Tourism, the driving force of the Portuguese economy

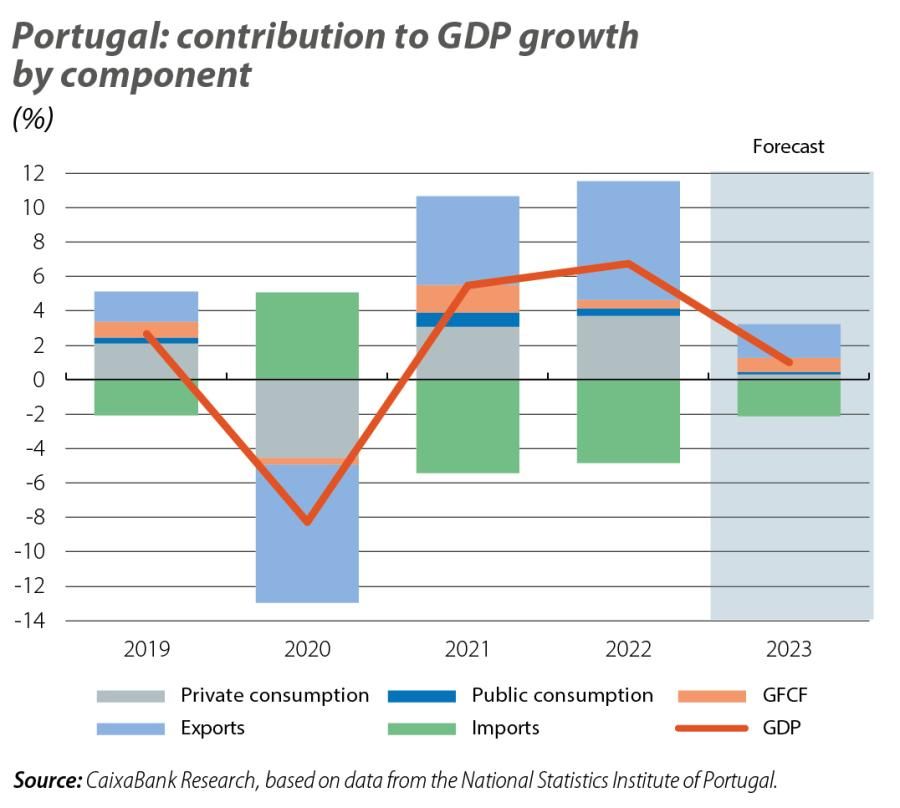

Exports and consumption were the components that contributed the most to this result, reflecting the sharp increase in tourism activity and the recovery in the consumption of durable goods, especially cars, thanks to the savings accumulated during the pandemic. The indicators available for the beginning of the year, still scarce, show a more positive pattern than expected in our forecast scenario. The confidence indicators improved in January and February, while the consumer indicators – car sales and card payments – are growing at a steady pace and tourism remains highly buoyant. For now, we keep the 2023 GDP growth forecast at 1%, but the risks are skewed slightly to the upside.

On the positive side, headline inflation fell for the fourth consecutive month, to 8.2%, according to the flash indicator (8.4% in January), thanks to the easing of inflation in energy products. On the negative side, after January brought the first drop in core inflation in 15 months, in February it resumed its rally, climbing 2 percentage points to 7.2%. In addition, unprocessed food registered inflation of 20.1%, a rate not seen since the country joined the euro.

The unemployment rate increased to 6.5% in Q4 2022, up 0.7 pps compared to Q3. Moreover, employment fell for the first time since Q1 2021 (–0.5% quarterly, –26,200 jobs), although it is still above pre-pandemic levels (+2.4%, +117,000 jobs). The normalisation of post-COVID activity in some sectors, such as health and social services, may at least partly explain this destruction of jobs. Registered unemployment, meanwhile, continued to climb in January by 4.9% (–9.5% year-on-year), driven by the increase in construction and trade.

This figure represents growth of 72.5% year-on-year and of 3.2% with respect to January 2020. The overall picture in 2022 was very positive, with total revenues of tourist establishments reaching 16.5% above the level of 2019, despite a slightly lower number of guests (–2%). For 2023 we expect the positive trend to continue, supported by (i) lower energy prices, which will be reflected in air fares, (ii) some specific events, such as the World Youth Days, and (iii) the recovery of Asian tourists.

In 2022 Portugal registered net borrowing of 0.4% of GDP, versus net lending of 1.0% of GDP the previous year. This deterioration mainly resulted from the worsening of the current account balance, which posted a deficit of 0.8% of GDP, due to the increase in the energy and income deficit, which could not be offset by the improvement in the tourism surplus. We expect a return to a surplus in 2023 thanks to a reduction in the current account deficit and an improvement in the capital balance, which will benefit from the receipt of the NGEU funds. The lower current account deficit will be driven by the correction of the energy deficit and the good outlook for the tourism sector.