Innovation in Spain: somewhat below the EU

How innovative is Spain relative to its European partners? We analyse the evolution of Spain’s position in the European Commission’s innovation index.

The European Commission’s innovation index

Innovation is a key variable for increasing an economy’s potential growth. In this article we analyse the evolution of the innovation index developed by the European Commission for the case of Spain in order to shed some light on this matter.

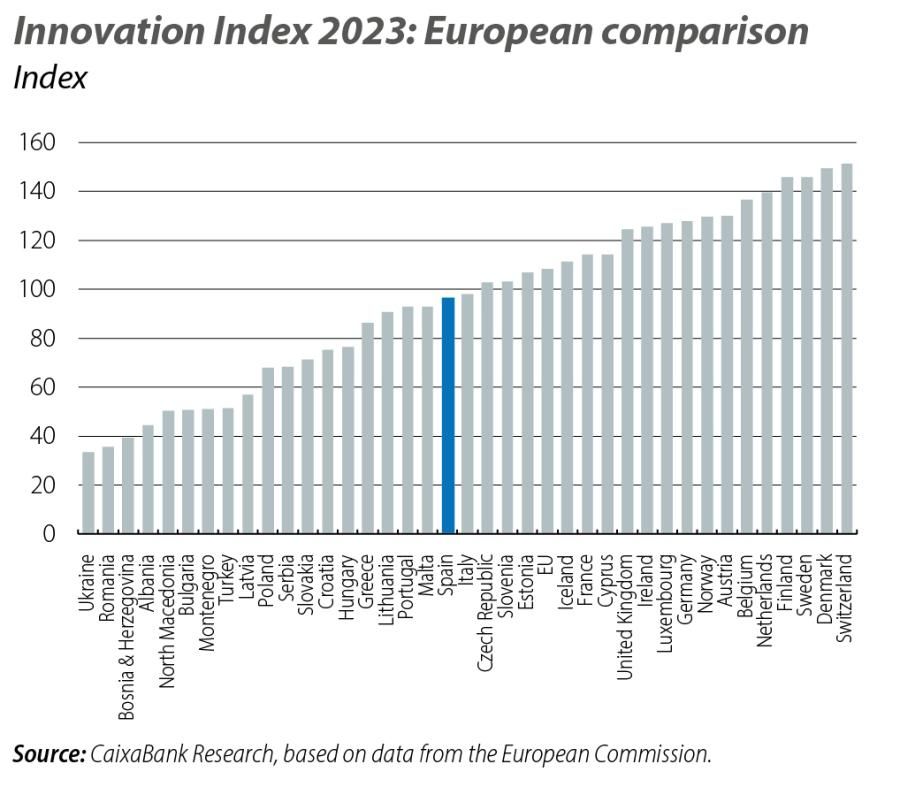

This index1 is built from 32 indicators grouped into 12 areas such as: talent attraction, investment in research and development, and use of information technologies. In 2023, of the 38 European economies analysed, the lowest value of the index was Ukraine (index of 33 points) and the highest was Switzerland (151 points). In addition, the EU average of 108.5 points in 20232 stood 11% below the US, the paradigm of innovation.

