Portugal: the revision of the National Accounts points to a more robust economy

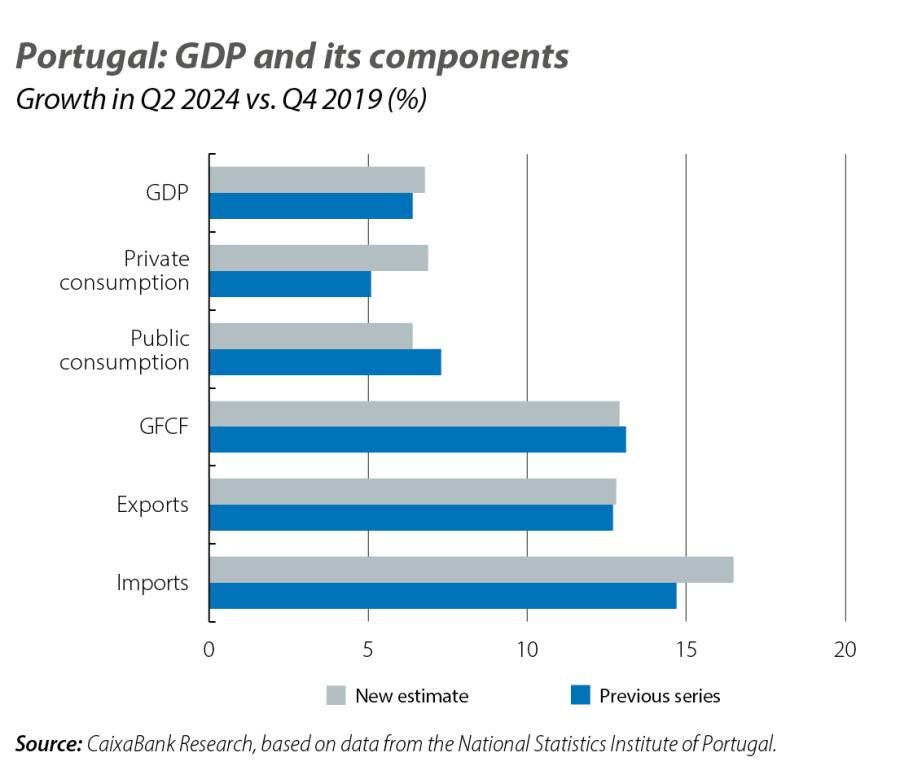

After reconsidering the key macroeconomic variables on the basis of the updated data series of the National Accounts, real GDP growth for 2023 was revised up from 2.3% to 2.5%. When combined with the revisions made in Q1 and Q2 2024, this places real GDP 6.8% above the level of Q4 2019. The new estimates reflect a greater contribution from domestic demand, via private consumption, and a lower contribution from foreign demand, due to an upward revision of import growth. Household savings have also been revised upwards. According to the revised series, in 2023 this variable stood at 14.3 billion euros, which places the savings rate at the end of 2023 at 8%, 1.4 pps higher than previously reported. The trend of a steady rise in the savings rate continued in S1 2024, bringing it to 9.8%. This was driven by a significant increase in nominal disposable income (+7.6% year-on-year), which exceeded the rise in nominal private consumption (4.6%).

As for recent developments, the indicators for Q3 continue to show mixed signals, with a steady improvement over the course of the quarter. The main synthetic indicators suggest an acceleration of activity in September. Among them, the European Commission’s economic sentiment indicator showed a particularly strong recovery, rising to 104 points in September and up 2.9 points versus August. Consumer sentiment also showed improvement, as did all other sectors with the exception of construction.

