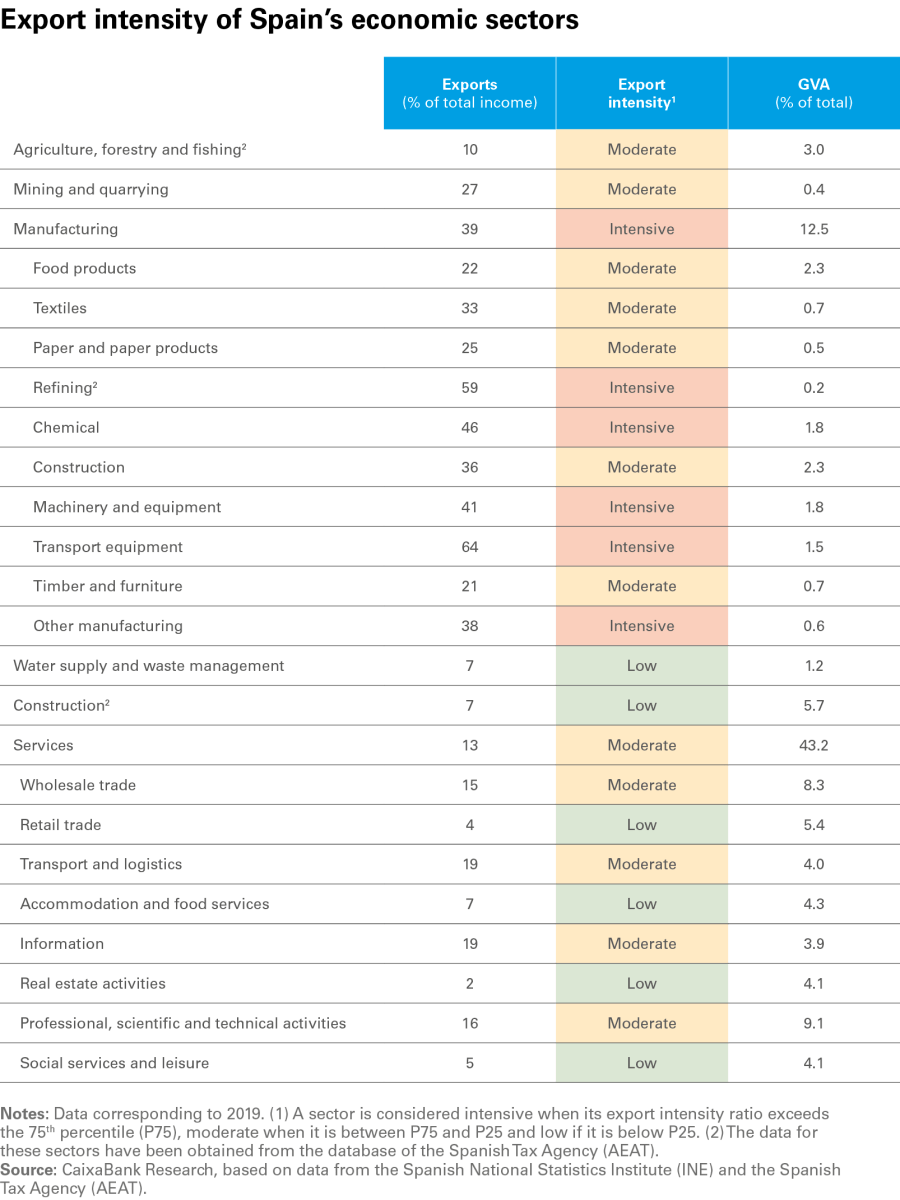

We define a sector’s export intensity as the value of its sales abroad as a percentage of the sector’s total sales.25 In the table below, we can see that all branches of manufacturing have a relatively high export intensity, with foreign sales accounting for at least 20% of total income in all cases. The most outward-oriented branches are the automotive industry (64%), refining (59%), chemicals and pharmaceuticals (46%), machinery (41%) and other manufacturing (such as jewellery or toys) (38%). Within services, only the cases of transport and logistics and information and telecommunications (both 19%) are notable. At the other end of the spectrum, real estate activities, retail trade, and social and leisure services have the lowest export intensity.

