An exceptional year for the catering sector in Spain

CaixaBank’s consumption indicators built using big data techniques and internal card spending data confirm the good dynamics of the catering sector in Spain and its close relationship with tourism.

The tourism sector has been a constant source of good news for Spain’s economy since the mobility and social distancing restrictions were lifted back in 2022. Having been one of the sectors hardest hit by the pandemic, Spain’s tourism sector has experienced a rapid recovery, which was completed in 2023. In parallel, and benefiting from this extraordinary revival of tourism, the catering sector also stands out as one of the most buoyant. Its turnover reached almost 100 billion euros in 2023, marking a new record figure and representing 9.2% growth over 2022, while also exceeding 2019 sales by 6%. In addition, catering reached a new high in terms of its number of registered workers, after employing 1.4 million people in 2023, 4.5% more than in 2022. However, the pandemic has forced a certain consolidation process in recent years, as there are 8% fewer active catering companies, with around 232,000 companies in 2023 distributed across 263,500 establishments, primarily bars and cafés (62% of the total).

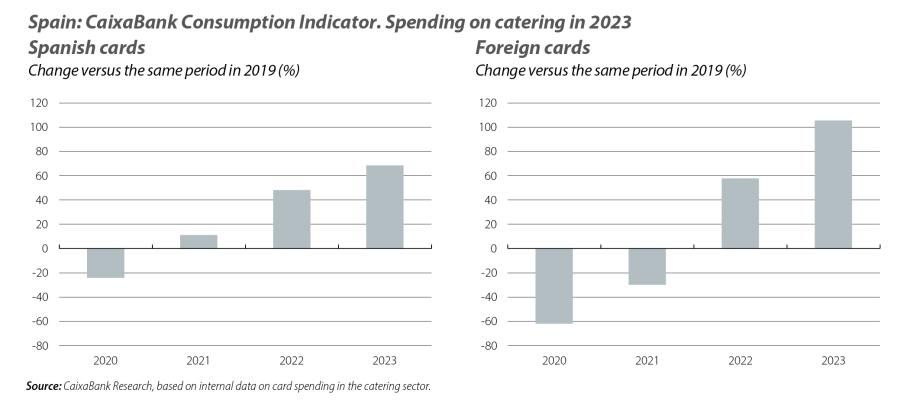

The consumption indicators based on our internal card spending data confirm this dynamic in the catering sector.1 As can be seen in the charts below, spending on catering dropped off sharply due to the restrictions imposed during the pandemic (especially in the case of foreign cards, as a result of the restrictions on mobility), but since mid-2021, spending with Spanish cards (and, since the end of 2021, with foreign ones too) has exceeded 2019 levels. In 2023, spending has continued to register significant growth, especially among foreign tourists. This growth also reflects the increase in prices in the sector (6.6% on average in 2023), as businesses have largely passed on their cost increases to consumers – it should be recalled that the catering sector has been exposed to the rise in energy prices and, above all, food prices.

- 1The CaixaBank Research Consumption Indicator tracks the evolution of consumption in Spain using big data techniques, based on duly anonymised internal data from expenditure with cards issued by CaixaBank, expenditure registered on CaixaBank POS terminals and withdrawals at CaixaBank ATMs. For further details on the methodology, see https://www.caixabankresearch.com/sites/default/files/content/file/2023/11/13/49/Nota%20Metodologica_RTE.pdf.