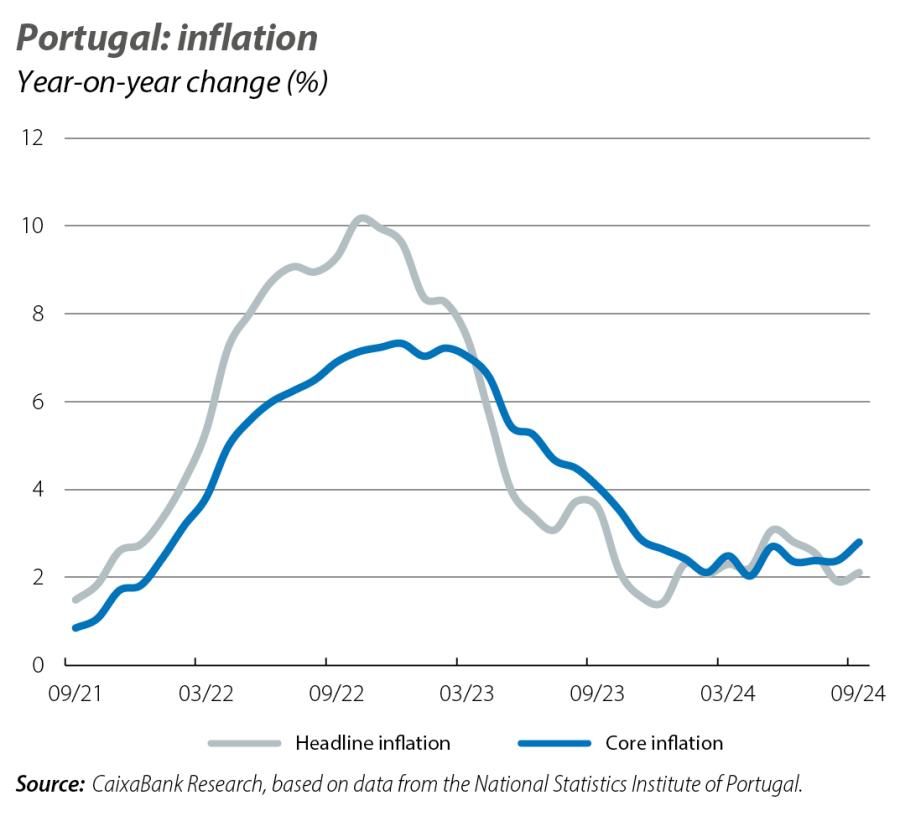

Headline inflation rose by 0.2 pps to 2.1% due to the rebound of the core components, while unprocessed food and energy inflation were more favourable (year-on-year inflation of 0.9% and –3.5%, respectively). Thus, the core index was worse than anticipated, rising to 2.8% (2.4% previously). We expect inflation to remain above 2% in the final quarter of the year, such that average inflation for the year as a whole will be 2.4%.

Employment loses momentum and in August its growth slowed to a year-on-year rate of 0.9%. Nevertheless, the unemployment rate declined again in August, reaching 6.4%. In this context, we have slightly revised our expectations for the unemployment rate downwards and we now expect it to stabilise at 6.5% in 2024 (versus 6.6% previously), moderating to 6.4% next year.

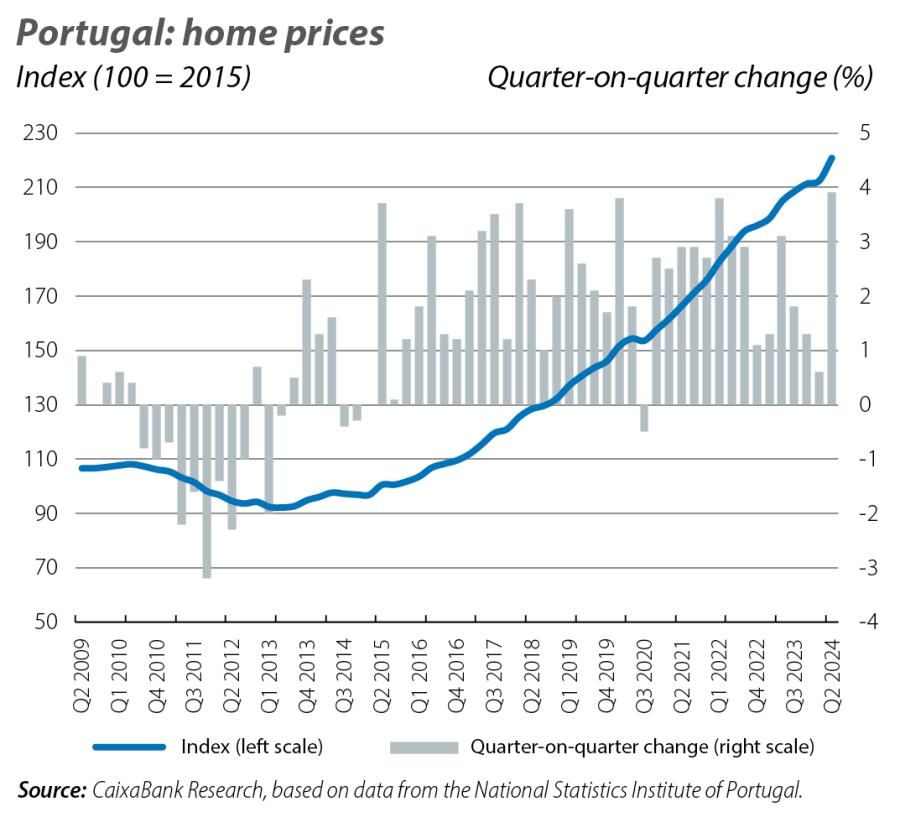

In Q2 2024, the home price index registered the biggest quarterly increase in the series, at 3.9%. This was a far higher growth rate than those recorded in previous quarters (+1.3% and +0.6% in Q4 2023 and Q1 2024, respectively). The number of sales also recovered, up 10.4% year-on-year and breaking a cycle of seven quarters of decline. In this context, we have revised our forecasts and now expect home prices to climb by an average of 6.8% in 2024.