A perspective of the Spanish economy through the lens of the new CaixaBank Research Sectoral Indicator

According to the new CaixaBank Research Sectoral Indicator, the most energy-intensive branches of the manufacturing industry and the agrifood sector are the ones which suffered the most in 2023. At the other end of the spectrum we find sectors such as hotels and restaurants and the automotive industry, which performed rather well.

In this article we present the CaixaBank Research Sectoral Indicator, an innovative tool that combines information from various economic activity indicators, the labour market and the foreign sector, allowing us to analyse the evolution of the economy from a sector-based perspective. According to the new indicator, the most energy-intensive branches of the manufacturing and the agrifood sector are the ones which suffered the most in 2023, especially in the middle two quarters of the year. At the other end of the spectrum we find sectors such as accommodation and food services and the automotive industry, which performed rather well. In recent months we have witnessed a turning point and an increasingly homogeneous performance among the various branches of economic activity, as the different sectors overcome the multiple obstacles that have arisen in recent years and move towards a more stable and sustainable pattern of growth.

Brief recap of the Spanish economy in 2023: better than expected performance

The Spanish economy slowed in 2023, but ended the year with growth of 2.5%, taking the consensus of analysts by surprise, having forecast growth of 1.0% at the beginning of the year. In year-on-year terms, the economy went from growing by 4.1% in Q1, a figure influenced by the base effect of the pandemic (the comparison is with the first quarter of 2022, when the effects of the pandemic were still notable in sectors linked to tourism), to growing by 2.0% in Q4 2023.1 This slowdown, which was less pronounced than anticipated, occurred in an adverse context marked by weak foreign demand, inflation that remained high and the impact of the rise in interest rates, as well as the consequences of the energy shock triggered by the war in Ukraine. These are factors which affected all productive sectors of the economy.

The relatively good performance of Spain’s economy in this unfavourable environment is explained by three key factors: the strength of the labour market (the number of people in employment grew by 783,000 people in 2023) which stimulated private consumption; a foreign sector that held up rather well in the first half of the year (although it slowed significantly in the second half), and the boost provided by public spending (which contributed 0.8 pps to GDP growth in 2023). This last figure is significant, since, if we exclude the sectors linked to the public sector,2 we see that economic activity cooled to a much greater degree, going from 4.2% year-on-year growth at the end of 2022 to 1.7% in Q4 2023.

This is corroborated by the new CaixaBank Research Sectoral Indicator,3 which captures a slowdown in the growth rate during the first half of 2023 across every one of the 24 sectors it encompasses, as shown in the following chart. However, the same indicator suggests that the slowdown may have bottomed out in Q3 2023 and that economic activity may have gained some traction in Q4 and in the opening months of 2024, based on the available information, which is still only partial.

- 1In quarterly terms, the economy only lost some momentum in Q3 (0.4% quarter-on-quarter compared to 0.5% on average in the first half), before accelerating once again in the closing stages of the year (0.6% quarter-on-quarter in Q4).

- 2The analysis excludes general government and defence, education

and health activities, as well as highly regulated sectors (the energy and financial sectors). - 3For further details on how the sector indicator is built, see the «Methodology note» on the CaixaBank Research Sector Indicator in this same article.

The CaixaBank Research Sectoral Indicator suggests that the slowdown may have bottomed out in Q3 2023 and that the growth rate may have stabilised in Q4 and Q1 2024

Disparate pattern in the growth rate of Spain’s economic sectors

In addition to this first reading of the aggregate performance of the Spanish economy, the CaixaBank Research Sectoral Indicator also allows us to characterise the individual performance of each of Spain’s economic sectors. Did they perform similarly throughout 2023 or, on the contrary, did they follow different trajectories? To answer this question, we look at the dispersion of the indicator, that is, the range of values (minimum and maximum) and the average value that the indicator takes among the 24 economic sectors that are analysed at any given time (see the following chart).

