Changes in the financial markets’ monetary policy expectations

After almost two years raising interest rates, in 2023 the major central banks reached the peak and adjusted their strategy: instead of raising official rates further, the monetary tightening was going to be implemented by keeping rates at that peak for longer. However, by the autumn the financial markets were already questioning this narrative. Why?

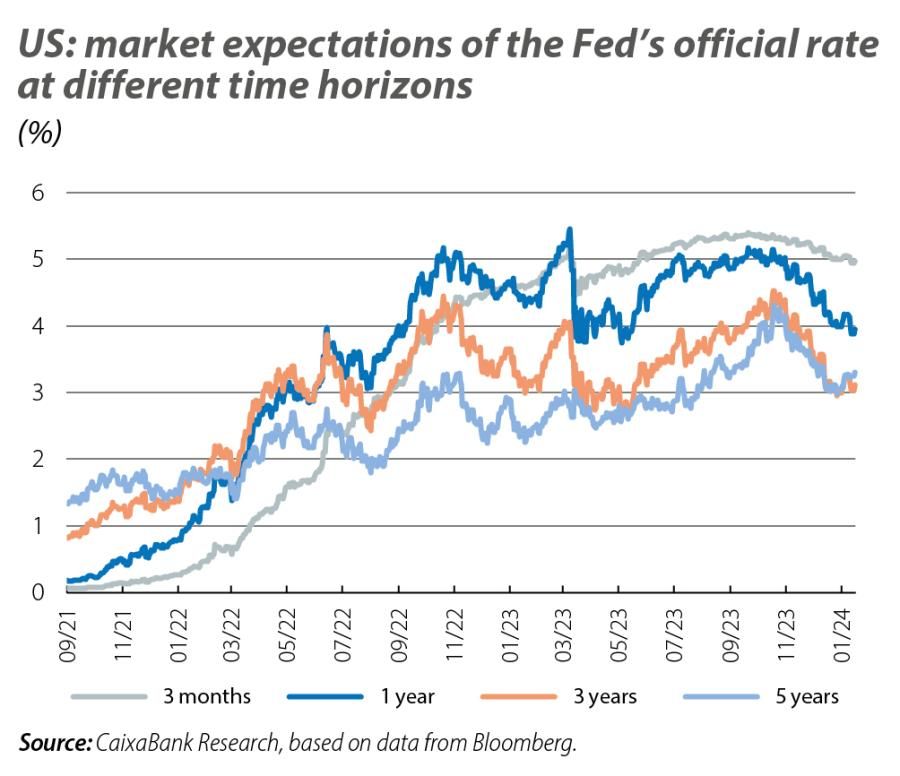

The first two charts show the daily evolution of expectations in the financial markets regarding the future path of the Fed and the ECB’s interest rates (i.e. the implied, or forward, rates).1 If we look at where expectations stood in late 2021, we see how the monetary tightening of the last two years took investors by surprise: in the US, the markets were expecting the Fed’s interest rates to lie in the 1.25%-1.50% range 3 years ahead (compared to the current level of 5.25%-5.50%), while in Europe they were betting on rates of –0.20% (versus the 4.00% observed). As the Fed and the ECB raised rates, the markets also raised their expectations accordingly, to the point that the cyclical tightening of monetary policy translated into a structural shift in interest rate expectations, with investors abandoning the narrative of a «sustained low interest rate environment for structural reasons» (such as productivity and demography). This was so much so that by last September the markets were forecasting long-term rates of 3.75%-4.00% for the Fed (+250 bps vs. pre-pandemic expectations) and 3.25% in the case of the ECB (+275 bps).

- 1. These expectations are not observable, but rather we infer them using the implied (or implicit) forward interest rates estimated according to L.E. Svensson (1994). «Estimating and interpreting forward interest rates: Sweden 1992-1994». NBER Working Paper.

