Wage dynamics in Spain: what does the CaixaBank Research wage growth tracker tell us?

We have developed a real-time indicator based on payrolls deposited into CaixaBank accounts in order to analyse wage trends in Spain. The indicator provides very up-to-date information on wage dynamics, with a high degree of detail at the geographic and sectoral level.

In the current context of high inflationary pressures, there is concern that second-round effects will lead to a wage-price feedback spiral. In order to analyse wage dynamics in Spain, here at CaixaBank Research we have developed a real-time wage growth tracker based on payrolls deposited into CaixaBank accounts.1 This indicator provides very up-to-date information on wage dynamics, with a high degree of detail at the geographic and sectoral level. This indicator therefore provides useful information not previously available, which can complement other wage income data sources.

CaixaBank Research’s wage growth tracker corresponds to the median year-on-year change in the monthly payroll, which is calculated in a completely anonymous manner. This monthly payroll corresponds to the net wage income received during the month.2 , 3 , 4

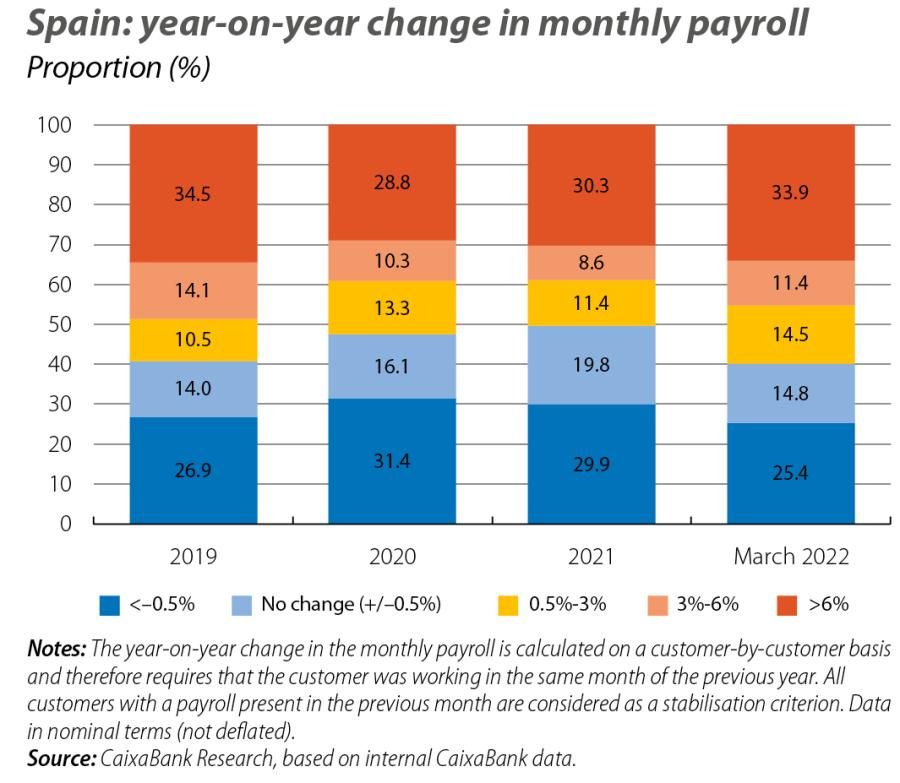

According to this internal indicator, in March 2022 wages in Spain rose by 2.2% year-on-year, a similar increase to that experienced prior to the pandemic (+2.1% year-on-year on average in 2018 and 2019) and higher than in 2020 and 2021 (see first chart). Thus, since last summer, workers’ payrolls have steadily improved, with moderate increases that leave behind the containment experienced during the pandemic.

- 1. This indicator is part of a set of indicators used to monitor the economy in real time, due to be published shortly.

- 2. Payrolls are identified as a specific type of transfer among CaixaBank customers’ account transactions (fully anonymised) and are stated in nominal terms (not deflated). All customers with a payroll present in the previous month are considered as a stabilisation criterion. The indicator corresponds to the two-month moving average. For further details, see the methodological note, due to be published shortly.

- 3. The distribution of payrolls is very similar to the wage distribution observed in the 2018 wage structure survey (the latest year with microdata available from the survey), as discussed in O. Aspachs, R. Durante, A. Graziano, J. Mestres, M. Reynal-Querol et al. (2021). «Tracking the impact of COVID-19 on economic inequality at high frequency». PLOS ONE 16(3): e0249121. https://doi.org/10.1371/journal.pone.0249121.

- 4. A similar indicator is the Wage Growth Tracker produced by the Atlanta Fed. This indicator measures the nominal wage growth of workers observed with a 12-month difference using data from the Current Population Survey (CPS) https://www.atlantafed.org/chcs/wage-growth-tracker.

Another, complementary measure for analysing wage dynamics involves looking at the proportion of payrolls that increase and decrease (see second chart). This «wage thermometer» shows that the proportion of workers whose payrolls rose by more than 3% in March 2022 (45.3% of the total) was lower than before the pandemic (48.6%). If we look at the percentage of workers who experienced wage increases in excess of 0.5%, we see that the proportion in March 2022 (59.8%) was already slightly higher than in 2019 (59.1%).