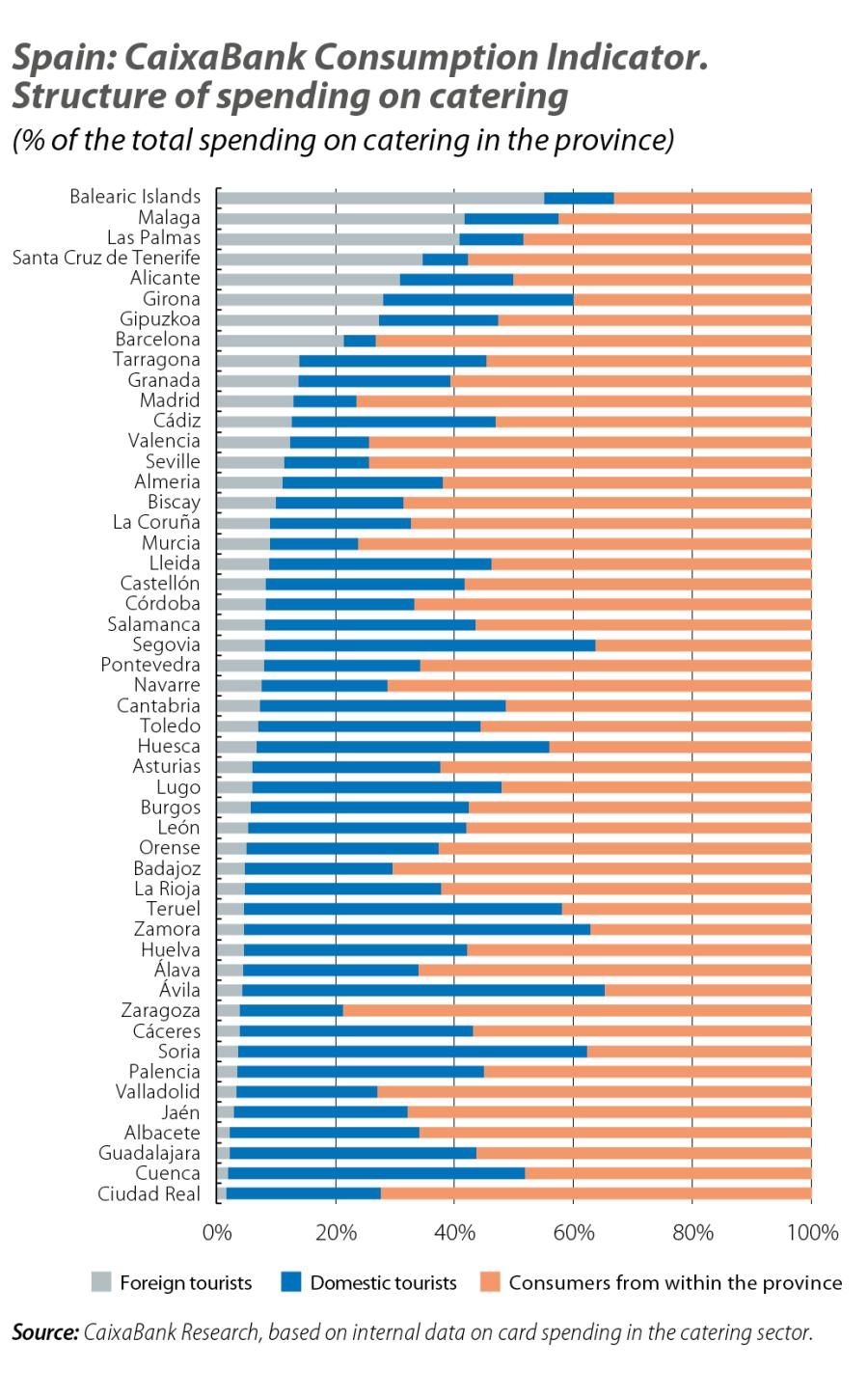

To what extent has this recovery in the sector been driven by the boom in international tourism in 2023? According to internal data, 28% of catering establishments depend on tourism expenditure, with 10% of them dependent on international tourists.2 Of course, the situation is not equal in all regions. The dependence on international tourists is particularly high in the provinces that are most attractive to those from beyond our borders: the Balearic Islands, Malaga, Las Palmas and Santa Cruz de Tenerife are the provinces that benefit the most, since at least 35% of the spending there is conducted with foreign cards (in the case of the Balearic Islands, the figure is over 55%). As for spending by domestic tourists,3 the pattern is not as clear as it is for international tourism, but the cases of Ávila, Soria, Zamora, Segovia and Teruel are worth highlighting, where spending by Spanish tourists accounts for at least 50% of the total spending on catering in the province.

- 2An establishment is considered to be dependent on tourism if spending by domestic or foreign tourists accounts for at least 33% of its total annual turnover.