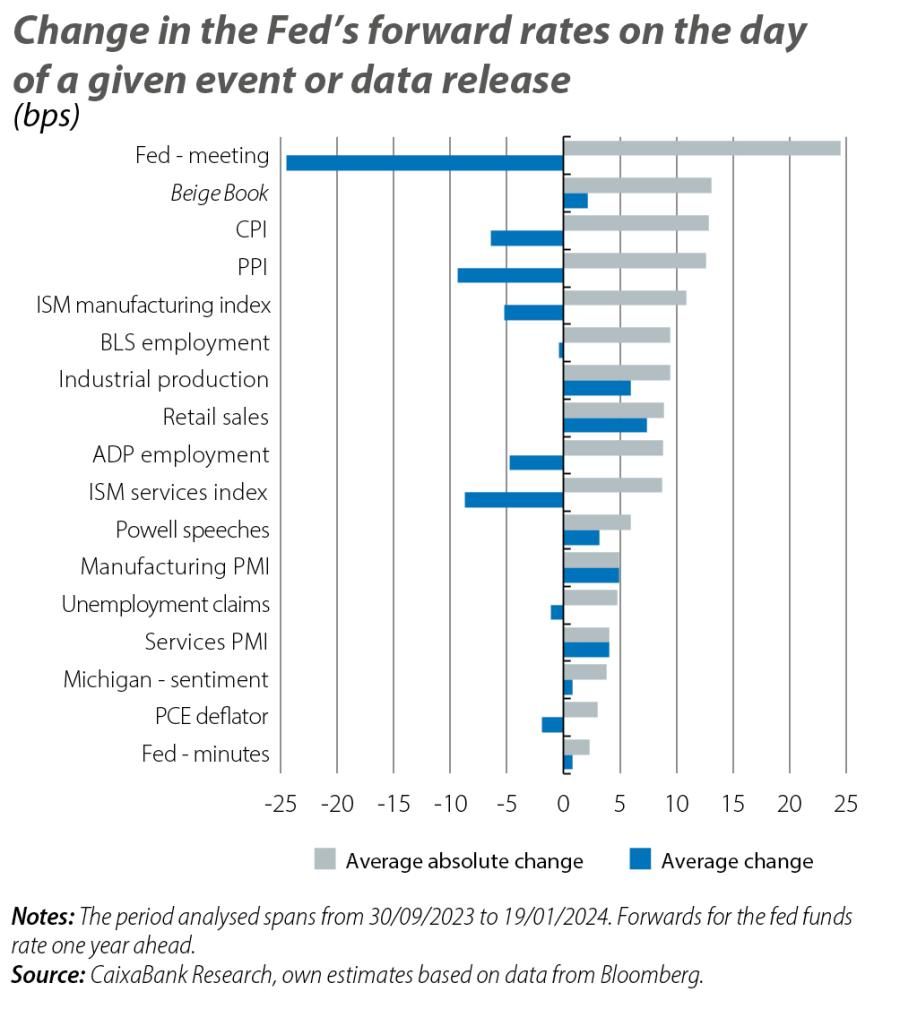

Before long, this narrative in the markets shifted yet again. By analysing daily fluctuations in the markets’ monetary policy expectations, we can identify the key economic events and data releases that accompanied the shift towards a new narrative of rapid and sustained rate cuts for 2024. The first big swing occurred on 1 November in the US, when 1-year forwards for the Fed’s official rate plummeted by over 15 bps following the central bank’s meeting (at which it announced no changes) and the publication of tenuous data regarding manufacturing activity (the ISM index). The adjustment gained momentum two days later, with a further decline in forward rates of almost 20 bps following a cooling in the employment statistics and the ISM services index. With no major surprises in the data in Europe, the forward interest rates for the ECB were partially dragged down by the US until 14 November. This date marked a milestone in the narrative shift, as the Fed and the ECB’s as forward rates for the Fed and the ECB fell by interest rates fell by almost 25 bps and more than 10 bps, respectively, after the publication of a sluggish GDP figure for the euro area (–0.1% quarter on quarter in Q3) and, above all, lower-than-expected US inflation data (CPI). Between late November and early December, the market’s shift was completed, coinciding with weak sentiment and economic activity data (consumer confidence, ISM and PMI indices), the slowdown in European inflation to 2.4% in November and Christine Lagarde’s testimony before the European Parliament (in which signs of cooling in the labour market were highlighted). At that point, the forward interest rates barely reacted to November’s US inflation figures and corrected slightly upwards following the release of data reflecting an acceleration in the US labour market in November.

Following a final collapse of the forward rates on the days of the Fed and the ECB’s December meetings (–32 and –9 bps in a single day, respectively), investor expectations have stabilised around a scenario in which the markets see the Fed and the ECB cutting rates in the spring and lowering them by around 150 bps in 2024 as a whole. Beyond the casuistry that appears to accompany each market session and every economic statistic that is published, the major daily movements reflect a realignment of expectations, led by the US and followed by Europe. This realignment is dominated by a dovish reading of the Fed and the ECB’s meetings and has been particularly triggered by good inflation data, as well as by a cooling in the economic activity data (see third chart). These ingredients have left the 1-year forwards ahead between 80 and 100 bps lower than where they stood in September 2023. Moreover, they have significantly dragged down long-term forward rates (by around 70 bps), despite the cyclical nature of the movement.2

- 2. Formally, long-term Fed and ECB rates should reflect structural factors and should not be significantly influenced by short-term fluctuations in the economic data. However, the volatility observed in the forward rates suggests that market expectations are not meeting this premise.