The chart clearly shows how the significant external shocks that the Spanish economy endured between 2020 and 2022 caused a sharp spike in the dispersion between sectors. First, the COVID-19 pandemic in 2020 caused a sharp drop in economic activity across the board (the sectoral indicator takes negative values in all sectors), and this drop was particularly intense in the sectors most dependent on social interaction (leisure and entertainment, catering and accommodation). The following years saw a rapid reversal of this effect, causing a surge in year-on-year economic activity growth rates. Second, the bottlenecks that emerged in global supply chains beginning in 2021 hurt manufacturing, which is more dependent on trade flows and the import of inputs (such as chips). In 2022, the war in Ukraine and the energy crisis drove up production costs, affecting more energy-intensive sectors the most. Finally, the rise in interest rates since mid-2023 harmed those sectors that are most dependent on external financing, such as the real estate sector and certain branches of industry.

However, the gradual absorption of these shocks during the course of 2023 has led to an increasingly even performance across the various sectors. This trend towards decreased dispersion is particularly apparent in the closing months of 2023 and the opening months of 2024, reflecting the fact that the economy is moving towards a more stable growth cycle, similar to the pre-pandemic period of 2015-2019.

The sector traffic light: how rapidly are the various economic sectors growing?

Another way to characterise the performance of the different sectors is to use the so-called sector traffic light, a chart in which the sectors are classified into five categories according to their rate of growth/contraction.4 In this way, conclusions can be drawn on the degree of synchronisation in the growth/slowdown of Spain’s various economic sectors.

- 4In particular, a sector is considered to be in a position of «significant weakness»if the value taken by the sector indicator lies below the 15th percentile (P15) of that indicator’s historical distribution; a position of «weakness»when it takes a value between P15 and P40; «stability» between P40 and P60; «expansion» between P60 and P85, and «significant expansion» when the indicator lies above P85.

The significant shocks which Spain’s economy endured between 2020 and 2022 had a widely varying impact on the different sectors, leading to greater dispersion in their rate of economic activity growth. As these shocks are gradually absorbed, the performance of the various sectors is becoming increasingly homogeneous

The chart provides a very visual picture of how the pandemic impacted our economy: economic activity plummeted between March and April 2020, when all sectors showed significant weakness. Since then, the recovery has been evident, with very high growth rates. If we look at the most recent pattern, since April 2023 there has been a slight slowdown in activity: the percentage of sectors with weak or very weak growth reached as high as 60% of the total (the worst figure since 2020). This slowdown was concentrated in various branches of the economy that make up manufacturing, especially those hardest hit by the rise in production costs, the increase in financing costs and the fall in foreign demand. In particular, the agrifood sector (agriculture, forestry and fishing and processing industry), mining and quarrying, construction, textiles, paper and the refining industry were the branches that performed the worst.

The slight slowdown in middle two quarters of 2023 was concentrated in the agrifood sector and manufacturing, which were harder hit by the fall in foreign demand and the high production costs

In any case, this deterioration was short-lived: it was concentrated in the middle two quarters of 2023 and did not extend to the whole economy. In the most recent months, there has been a clear improvement in the sectors that suffered the most, and none are in a situation of significant weakness. Behind this improvement there are incipient signs of a revival in manufacturing and the agrifood sector, which we expect will be consolidated during the course of 2024, as we will see in detail in the next article of this Sector Report.

In the first few months of 2024, around 60% of sectors maintained stable growth. In other words, just as in the dispersion chart, we can see that the economy is moving towards more constant growth rates, after several years of significant distortions (the pandemic, supply chain disruptions, geopolitical conflicts, the energy crisis, etc.) in which sectors enjoying strong growth coexisted with others in contraction.

Economic activity, the labour market and the foreign sector: the pillars that explain the performance of the various economic sectors

CaixaBank Research’s Sectoral Indicator is calculated using indicators from different spheres that can be grouped into three major pillars: economic activity, the labour market and the foreign sector. Analysing the contribution of these three pillars to the indicator allows us to take a closer look at the factors that explain the economy’s behaviour throughout the cycle. Firstly, we can see that the strength of Spain’s labour market has played an important role across all sectors, and this pillar has been keeping the sectoral indicator in positive territory since Q2 2023.

