Post-COVID-19 Europe: a story of convergence or divergence?

The economic shock of COVID-19 in 2020 has been unprecedented, of global scope but with differing intensity across countries and sectors. The euro area is no exception. Our central scenario assumes that Europe's economies will start to recover in 2021, although they will probably have to wait until 2023 to regain their pre-crisis levels of activity.

The economic shock triggered by the COVID-19 pandemic in 2020 has been unprecedented, of a global magnitude, and uneven between countries and sectors. This has also been the case for the euro area: while GDP has fallen in all the region’s economies, the impact has varied according to the prevalence of the virus in each country, the measures implemented to contain it, the structure of the economy and the economic policies developed by governments to soften the blow.

The hardest hit sectors have been leisure and catering, as well as retail, transport, accommodation and food services. As a result, the fall in GDP is more pronounced in countries that are more dependent on these sectors, such as Spain, France and Italy. Industrial activity, on the other hand, is being less affected by the crisis, although it has also declined considerably.

To counter the economic shock and avoid a surge in unemployment and business failures, as well as to preserve the productive fabric of the economy, European governments have deployed an unprecedented package of fiscal measures: according to the budget plans that each country sent to the European Commission in October, they amount to 4.2% of the euro area’s GDP and are mainly aimed at strengthening the health sector, offsetting the fall in workers’ and businesses’ incomes and, to a lesser extent, boosting the economic recovery through measures such as indirect tax cuts and new investments. In addition, Member States also undertook a series of initiatives to support households’ and businesses’ liquidity, such as suspending tax payments and social security contributions or granting guarantees for business loans. In this sphere there are also differences between countries: those with a lower level of public debt provided more direct aid, while countries with a weaker fiscal position opted for a higher proportion of measures aimed at supporting liquidity. In addition to these discretionary measures, the automatic stabilisers of European economies also played their part in cushioning the shock, and the euro area deficit for 2020 is expected to stand at around 9% of GDP.

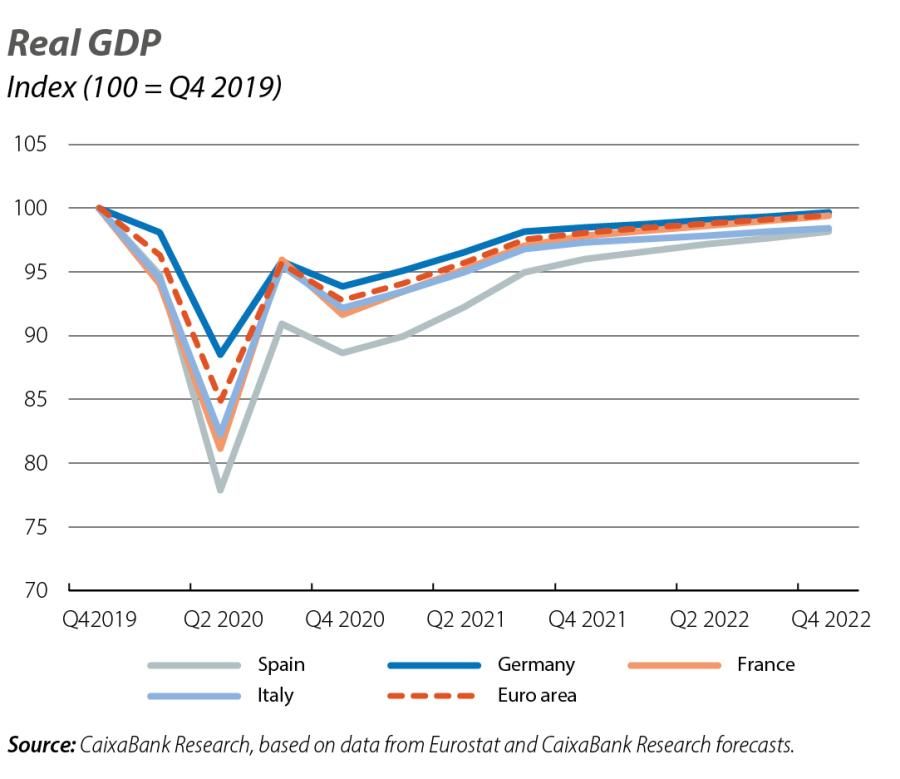

The recovery in economic activity in Q3, following the first wave of the virus and the relaxation of social distancing measures in most European countries, was spectacular and demonstrated European economies’ resilience and the success of the fiscal and monetary measures deployed. However, the second wave of the pandemic in Q4, which is being fought with more targeted and localised measures, is causing a new contraction in economic activity. Once again, the scale of this contraction will differ between countries, as the mobility data suggest (this is an indicator that is proving very accurate in assessing the economic impact of the COVID-19 pandemic).1 For the year as a whole, we expect Spain, France and Italy to end 2020 around 11%, 8.4%, and 7.9% below their respective pre-crisis levels (in contrast, Germany’s GDP will be only 6.1% below).