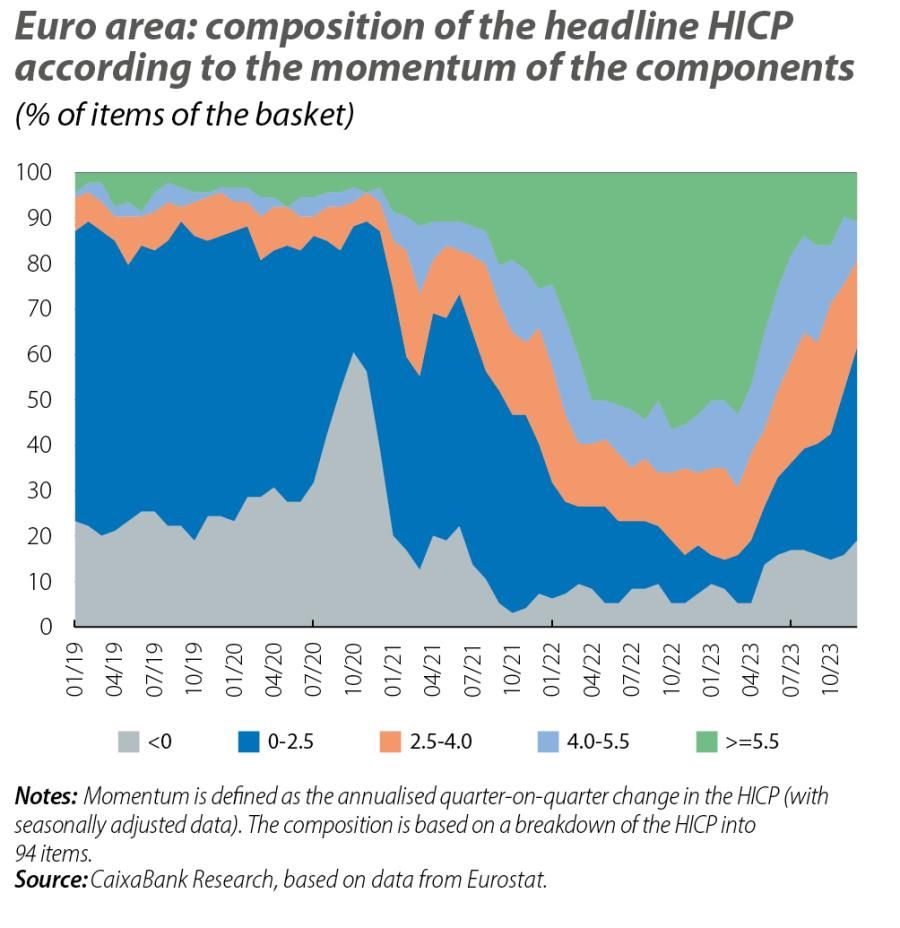

The shift in expectations in the financial markets has been sudden3 and, once consolidated, rather insensitive to new economic activity or inflation data. The evolution of inflation and its outlook, meanwhile, has been somewhat more gradual. Beyond the base effects which, especially in the year-on-year comparison of energy prices, contributed to rapid disinflation, more real-time indicators such as momentum4 already suggest that the 2% inflation target is in sight, although they also stress that there is still some way to go. For instance, in the euro area the percentage of components of the price index with a momentum above 2.5% fell from 65% in the summer to 38% in December. This is a significant decline, although it remains a far cry from the pre-pandemic norm of 15%. In the US, this percentage has normalised to pre-pandemic levels, albeit with an important difference: housing, which is one of more than 80 components in the analysis, represents over 30% of the basket for the headline index, it has a momentum in excess of 5% and it is taking longer than expected to cool down.5

- 3. In the US, four sessions alone produced (in aggregate) a gross decline in expectations of 90 bps.

- 4. Momentum refers to the annualised quarter-on-quarter change in the seasonally adjusted CPI, and captures recent trends better than year-on-year changes (which are more influenced by base effects). In December, it stood at 1.2% in the euro area and at 2.8% in the US.

- 5. See the Focus «The importance of rents in US inflation» in the MR09/2023.

Alongside this new market narrative, the central banks are also targeting rate cuts in 2024, but with greater caution. This is perhaps because, like the markets, they acknowledge the good inflation data, but before moving their chips they want to have a high degree of confidence that inflation will soon return to the target rate, especially given the strength of the labour market and the need to boost their credibility after two years of an inflationary crisis. The inflation figures in the coming months, among a wide range of indicators, will be key for determining whether the view of the markets or the greater caution of the central banks will win out.