Secondly, we note a turning point in the economic activity indicators in April 2023, across all indicators and sectors, when this pillar ceased making a positive contribution to the indicator. In any case, these activity indicators have recovered and in the most recent months they have once again been making a positive contribution to the indicator. Finally, the foreign sector pillar has also deteriorated since April 2023 but shows little sign of improvement in the latest data. The improved growth outlook for our main trading partners in 2024 should help the foreign sector to improve.

If we replicate the idea of the traffic light chart for each of the three pillars, we can also draw interesting conclusions that shed more light on the behaviour of the sectors.

The traffic light for the labour market5 shows that only four of the sectors analysed currently exhibit weak growth in the indicators related to the labour market: agriculture, forestry and fishing, mining and quarrying, textiles, and timber industry. On the contrary, almost half of the sectors are currently in a phase of expansion through this pillar, with transport and logistics, accommodation and food services, and information and telecommunications sectors performing the best.

- 5The chart shows the percentage of sectors classified in each of the 5 growth categories, which are defined as follows: «significant weakness»if the value taken by the sector indicator lies below the 15th percentile (P15) of that indicator’s historical distribution; «weakness»when it takes a value between P15 and P40; «stability» between P40 and P60; «expansion» between P60 and P85, and «significant expansion» when the indicator lies above P85.

The traffic light for economic activity shows a significant deterioration in this pillar in 2023, when around 60% of the sectors were in a situation of weakness. This stands in stark contrast to the significant expansion recorded in 2021 and 2022 (years of rapid economic recovery following the blow dealt by the pandemic). This poorer performance in 2023 is essentially due to the deterioration in manufacturing and the agrifood sector.

Finally, the traffic light for the foreign sector has been subtracting from overall economic activity since 2022 and its deterioration intensified in 2023. Indeed, it represents a significant burden for the wider economy: Around 70% of sectors show a deterioration in their trade flows, and it is especially intense in the extractive, paper and textiles. In the article «Which of Spain’s sectors have been hardest hit by the slowdown of our trading partners?» in this report, we analyse how foreign demand has acted as a brake on the economy as a whole and which sectors have been most affected by this decline in trade flows.

The CaixaBank Research sector clock: where in the cycle do the various economic sectors currently lie?

A final analysis in this article involves determining where each sector currently lies in the business cycle. To this end, the CaixaBank Research sector clock considers, on the one hand, the level of the indicator (horizontal axis) and, on the other, its change in the last year (vertical axis). The resulting quadrants offer a picture of the sector’s current position and its recent trend: expansion (indicator in positive territory and with growth in the last year); slowdown (positive indicator, but with a decrease in the last year); contraction (negative indicator and in decline in the last year); and recovery (negative indicator, but growing in the last year).