- 1. See the Focus «Mobility and economic activity in the second wave: how much will GDP fall by in Q4?» in this same Monthly Report.

In 2021, one of the key words will be recovery, but the word uncertainty, unfortunately, will continue to accompany us. Although the latest news is that a COVID-19 vaccine will soon be available, there are still questions over the production and distribution capacity, as well as over who can – or even who will want to – get vaccinated, and when. Therefore, it may be necessary in some countries to prolong the restrictions of recent weeks or to reactivate them in the early stages of next year after a de-escalation phase, depending on how the pandemic evolves. However, uncertainty should not be confused with pessimism. In our baseline scenario, we see European economies kick-starting their recovery in 2021 largely thanks to a more positive outlook, favoured by the foreseeable widespread use of rapid tests and the aforementioned availability of vaccines. Thus, despite the uncertainties that will dominate, sooner or later the medical advances ought to have a positive effect in 2021 that will translate to the economy. Nevertheless, we will probably have to wait until 2023 before pre-crisis levels of economic activity can be reached.

Similarly, we are unlikely to return to the pre-pandemic «normal» any time soon: the restrictions, although reduced, will not be completely lifted until herd immunity is achieved and the pandemic is under control, and new social behaviours will not disappear overnight. For this reason, it is also unlikely that the economic sectors heavily affected by this crisis, such as tourism and air transportation, will return to pre-crisis levels of activity quickly. Consequently, economies that depend more heavily on these sectors, such as Spain, will likely take longer to recover to pre-COVID-19 activity levels. There is also a risk that countries with less fiscal margin will be more reluctant to continue supporting the economy to the same extent if the pandemic persists for longer than expected.

As a result, this crisis, like the previous one endured by the euro area, could further increase the gap in economic prosperity between European countries (see third chart).

One of the major differences between the current crisis and the previous one is the economic policy response at the European level. In addition to setting up a series of funds through which the EU will be able to lend to its Member States at reduced interest rates (ESM, SURE, etc.), the European Council approved the creation of a European recovery plan, known as Next Generation EU (NGEU), with a budget of 750 billion euros. The main component of NGEU is the Recovery and Resilience Instrument. This instrument will provide 312.5 billion euros in grants and 360 billion in loans between 2021 and 2026 to EU Member States to help finance investment projects and reforms that boost the recovery and their economies’ resilience. Crucially, the amounts available for each country will depend on how severely-affected they will be by the crisis. This is a historic agreement, as it will be the first time the EU has issued its own debt to transfer such large sums to its Member States.

NGEU was created to support Member States’ efforts to respond to the COVID-19 crisis and to boost the EU’s green and digital transitions. In addition to supporting economies’ recovery, the goal is for NGEU to trigger a substantial and widespread increase in public investment, which has been weak in the euro area over the past 10 years, especially in countries with higher public debt (which has contributed to the economic divergence between countries after the 2008 financial crisis). Through NGEU, countries with less fiscal space will be among those that will receive a greater sum of European funds to invest in investment projects and national reforms. It is estimated that Spain, for instance, could receive some 72 billion euros in transfers, a considerable amount that could have a substantial impact on the country’s economy.

The implementation of this historic decision lies in the hands of the European Commission and the European Council, which will have to approve each country’s national recovery plans in 2021. Above all, however, it is in the hands of national governments, which must use the funds in the best way possible and not let this enormous opportunity go to waste. In developing their national recovery plans, they will have to think about which investment projects are most appropriate to drive the recovery and transformation of their economies, which reforms to accompany them with, and what processes will be necessary to ensure the best execution of those projects.

This will involve a Herculean effort, even more so in the midst of the euro area’s biggest ever crisis, and this effort will have to be sustained for several years. However, if well executed, it will end up being a catalyst for convergence that could become a permanent tool, helping to complete the architecture of Europe’s monetary and economic union.