Cautious optimism returns to the financial markets

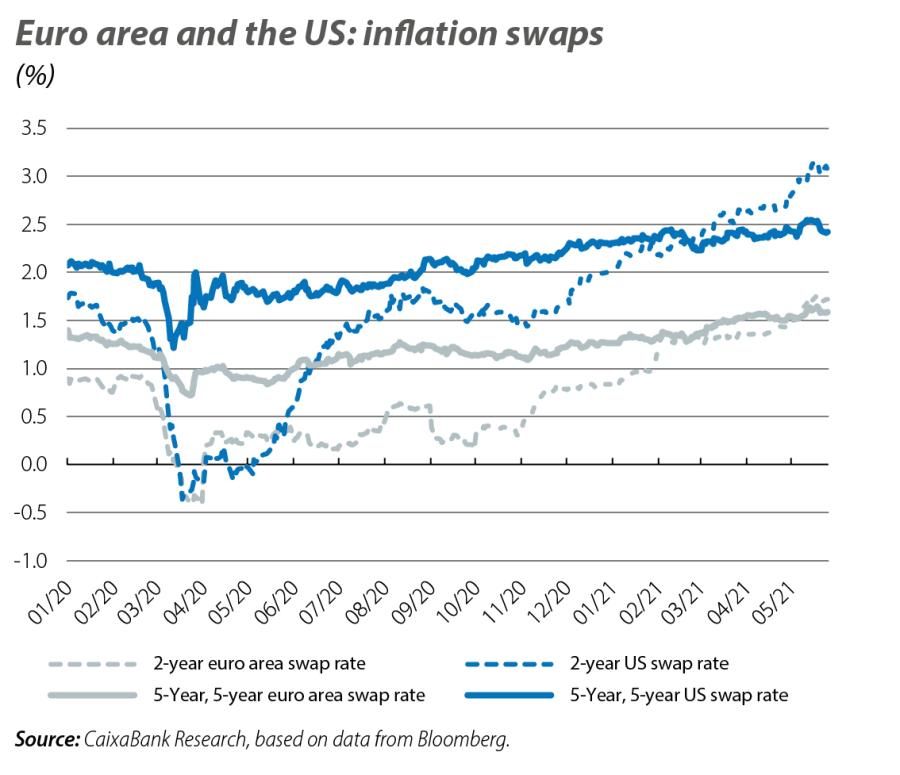

In May, the progress of the economic recovery, especially in the euro area, favoured a greater appetite for risky assets. Economic activity indicators, such as the PMIs, stood well above the 50-point mark and hinted at what could be a significant rebound in GDP in Q2 (see the International Economy section for further details). Also, the corporate earnings campaign accompanied the improvement in investor sentiment, as 87% of the companies in the S&P 500 reported higher profits than consensus expectations (72% in the case of the Eurostoxx 600). However, some factors, such as the rise in the number of COVID-19 cases in Asia, or fears of a sustained rebound in inflation (mainly in the US) which could force an early withdrawal of the monetary stimuli, limited the gains in the equity market. In any case, the messages from the major central banks still point in the same direction: both the ECB and the Federal Reserve believe that the spike in inflation will be temporary, and for the euro area in particular the central bank believes that a dovish monetary policy will need to be maintained for some time to come in order to bring medium-term inflation closer to its target. That said, some voices within the FOMC and even the ECB’s Governing Council are suggesting that some of these stimuli should begin to be reduced.

Despite both the Fed and the ECB maintaining that the rebound in inflation is transitory and should not change the direction of monetary policy, the progress of the economic recovery is encouraging the most hawkish members to talk about reducing the pace of net asset purchases. In the case of the Fed, the minutes of the April meeting offered a surprise by revealing that some members proposed discussing at upcoming meetings the idea of adjusting the asset-purchase programme should the economy continue to register «rapid progress» with regard to the targets. However, since April’s meeting the rapid improvements in the employment data have moderated, which could lead to these plans being put on hold. In the euro area, meanwhile, discussion of the rate of purchases under the PEPP, which currently stand at around 80 billion euros per month, was postponed until June. Members of the Governing Council will have to weigh up two opposing factors at the meeting: on the one hand, what is expected to be a solid rebound in economic activity in the second half of 2021 and, on the other, the rebound in interest rates on sovereign debt. In any case, some members’ messages suggest that, after the PEPP comes to an end, ECB support will continue to be needed to bring inflation in line with the target of below, but close to, 2%.

Interest rates on sovereign debt in Germany and the US surged during the first half of the month, hoisted up by the surprise of April inflation data in the US and economic indicators that suggest bottlenecks are being generated in some sectors of industry and transportation. The bund rallied 13 bps and reached –0.10%, a level not seen since May 2019. However, as the month progressed and messages from members of the Fed and the ECB indicated the continuation of the dovish monetary policy, interest rates on these assets returned to levels similar to those seen at the beginning of the month. Risk premiums for the European periphery, meanwhile, followed a very similar pattern, registering an increase in the first few weeks before ending the month almost flat (both the Spanish and the Portuguese spread fluctuated in the range between 65 and 75 bps).

In May, the main stock market indices maintained the good performance of the previous month and once again registered gains. These were higher in Europe (Eurostoxx 600 +2.1%, Ibex 35 +3.8% and PSI-20 +2.6%) than in the US (S&P 500 +0.5% and Nasdaq –1.5%), despite there being more positive surprises in the corporate earnings campaign on the other side of the Atlantic. The greater relative weight of companies in the discretionary consumption and technology sectors in the US could partly explain the worse performance of the US indices, as these sectors were particularly sensitive to the rises in inflation expectations and official interest rates.

The improved outlook for economic growth in the second half of 2021 reinforced the expectation of higher demand for crude oil, and the price of a barrel of Brent reached levels not seen since 2019. This factor overpowered others which momentarily pushed the oil price down, such as the rise in COVID-19 cases in Asia, especially India, and the thawing of relations between the US and Iran, which could culminate in the lifting of the export sanctions currently imposed on Tehran. Some estimates suggest that Iran could add 1.5 million barrels a day to the oil market, around 1.5% of global output. In FX markets, meanwhile, the US dollar weakened against most advanced-economy currencies, allowing the euro to fluctuate at around 1.22 dollars. Emerging currencies registered widespread appreciation, with the exception of the Turkish lira, which continued to show weakness in the face of investors’ lack of confidence following the changes made by Turkish President Recep Tayyip Erdoğan at the head of the country’s central bank.