Spain: strong growth outlook, albeit more moderate than in the first half

The Spanish economy performed better than expected in the first half of the year, but a slight moderation is anticipated in the second half.

The Spanish economy performed better than expected in the first half of the year, but a slight moderation is anticipated in the second half

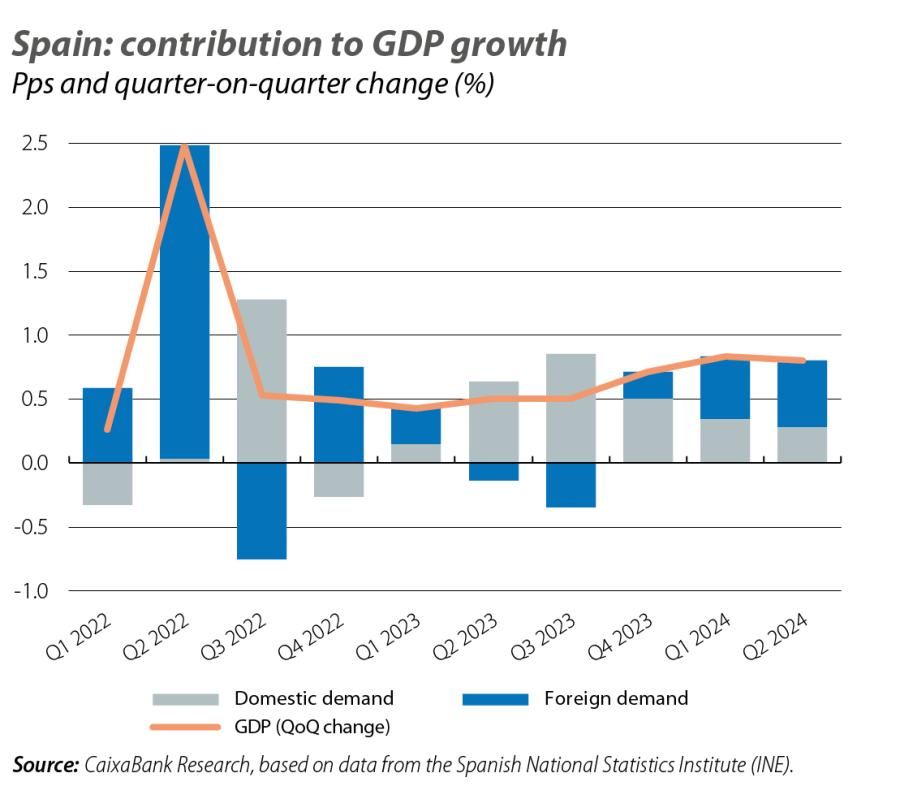

GDP grew at a quarter-on-quarter rate of 0.8% in both Q1 and Q2 of this year. This strength is mainly due to the good performance of the foreign sector, driven by a booming tourism sector in Q1, as well as the strength of foreign sales of goods in a context of moderating imports in Q2. Looking ahead to the coming quarters, the foreign sector could gradually give way to domestic demand as the main driving force, in view of the normalisation of the pace of growth in the tourism sector and the weakness shown by our main trading partners in the euro area. Domestic demand, for it part, should gain strength as purchasing power continues to recover and uncertainty surrounding the monetary policy outlook diminishes. However, the stronger domestic demand is not expected to fully compensate for the slowdown in the foreign sector.

Spain’s GDP growth for Q2 2024 beats expectations

GDP expanded 0.8% quarter-on-quarter in Q2, surpassing both the euro area average (0.3% quarter-on-quarter) and our own expectations, with a growth forecast of 0.5%. In year-on-year terms, the rate accelerated to 2.9% from the 2.6% recorded in the previous quarter. The foreign sector remains the main growth driver, with a 0.5-pp contribution to quarter-on-quarter GDP growth. Domestic demand is also on the rise, albeit at a more modest rate, contributing 0.3 pps to GDP growth. Private consumption rose by 0.3% quarter-on-quarter and public consumption by 0.2%. Investment continued to record strong growth, at 0.9% quarter-on-quarter, driven mainly by investment in construction. Exports, meanwhile, expanded 1.2% quarter-on-quarter thanks to exports of goods, while imports fell by 0.2%.