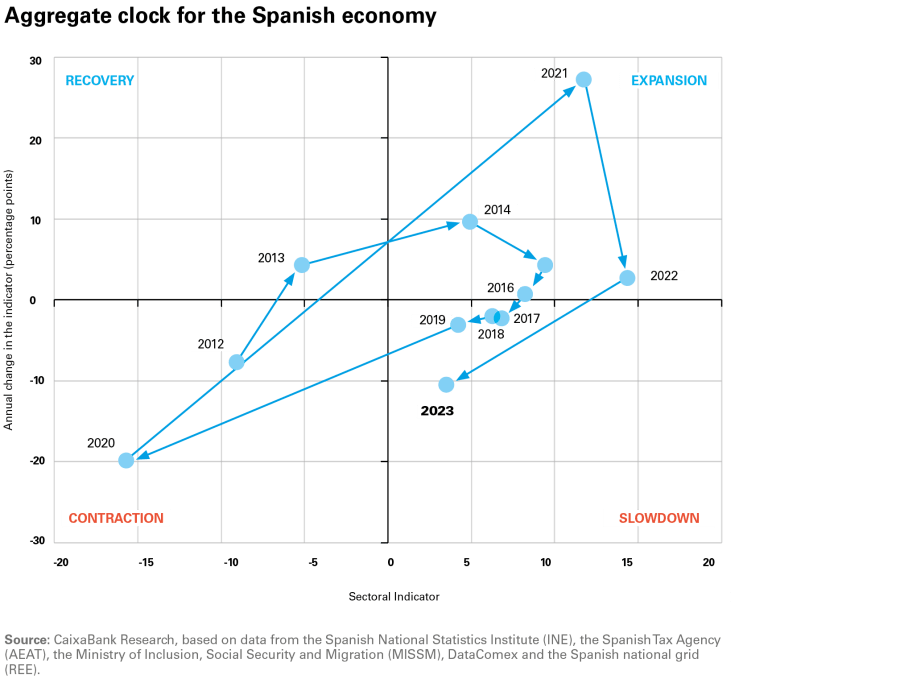

Firstly, we will examine the aggregate behaviour of the sectors over time in order to observe how Spain’s economy has been moving throughout the cycle. In this «aggregate clock» (see the chart on the next page), we can see the significant impact that the pandemic had on Spain’s economy: in 2020 the economy was in a clearly contractionary position, but in 2021 it moved directly into a highly expansionary phase without passing through the recovery phase. This is due to the very nature of the health crisis: a widespread collapse of the economy at first, due to unprecedented mobility and business restrictions, before entering a phase of rapid acceleration when those restrictions were lifted. The almost instant nature of this step change reflects the fact that the productive capacity of Spain’s economy had been left relatively unscathed at the height of the crisis.

In 2022, the economy continued to enjoy strong growth (the indicator is above 2021 levels), although the comparison with the exceptional prior year of 2021 results in it moving towards the slowdown quadrant. In 2023, the slowdown in economic activity was more evident (the indicator decreases, although it remains positive) and the comparison with the previous year is unfavourable, resulting in it lying well within the slowdown quadrant. It is also approaching the centre of the clock’s coordinates, indicating an increasingly stable behaviour.