- 25Data from the National Statistics Institute’s structural enterprise statistics, except for some sectors for which no data are available, where we have used export data from the Spanish Tax Agency (AEAT). The latest available data for this survey is from 2021. However, given the impact of the multiple factors that have affected the Spanish and global economy in recent years, for this analysis of export intensity we have opted to use 2019 data in order to avoid the effects of the pandemic and the post-pandemic period.

Manufacturing is particularly export-intensive, with refining, automotive, and chemical and pharmaceutical industries selling the most abroad

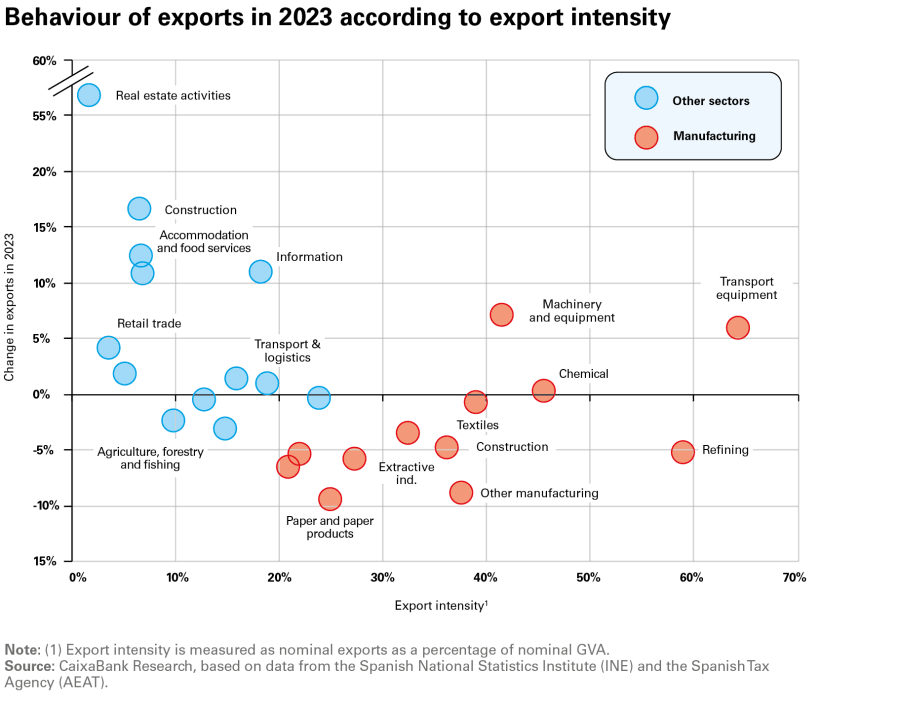

Next, we ask ourselves how exports have behaved in 2023 in Spain’s various economic sectors. The chart on the following page shows the change in exports in 2023 (vertical scale) relative to their export intensity (horizontal scale). Firstly, this chart reveals what we already suspected: the various branches of manufacturing, which are the most export-intensive sectors according to the table above, generally recorded a decline in foreign sales in 2023. The only exceptions were two sectors for which the economic situation in 2023 was favourable: the manufacture of transport equipment (6%), where exports received a boost from the revival of the automotive sector, and the manufacture of machinery and equipment (7%), where sales abroad benefited from the end of the supply chain disruptions (specifically, the end of the microchip crisis).

In contrast, exports in services generally performed better in 2023. Of particular note are the cases of real estate activities (up 57%, a very positive figure which was affected by certain specific transactions in the sector), construction (16%), accommodation and food services (12%, driven by the strong tourist season) and the information and telecommunications sector (11%).

Which sectors have been most affected by the weakening of foreign demand?

