Volatile summer for the financial markets

Between the 2nd and 5th of August, the financial markets experienced their most turbulent sessions in years, triggered by hasty fears of a US recession and an unexpected decision by the Bank of Japan that caused a spike in volatility. Since then the markets have turned a page, rendering those declines of early August no more than a scare and restating the soft-landing scenario as being the most likely.

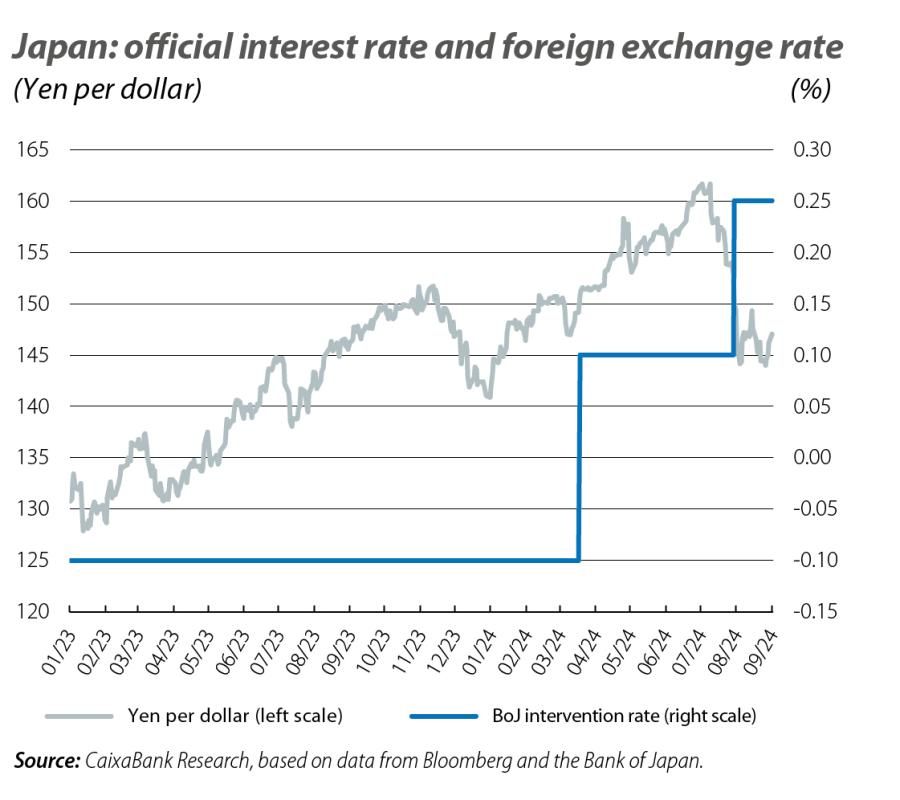

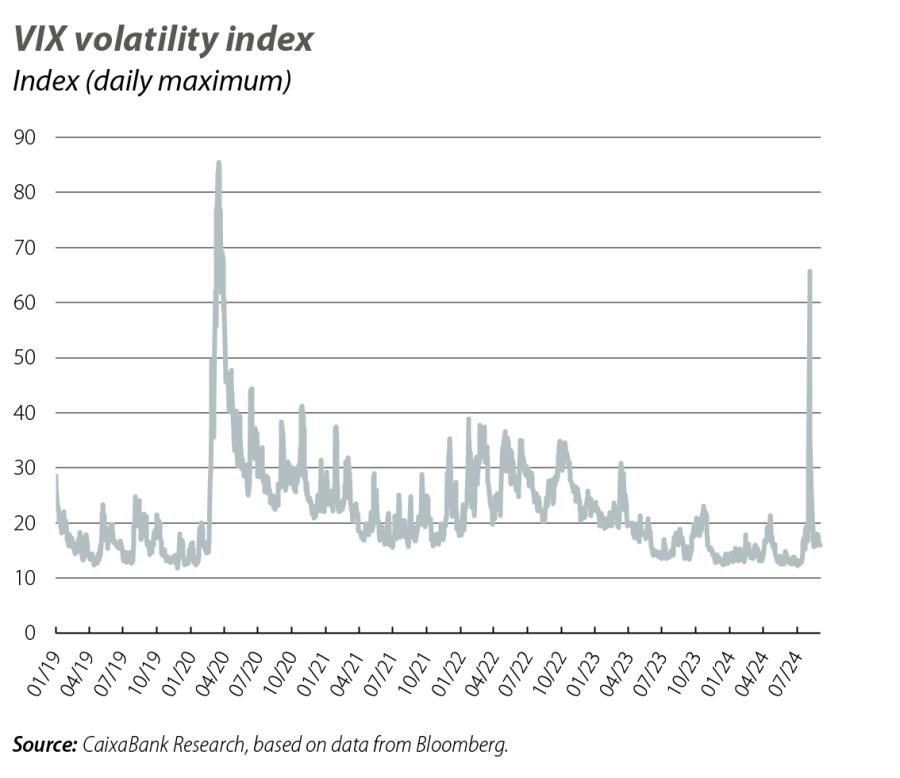

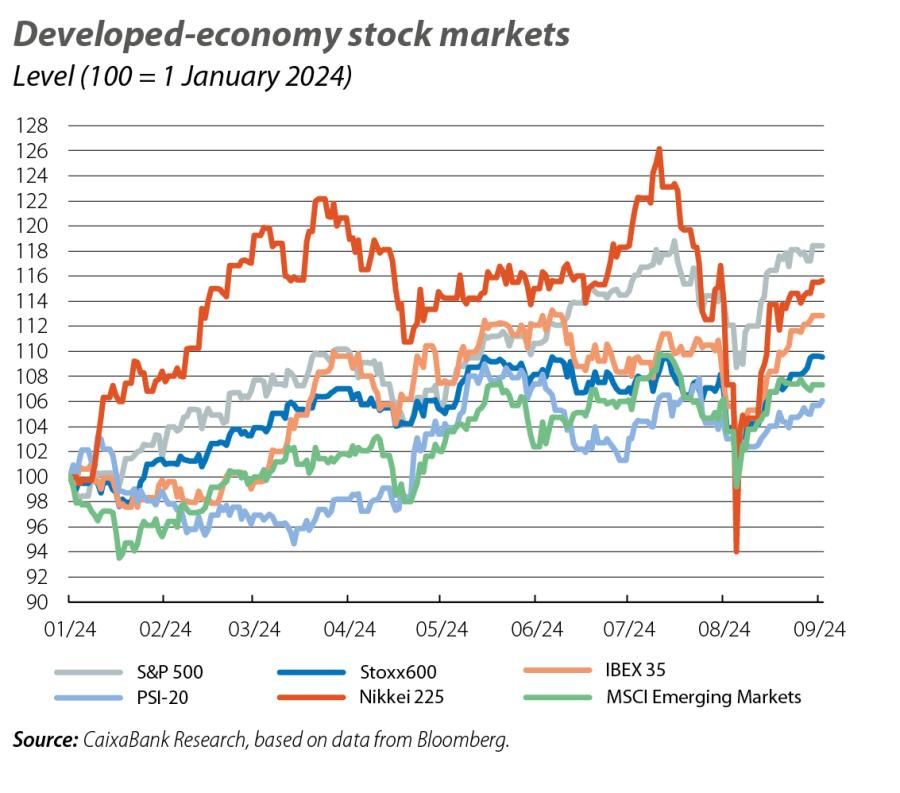

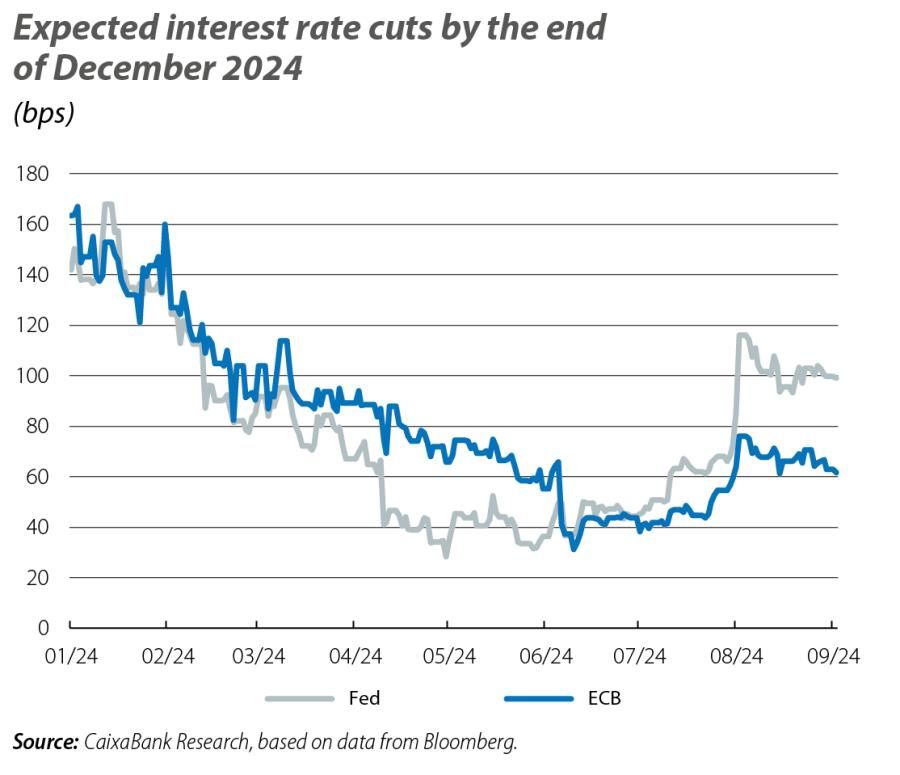

It all started on 31 July, when the Bank of Japan (BoJ) unexpectedly announced an increase in its benchmark interest rate from 0.10% to 0.25%. The surprise caused a rally in the value of the yen within the space of just a few days, and this triggered a sharp fall in the Japanese stock market and prompted the closure of carry-trade positions (whereby low-cost financing denominated in yen is used to invest in higher-yield assets). This, in turn, exacerbated