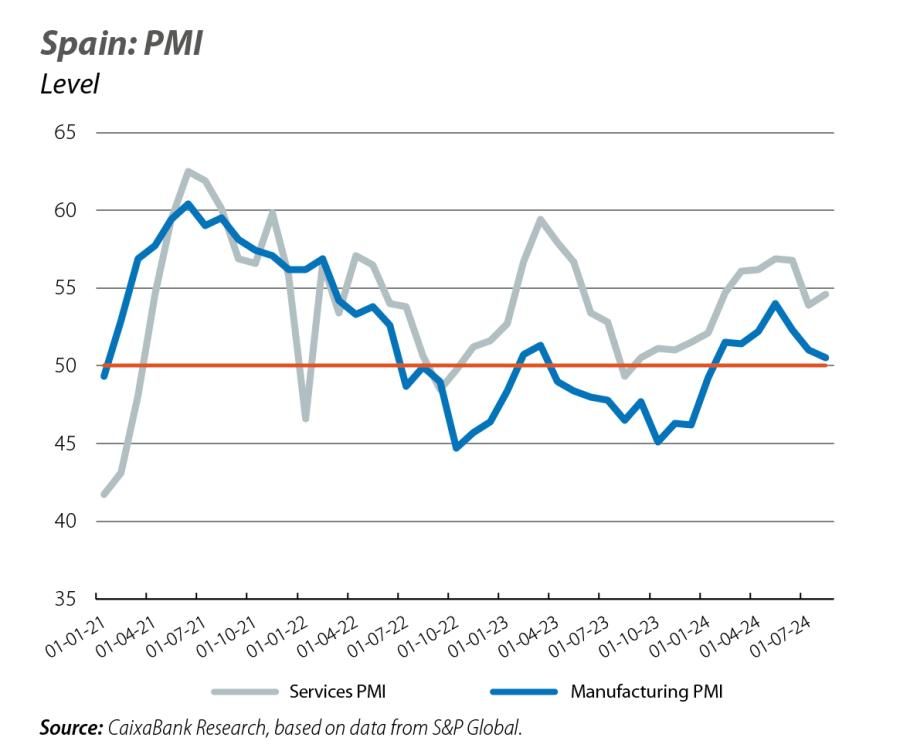

The first economic activity indicators available for Q3 reflect a more contained tone

The Purchasing Managers’ Index (PMI) for the manufacturing sector has steadily slowed during July and August, and in its last reading it stood at 50.5 points, down from 52.3 points in June. The PMI for the services sector, for its part, has rebounded in August after suffering a slump in July and stands at 54.6 points (56.8 points in June). Given that they remain above the threshold denoting growth (50 points), both of these readings point to activity growth in the respective sectors, albeit at more moderate rates than in the previous quarter. On the consumption side, consumer confidence fell in August and scored –15.2 points, compared to –13.7 points in July. In contrast, the retail trade index rose by 0.5% month-on-month in July and brought the year-on-year rate to 1.0%, compared to 0.4% in the previous month.