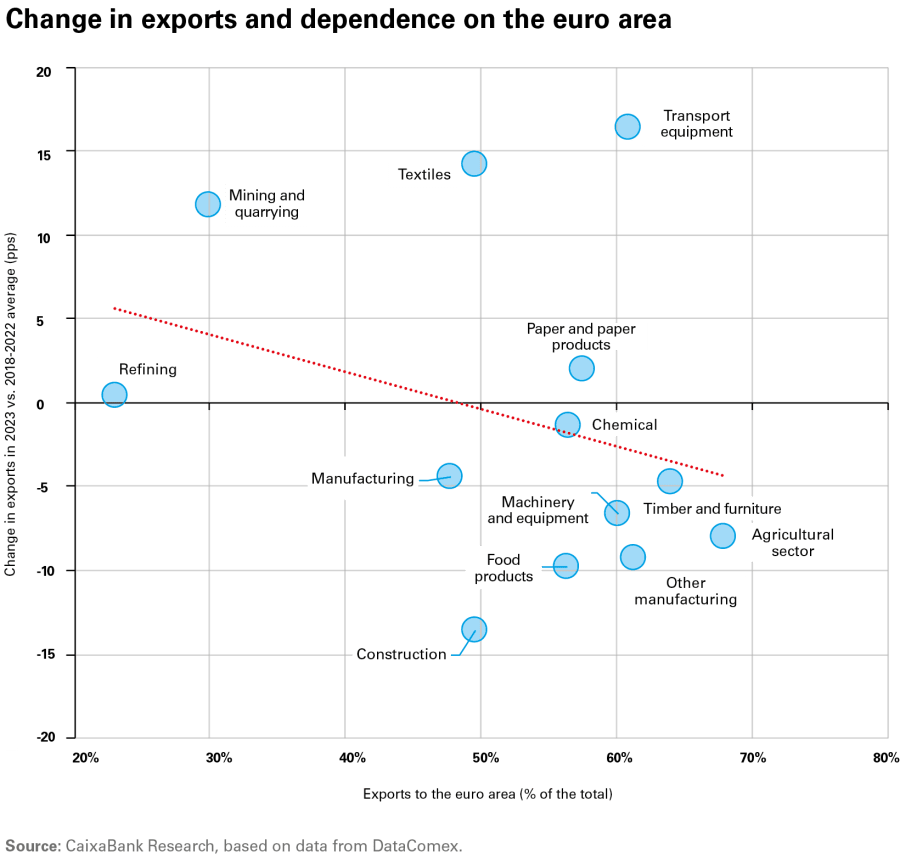

In 2023, the euro area slowed significantly: it grew by just 0.5%, compared to 3.4% in 2022, and the region’s largest economy, Germany, weakened the most (–0.1% vs. 1.9% previously). To gain a better understanding of the impact of this slowdown in Spain’s main goods export market, we disaggregate the non-tertiary sectors (industry and agriculture, forestry and fishing) according to the destination of their exports and we group these destinations into four categories: (i) Germany, being the fourth largest destination of Spanish exports and the European economy that performed the worst in 2023; (ii) the rest of the euro area, as the main destination region for Spanish sales abroad; (iii) the US, which is the third most important destination for Spanish exports and one of the most buoyant in 2023,26 and finally (iv) the rest of the world.

- 26The US economy was particularly buoyant in the second half of 2023, with average quarterly growth of 1.0%, closing the year with a year-on-year growth rate slightly above 3.0%. For the year on average it grew by 2.5%, compared to 1.9% in 2022.

The sectors most dependent on the euro area are agriculture, forestry and fishing, timber industry, other manufacturing, transport equipment and machinery and equipment, all of which see over 60% of their exports go to the region. At the opposite end of the scale we find the extractive industries and refining industry, which are the most diversified branches of industry. These are followed, albeit to a lesser extent, by textiles and construction, with over half of their exports going to non-European destinations.

The sectors that export the most to the euro area are the ones that have moderated their exports the most in 2023. These include the agrifood sector, timber industry and other manufacturing

The following chart compares, for each sector, the recent performance of their exports of goods (vertical axis) and their dependence on sales to the euro area (horizontal axis). In general, the growth of exports has moderated more in the sectors that are most dependent on sales to the region. The clearest cases include the agricultural sector (where Germany accounts for a huge portion of exports), as well as timber industry and machinery and equipment, where exports fell sharply. On the opposite side we find mining and quarrying, which is much less dependent on the region and where the United States is one of its main destination markets (accounting for more than 10% of its exports), such that the rebound in exports in 2023 coincides with the buoyancy of the US economy.

The big exceptions include, on the negative side, construction, where exports are relatively diversified but are falling sharply, potentially due to the difficult times construction is currently going through in many advanced economies.27 On the positive side we find the exception of transport equipment, which is enjoying a favourable economic context following the end of the disruptions to global supply chains and the revival of production in the sector after several years of difficulties.