- 3Domestic tourist spending is considered to be card spending that is conducted outside the province in which the CaixaBank card holder resides.

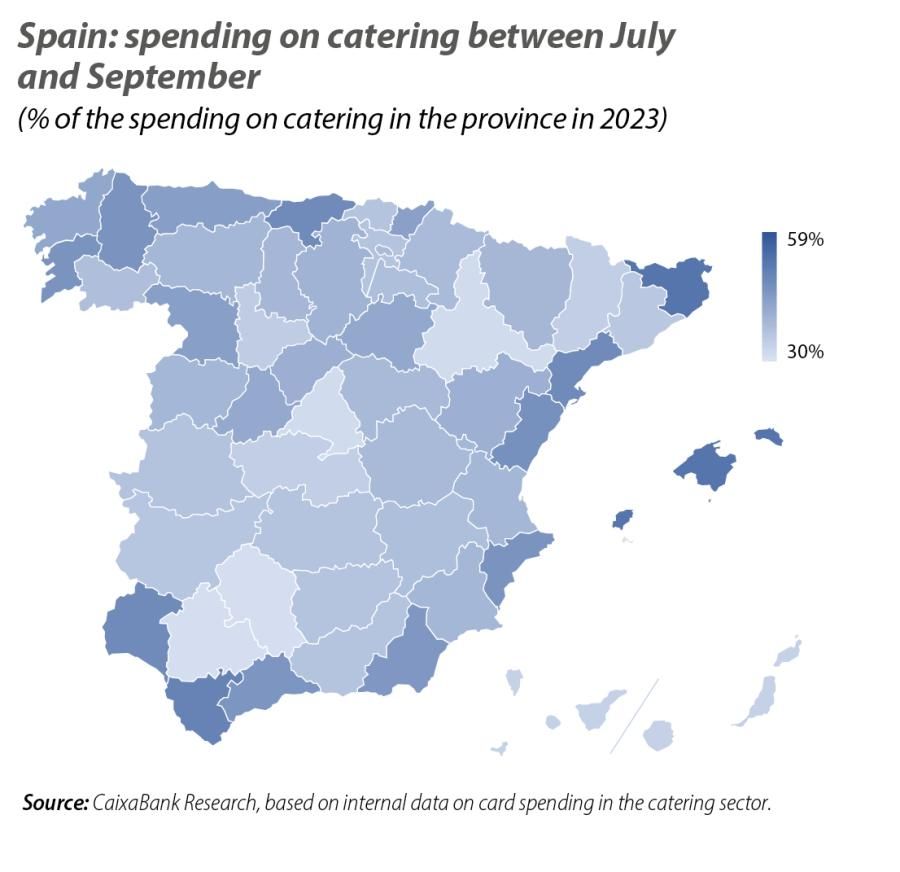

It should be noted that most catering expenditure is concentrated in the summer months, since at least 30% of the sector’s turnover is generated between the months of July and September. Again, the pattern is quite different from province to province. The sector’s revenues are particularly seasonal in the Balearic Islands, Girona and Cantabria, where over half of annual revenues occur in those three months of the year. On the other hand, Cordoba, Seville, Zaragoza, Madrid and the Canary Islands, among others, record between just 30% and 35% of their total turnover in those months of the year.

Outlook for the coming months

Having recovered pre-pandemic figures, and in a context of normalisation of economic growth rates, the indicators for tourism activity continue to exceed expectations. However, growth in the tourism sector can also be expected to normalise now that pre-pandemic levels have been reached in 2023.4 Even so, we expect growth of 1.5% for tourism GDP in 2024, although the beginning of the year has proven better than this forecast would indicate. Under this scenario, the catering sector ought to maintain the good tone of last year, taking into account the good outlook for private spending, thanks to the gain in households’ purchasing power (wages are growing above inflation) and the expectations of a moderation in production costs.

- 4For a more detailed account of the factors that will affect the tourism sector over the coming months, see the article «The current state and outlook for tourism in Spain: Strength and resilience» from the last Tourism Sector Report.