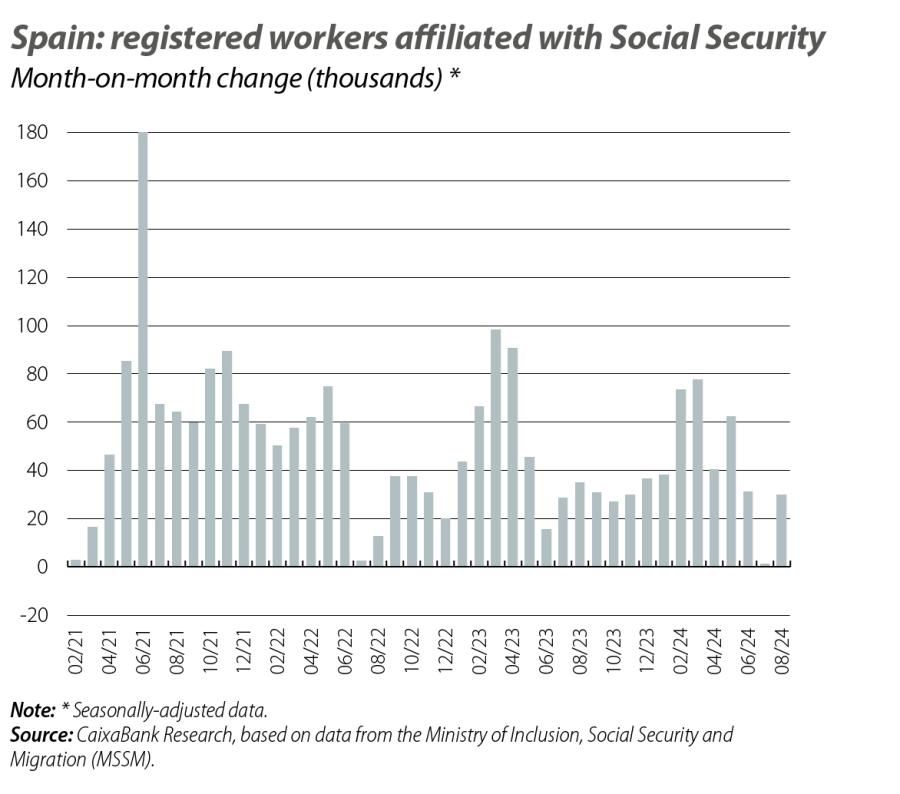

The labour market is also advancing more timidly

As is commonplace in the month of August, the number of registered workers affiliated with Social Security fell. This month it did so by 193,704 workers compared to the previous month, or –0.91%. This decrease is consistent with past experience in the month of August: last year the number of registered workers fell by a monthly rate of 0.89%, while the average decline recorded in the month of August during the period 2014-2019 was 0.88%. The total number of registered workers stands at 21,189,402, which is 482,902 more people than a year ago and represents a year-on-year growth rate of 2.3% (2.4% in July). Correcting for seasonality, employment in August registered a rise of 30,189 registered workers, after having remained practically flat in July (+1,335). So far in Q3, quarter-on-quarter growth in the number of affiliates slowed to 0.3%, down from 0.8% in Q2.