Spain compared to the EU: room for improvement

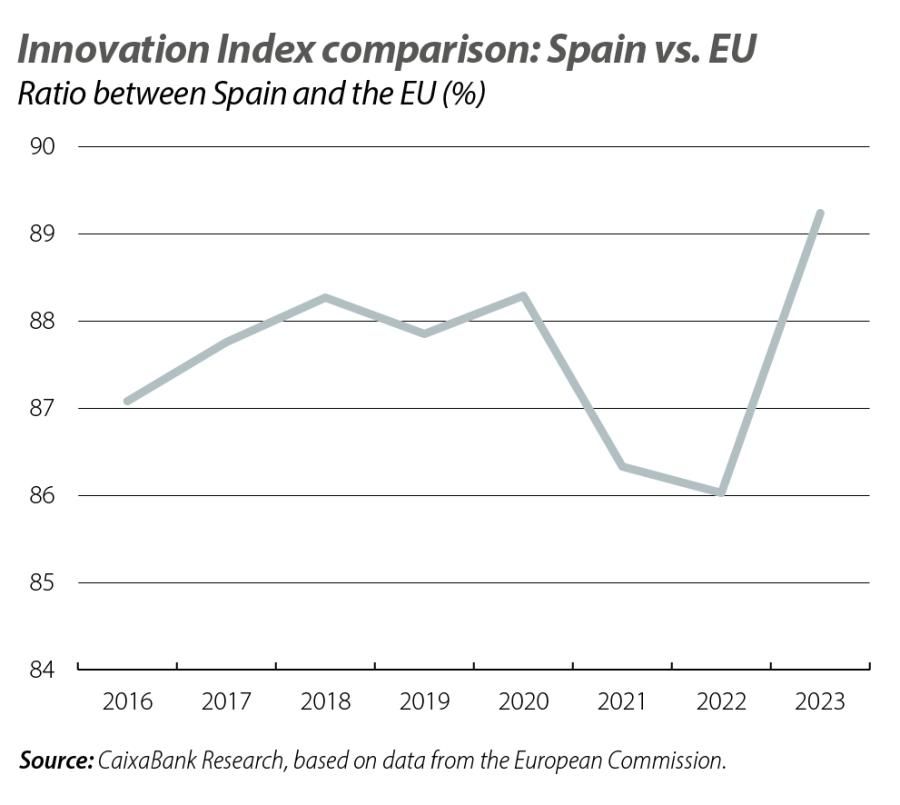

In 2023, the innovation index for Spain stood at 96 points, 11% below the EU average. Seven years ago, when this index was first introduced, Spain stood 13% below the EU average, so although we have slightly narrowed the gap with the euro area, we are still somewhat behind. Relative to our main European peers, in 2023 the index for Spain was 15% below the level of France, 25% below Germany, 1% below Italy, but 4% above Portugal.

Having seen these statistics, why is Spain trailing behind the EU and our main European partners when it comes to innovation? To answer this question, we compared Spain with the European average in 2023 in certain key components of the innovation index.

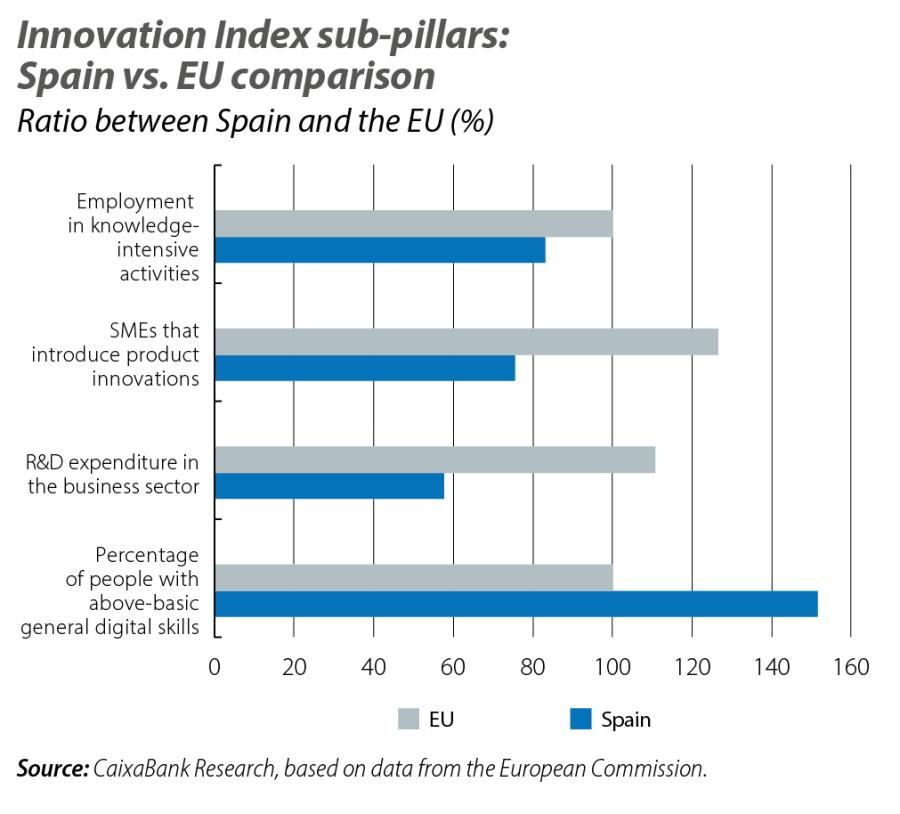

The results, which can be seen in the third chart, show that Spain is clearly ahead of the EU in the measure of workers with advanced digital skills and is relatively close in terms of employment in knowledge-intensive occupations. On the other hand, two dimensions where we need to improve (as we are lagging far behind) are in the degree of innovation in SMEs and in the level of R&D spending invested by the private sector. The fact that Spain is comparatively better in advanced digital skills and in technological employment offers a hopeful message for the prospect of narrowing the gap with Europe. Three reflections are, in any case, inescapable. Firstly, it is essential that there are no skill mismatches, such that these skills can be matched with jobs that have a high innovative potential. The evidence to date indicates that aligning the skills of the labour supply with those which companies are seeking is a task that remains pending for the Spanish economy.3 Secondly, greater investment in R&D is essential in order to make the qualitative leap to which we aspire. Thirdly and finally, in a country in which SMEs are a very important part of the productive fabric, it is essential that advances in innovation are widely disseminated across the business sector and that SMEs grow in scale.4

- 376% of companies report a skills gap between what their organisations need and the training offered by the university system. At the same time, 79% of companies report a skills gap among candidates with vocational training. See J. Canals (2020), «Changes in the portfolio of skills needed by Spanish companies following COVID-19».

- 4In Spain, the productivity level of large corporations is more than twice that of micro-enterprises. In addition, several studies highlight that large corporations are more likely to invest in intangible assets. However, the relative weight of medium- or large-sized companies in the Spanish economy is lower than in other countries. In Spain, around 35% of employment is in companies with more than 50 employees – a proportion that stands at 66% in Germany.