the movements in the foreign exchange and stock markets. Two days after the BoJ’s decision, the employment data for July in the US were published, with the figures falling somewhat short of expectations (see the International Economy - Economic Outlook section). This triggered fears of a possible recession, intensifying the state of nervousness around the globe. What began as a downturn in the Japanese stock market ended in a global sell-off of shares. Japan’s Nikkei 225 index experienced its worst day in almost 40 years, falling 12.5%; the S&P 500 recorded its biggest fall since November 2022, while developed-economy stock markets fell to 8.2% below their July peaks. The dollar lost up to 3% of its value, while the yen appreciated by as much as 6%. The VIX volatility index reached heights not seen since the pandemic, further exacerbated by the low liquidity that is typical of the summer. The money markets, meanwhile, increased their expectation regarding the Fed’s rate cuts for 2024 from 50 bps to 100 bps, placing rates within the 4.25%-4.50% range by the end of the year.

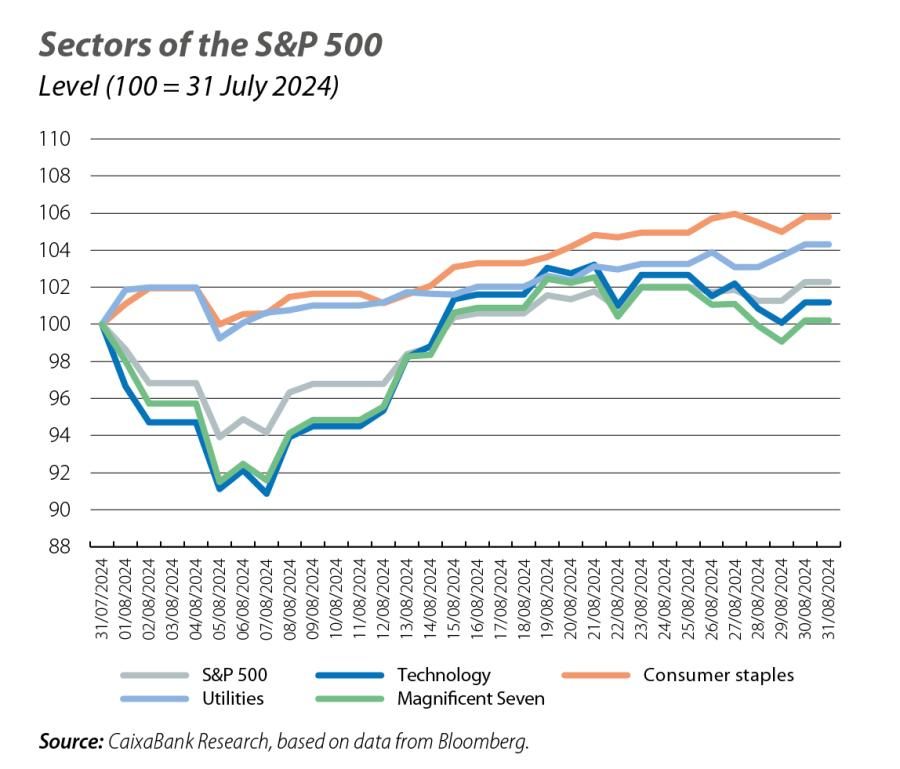

Since then, calm seems to have gradually returned to the markets, supported by the latest activity and inflation data which paint a picture of a gentle slowdown scenario with inflation almost under control. Thus, most of the major stock market indices ended the month of August with gains of more than 1%, except the Nikkei 225, which, despite managing to recover much of the setback endured at the beginning of the month, closed slightly in red. In the euro area, the IBEX 35 performed particularly well, driven by the consumer sector. In the US the sector breakdown reveals that the recovery of equities presented a more defensive bias, led by sectors such as consumer staples and utilities. The big tech firms, meanwhile, lagged behind, with the Nasdaq closing the month below the S&P 500 and the Magnificent Seven climbing just 0.20% in August. After all, with the latest earnings season now concluded, the results of the big tech firms have highlighted once again the challenges of monetising AI in the short term.