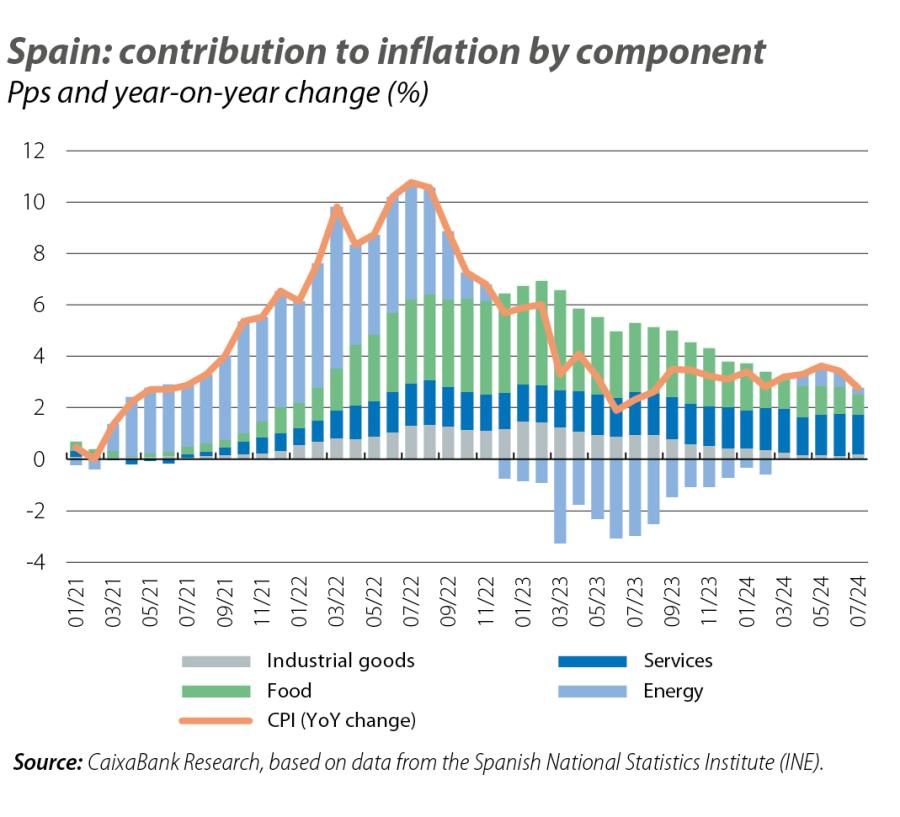

Headline inflation approaches 2% in August

According to the CPI flash indicator published by the National Statistics Institute (INE), headline inflation fell 0.6 pps in August to 2.2%, as a result of the decrease in fuel prices and, to a lesser extent, unprocessed food. In the absence of the breakdown by category, the fall in food prices indicated by the INE could offer a respite for the component that has been experiencing the highest rate of inflation this year (4.7% on average). On the other hand, core inflation (excluding energy and unprocessed food) stood at 2.7% (0.1 pps lower than in July). The figure for this month represents a further step towards a normalisation of inflation; however, the increase in electricity prices anticipated by the futures markets could hold back this corrective trend in the closing stages of the year.