The wage dynamics we observe are not the same across the board if we differentiate by type of employer (specifically, between the public and private sectors). Public sector employees saw their payrolls increase by 2.4% year-on-year in March 2022, somewhat lower than the growth they experienced prior to the pandemic (2.8% in 2018-2019) but slightly higher than private sector wages. For the latter, the payroll growth stood at 2.1% year-on-year in March 2022, already above the average rate for 2018-2019 (1.7%).

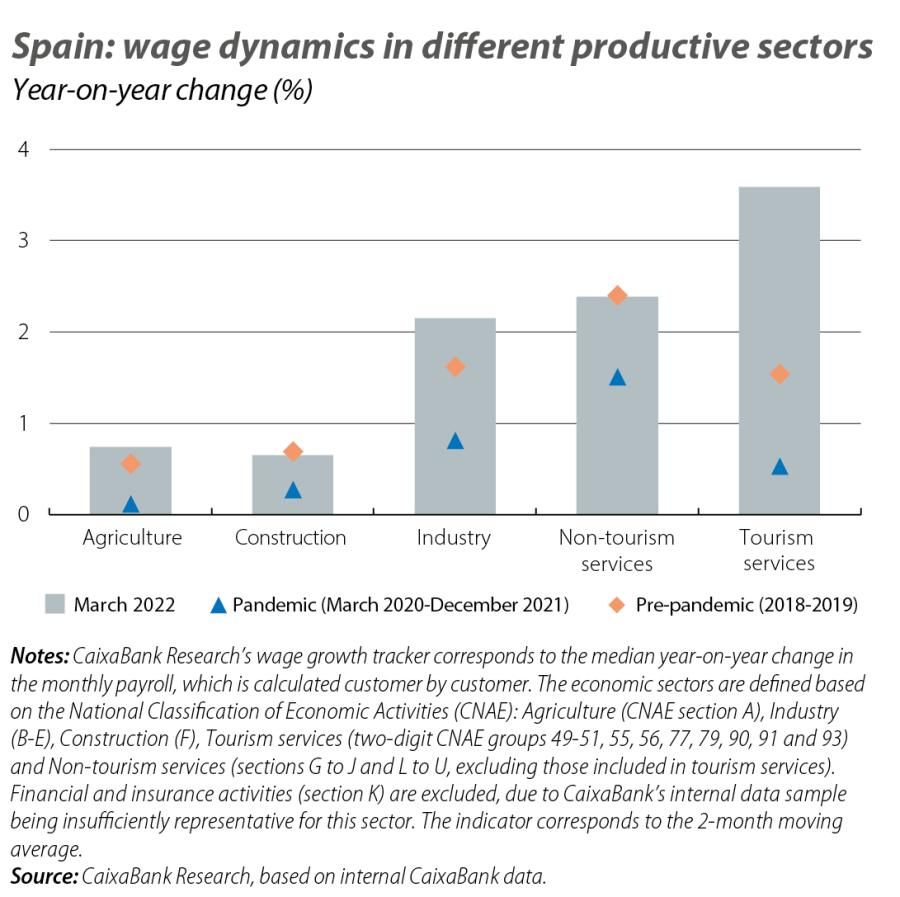

The wage dynamics are also different from one economic sector to another. Wages increased by 2.4% year-on-year in March in non-tourism services and by 2.1% in industry, while they are lagging further behind in the case of construction and agriculture (both 0.7%) (see third chart). We can conclude that, in all these sectors, wages are recovering some buoyancy as we emerge from the pandemic, with wage rises similar to those of 2018-2019. On the other hand, for the tourism services sector, which includes retail and hospitality, the payrolls increased by 3.6% year-on-year in March 2022, a higher rate than in 2018-2019. This reflects the recovery of the sector following the two years of pandemic during which they were heavily affected by activity restrictions.

By autonomous community region, in March 2022 wage rises of between 1.9% and 2.4% year-on-year were observed in most regions (see fourth chart). Also, in all regions, the wage growth observed for this period was higher than during the pandemic. However, there are marked differences between regions, with Asturias (1.6% year-on-year), Cantabria (1.8%) and Castilla-La Mancha (1.8%) registering the lowest wage rises. Those registered in Catalonia and the Community of Valencia were higher (2.4% and 2.5%, respectively), as one would expect given that these regions have also registered a recovery in economic activity above the national average.

In conclusion, for the time being there are no signs of significant wage pressures in Spain, neither in general, nor differentiating by sector or region. Nevertheless, the inflationary pressures and the uneven impact of the war in Ukraine across different sectors could change this situation in the coming months.5 Here at CaixaBank Research we will analyse the trend in wages month by month in order to quickly shed light on what is happening in our labour market.

- 5. See the Focus «Which sectors are most affected by the conflict in Ukraine?» in the MR04/2022.