- 27For an in-depth analysis of how the supply of housing in advanced residential markets is at modest levels versus ongoing strong demand, even in a context of high interest rates, see the article «Advanced-economy real estate markets: home price resilience and supply shortages» in the Real Estate Sector Report S1/2024.

Spanish services exports are performing somewhat better

Foreign revenues in services have been performing better than those in goods, no doubt benefiting from not being subject to the same constraints that exports of goods have recently endured, but also thanks to a certain structural shift in the Spanish economy’s export model, whereby the role of services is becoming increasingly relevant.28 In particular, real estate activities, accommodation and food services, and information and telecommunications have performed particularly well in 2023, recording double-digit annual growth. Nevertheless, they were also growing rapidly in the pre-pandemic period, as shown in the chart below.

- 28The balance of payments also shows the increasingly important role of services, and not just tourism, which has made it possible to offset the deficit in the Spanish economy’s goods and income balances in recent years. For further analysis of the boom in tourism and non-tourism services in the balance of services, and a comparison of the situation with that of other European economies, see the article «Spain’s current account balance in the European context» in the Monthly Report of March 2024.

In the case of real estate activities and accommodation and food services, the strength of revenues from abroad seems to respond to the growing international appeal of Spain’s residential and tourism sectors. In the case of the former, these exports reflect the income generated by property sale or rental services rendered to clients outside Spain. In 2023, these exports surged by around 60% in a year, which shows the growing interest of Spain’s residential market among non-residents (in terms of ownership, non-residents accounted for 15% of sales in 2023 compared to 13% prior to the pandemic).29 On the other hand, revenue generated from services related to accommodation and food services rendered to non-resident customers rose by 12% in 2023. This figure is not surprising either, considering that all the indicators related to international tourism exceeded their pre-pandemic figures in 2023.30

However, the upturn in exports in the information and telecommunications sector (11% in 2023) is more related to the acceleration of the digitalisation process in developed economies in recent years. In this case, the increase is driven by information technology services, telecommunications service providers, or information technology (ICT) consulting services – sectors in which Spain has a strong position in international markets. The rise in the demand for digital services, the expansion of connectivity (following the deployment of advanced telecommunications networks such as 5G technology), technological innovation (artificial intelligence, the Internet of Things, cloud computing and cybersecurity), the increased penetration of e-commerce (increased demand for digital infrastructure) and the rise of teleworking (as a result of the pandemic, with the consequent increase in demand for online communication and collaboration tools) are some of the areas with the greatest potential.

- 29It should be noted that, for VAT purposes, home sales in the Canary Islands (which account for 4% of the national total) are treated as an export in the statistics of the Spanish Tax Agency (AEAT). However, this classification does not seem to be distorting the data, considering that the residential market of the Canary Islands accounts for just 4% of the national total and, moreover, the number of home sales fell by 7% in 2023, according to the Spanish National Statistics Institute (INE).

- 30For a more detailed analysis of the excellent phase that non-resident tourism in Spain is currently enjoying, refer to the Tourism Sector Report S1/2024.

Outlook for Spanish exports in 2024

Exports of goods have been affected by multiple shocks in recent years: disruptions to global supply chains (as a consequence of COVID-19 and, later, armed conflicts), the impact of increased production costs on activity (particularly in the more energy intensive branches of industry) and, most recently, the deterioration of foreign demand due to the widespread slowdown in Europe in 2023.

In fact, some of the export sectors that are most dependent on European destinations were those that recorded the greatest drop in foreign sales, particularly agriculture, forestry and fishing, the timber industry and machinery and equipment, among others. In any case, we expect this burden to dissipate over the coming quarters as the euro area economy gradually gains traction, given that we expect it to shift from growing by 0.7% in 2024 to 1.7% in 2025, thus acting as another tailwind for Spain’s export sectors that are most dependent on the region.

On services side, in addition to the international appeal that our country is currently enjoying in sectors such as tourism and the residential market, international services are also taking on an increasingly important role in sectors such as information and telecommunications, reflecting the recent momentum in the transition to a more digital economy. Given that revenues from abroad have already been growing rapidly in recent years, suggesting this is not a short-term phenomenon, we expect foreign revenues in these sectors to remain buoyant in the medium and long term.31

- 31For an analysis of how the weight of exports relative to total revenues has changed in the various sectors of the Spanish economy, see the article «The export intensity of Spain’s economic sectors» in the Monthly Report of December 2023.