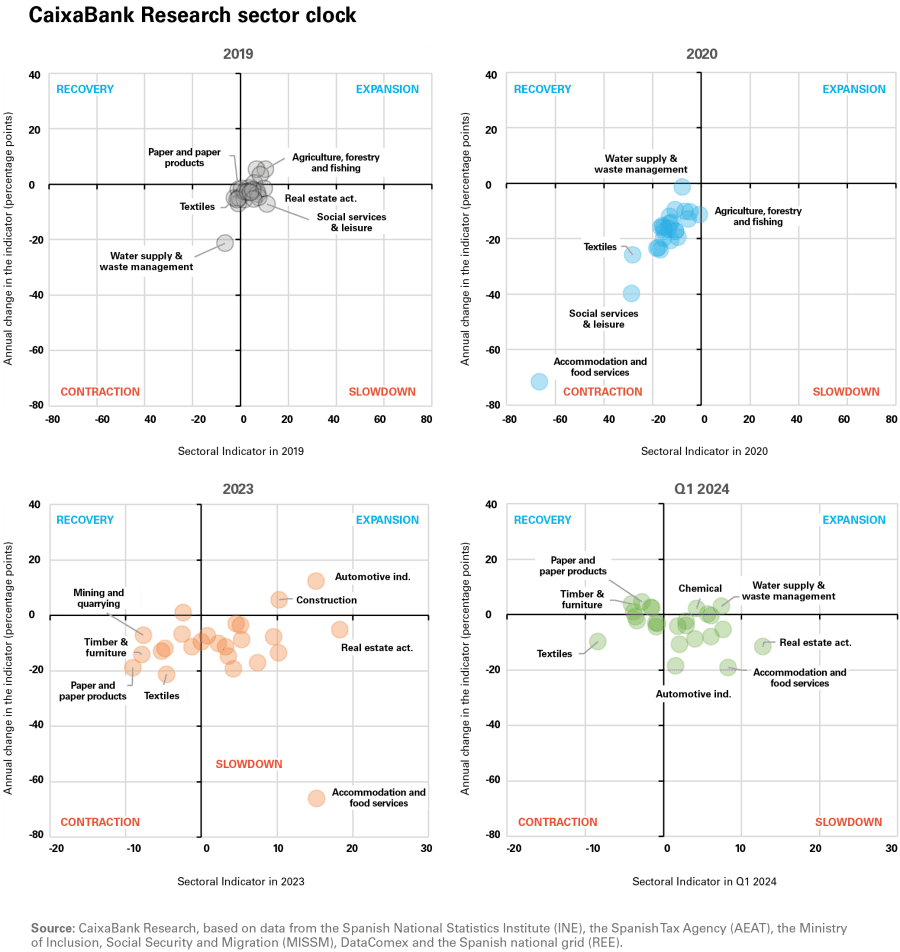

Next, comparing the clock at different points in time and for the various sectors of the economy allows us to see how the sectors move between the quadrants. To this end, we show how the various sectors have moved through the cycle beginning in 2019 (pre-pandemic situation), in 2020 (to observe the effects of the pandemic), in 2023 and, finally, in the latest available month.

The CaixaBank Research sector clock allows us to determine where each sector currently lies in the business cycle (expansion, slowdown, contraction and recovery) and to see the movements over time.

The 2019 sector clock provides a clear picture of the pre-pandemic situation, when the economy was broadly stationary, with growth close to its potential rate and a highly homogeneous pattern across the different sectors (low dispersion, with most sectors near the centre of the clock). The only obvious sources of weakness are the textile, paper and water supply industries.

Moving on to the 2020 sector clock, the effects of the pandemic are apparent as the collapse of the economy placed all sectors in the contraction quadrant. However, there is considerable dispersion between sectors, as the impact of the pandemic was felt the most in the sectors most dependent on social interaction (accommodation and food services, and social services and leisure), while its impact was somewhat less pronounced in the case of activities that are considered essential (most notably agriculture, forestry and fishing). It should be noted that in 2021 and 2022, as the mobility restrictions were lifted, the situation in accommodation and food services and leisure sectors was reversed, as they became the sectors that were providing the biggest boost to Spain’s economy.

The sector clock for 2023 shows significant dispersion between sectors, as the factors that have characterised the economic scenario in 2022 and 2023 have affected the various branches of the economy very differently. Manufacturing has been particularly affected by the sharp rise in production costs, especially the more energy-intensive branches (most notably the paper, timber and extractive industries). On the other hand, transport equipment stands out positively, as it has enjoyed a revival after having been held back for several years by the drop in demand, the rise in costs and the disruptions to global supply chains. Accommodation and food services stands out, as it remains one of the best performing sectors in the economy yet it appears in the slowdown quadrant because of the comparison with the sector’s exceptional revival in 2022, which has caused the indicator to fall in annual terms.

The CaixaBank Research sector clock for the opening months of 2024 indicates an improvement in chemical and pharmaceutical, water supply and retail industries, which now lie in expansionary territory

The sector clock for Q1 2024 shows only a few minor changes from that of 2023. Firstly, there is less dispersion between sectors, which are grouped closer to the centre of the clock, and there are no «step changes» as abrupt as those observed in 2023, as in the case of accommodation and food services.

Secondly, there are certain positive trends: chemical, water supply and retail industries are improving and lie within the expansion quadrant. Many industries also show an improvement, having been weighed down by the rise in costs in recent years but now lying in the recovery quadrant (the timber, paper, extractive, and construction), as does agriculture, forestry and fishing. Real estate activities, transport equipment and accommodation and food services remain among the best performing sectors, although their growth rate has moderated relative to last year (they are in the slowdown quadrant).

Finally, industries that remain in the contraction quadrant include food products (weighed down by costs) and textiles, while the wholesale trade sector has deteriorated and now also lies in this quadrant.

In the next article of this report «Outlook for the Spanish economy and its sectors» we analyse where the various economic sectors will be in 2024 and 2025 according to our forecasts.