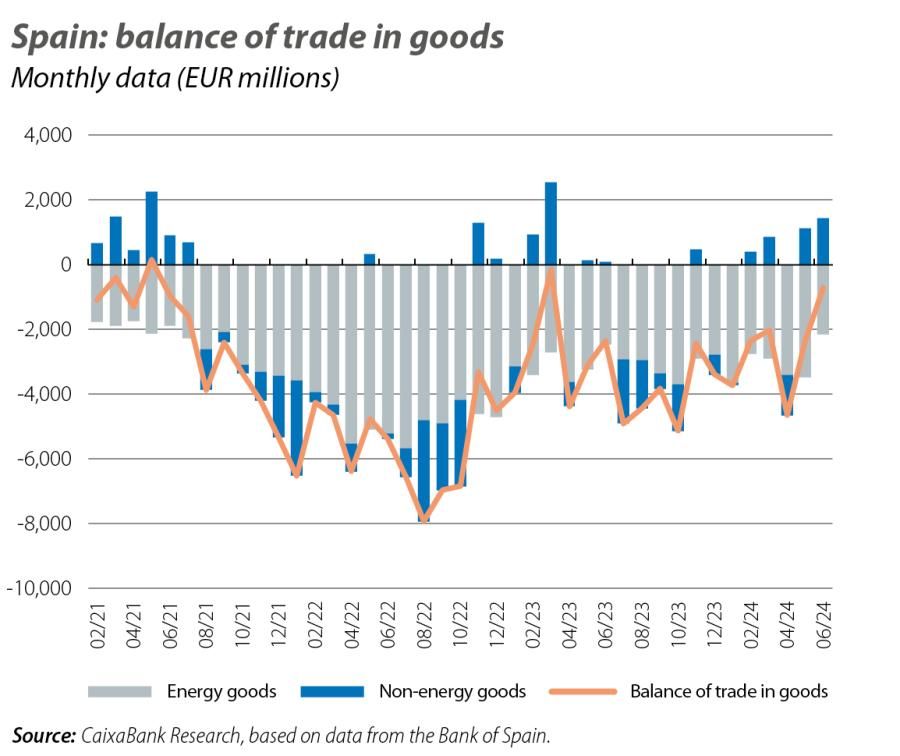

Despite the fall in exports, the trade deficit narrows rapidly in June

For the first time in three months, exports of goods fell in June, at a rate of 3% year-on-year. However, the fall in imports was even more pronounced (–7.3%), causing the deficit to decline to 713 million euros (–2.355 billion in June 2023). By component, the deficit in the energy balance stood at 2.158 billion, down from the 2.454 billion recorded in June 2023. The non-energy balance, meanwhile, showed a surplus position of 1.445 billion euros, compared to 99 million a year ago. With this data, the first half of 2024 closed with a deficit of 15.822 billion, marking a slight improvement over the first half of 2023 (–16.420 billion), but exceeding the average for the period 2014-2019 (–11.938 billion).

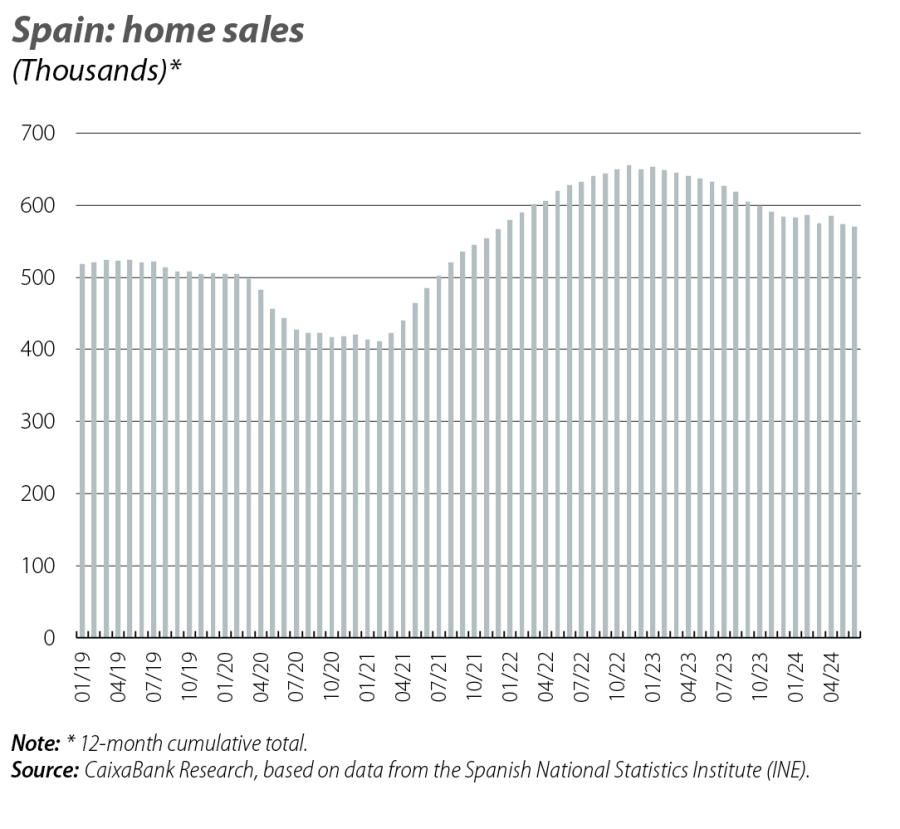

Home sales continue to moderate

In June, homes sales decreased by 6.1% year-on-year. By type of housing, the timid increase of 0.9% year-on-year in new home sales was not enough to offset the 7.8% year-on-year decline among existing homes. Despite the setback, home sales remain at a high level: in the past 12 months there have been some 570,000 transactions, 12.8% more than in 2019.