The futures markets have also calmed down, albeit to a lesser extent. At the peak of the volatility, the markets severely penalised the Fed’s decision to maintain interest rates in the 5.25%-5.50% range at its July meeting. They began speculating about a rate cut in the lead-up to the September meeting and assigned an almost 100% probability that the Fed would lower rates by 50 bps, instead of 25 bps. That probability is now at just 35%. What did not change was the expectation that the Fed will make 100 bps of cuts by the end of the year, compared to the 50 bps anticipated prior to the release of the employment data. Behind this expectation lies the shift in the Fed’s focus from inflation to labour market risks, noting that any further cooling would not be welcome. In addition, Powell stressed that the Fed has ample room to act on any risk that might emerge, suggesting they could be more aggressive in their monetary easing. So, while the Fed is almost certain to lower rates in September, as Powell assured by stating that «the time has come for policy to adjust», the speed and intensity of subsequent movements will be determined by how things pan out in the labour market over the coming months. The adjustment of expectations in the US caused treasury yields to fall by as much as 35 bps in August in the case of the 2-year yield, which is especially sensitive to short-term monetary policy.

The adjustment of expectations for the ECB was less pronounced and, after some initial volatility due to the contagion effect of events in the US, expectations once again settled on two rate cuts of 25 bps each for the rest of the year. The ECB's position, generally speaking, has been that the recent data open the door to rates being reduced even further, provided that the disinflationary process continues, and that the slowdown in wage growth is a particularly promising sign. That said, the ECB has also generally adopted a cautious tone and has advocated a gradual approach to monetary policy formulation. Consequently, sovereign yields in the euro area ended the month almost flat.

The foreign exchange markets have felt much of the impact of the shift in interest rate expectations in the US. The dollar weakened 2.30% against its main peers, and against the euro it reached 1.12 dollars/euro, before finally closing at 1.10 dollars/euro. The yen, meanwhile, oscillated in the 154-144 yen/dollar range, finally settling at around 146 yen/dollar, representing an appreciation of 5% since the BoJ’s announcement.

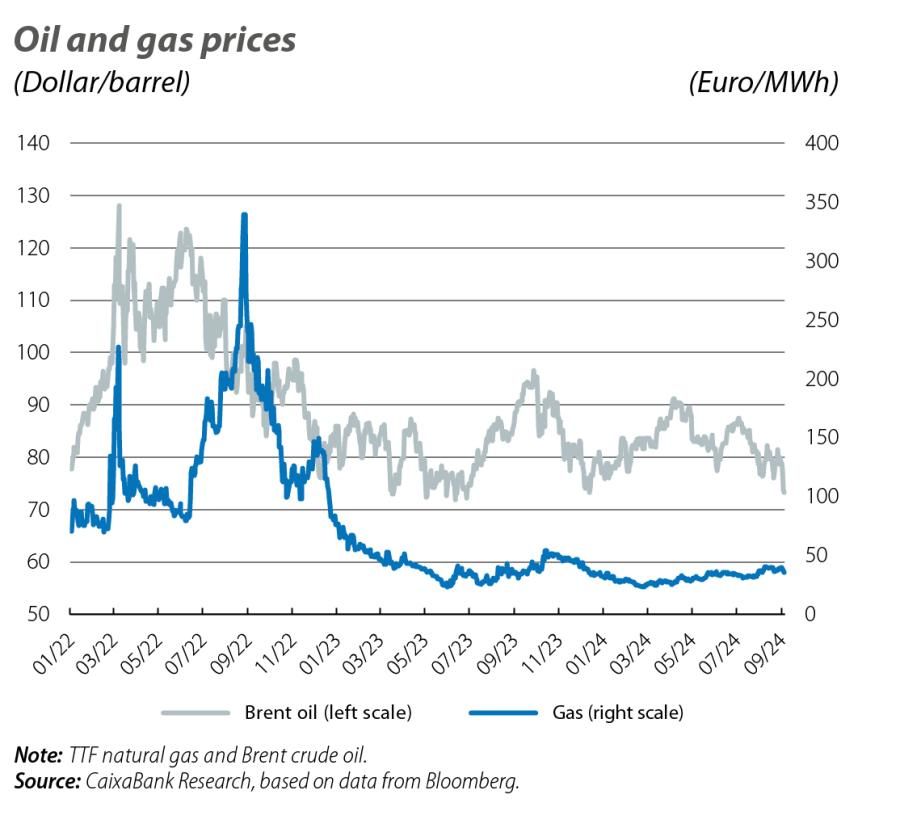

Their market prices thus continued to respond mainly to the fundamentals of each market, and even the increase in geopolitical tensions in the Middle East was insufficient to cause a significant rise in oil and gas prices. Towards the end of the month, downward pressures on oil prices increased due to growing doubts about demand in the US and China amid continued weakness in manufacturing activity coupled with an increase in global crude oil supply. The Brent barrel price reached around 73 dollars, its lowest level this year, undoing the gains accumulated in 2024.