The economic climate indicator remained unchanged in Q2, while confidence in the industrial sector is improving and the production outlook has gained strength. In the same vein, household sentiment is showing a positive trend and the partial consumption indicators suggest that household spending remains buoyant. Investment-related indicators also predict a positive performance, with imports of capital goods accelerating. The foreign sector is performing well, although a sharper acceleration in imports could limit the contribution of foreign demand to GDP growth.

The Portuguese economy’s lending capacity increased in Q1 and stood at 8.76 billion euros in the cumulative 12-month period, representing 3.2% of GDP, half a point higher than at the end of 2023. This evolution was the result of a 3.2% increase in the total volume of savings in the economy, as well as an increase of 4% in the balance of transfers received from the rest of the world (including European funds) compared to almost stable investment, which grew by just 0.2%. By sector, companies are saving the most, as well as being the sector that is receiving the most capital transfers. However, they are also the group that is investing the most, which translates into financing needs of 2.2% of GDP. In the rest of the sectors, the situation is reversed: savings exceed investment, thus contributing to the economy having a lending capacity. In the case of households, their savings rate increased to 8% of disposable income, the highest level since 2014. This reflects the higher income growth (8.4% vs. 5.3% for consumption), supported by the strong growth in the total wage mass (employment and wages) of 10.6%. Finally, the public sector recorded a surplus of 0.9% of GDP.

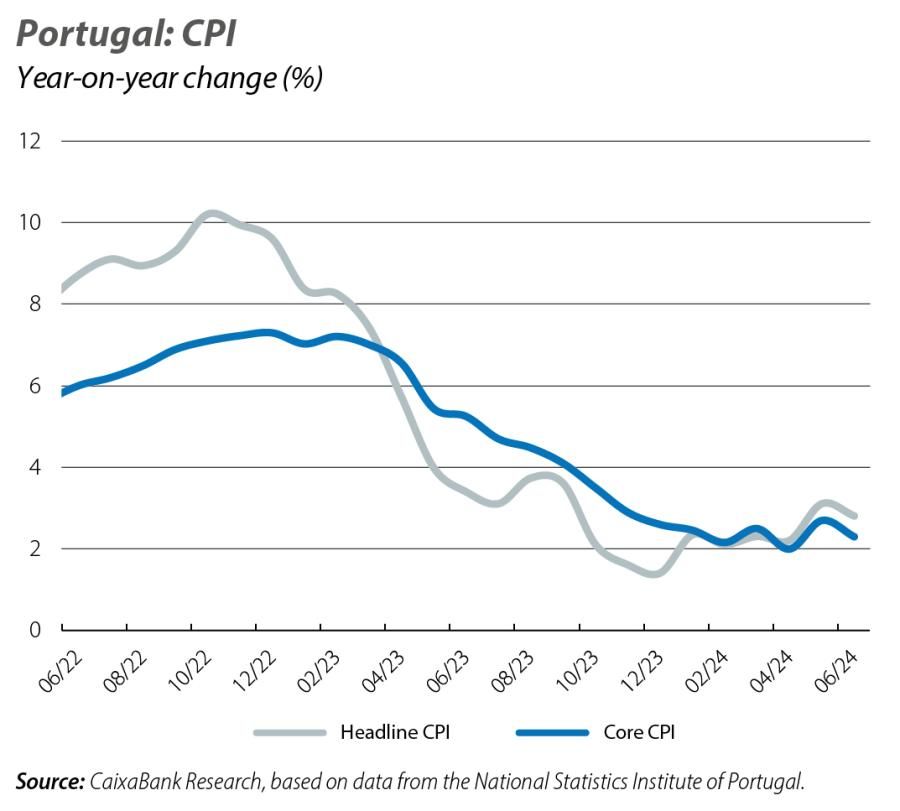

Following the shock of the previous month, the CPI once again stood below 3% in June. Specifically, it fell 0.3 pps to 2.8%, while the core index decreased 0.4 pps to 2.3%. Although fluctuations are still expected in 2024, we expect a more favourable trajectory and that inflation will remain below 3%, meaning that the path towards disinflation appears to have consolidated.

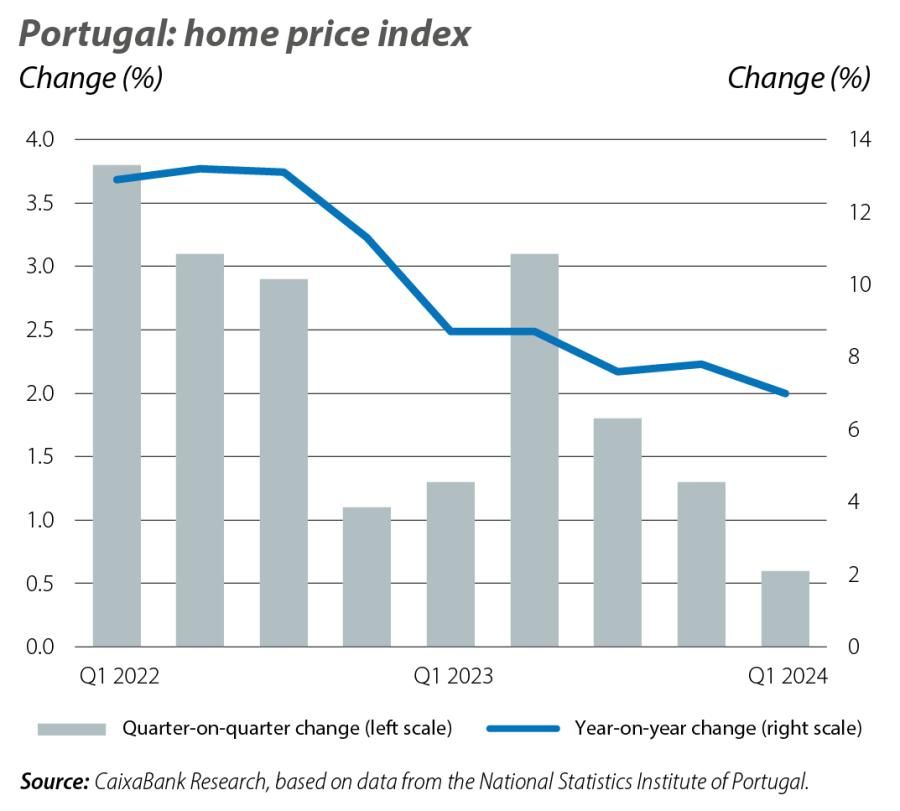

For the third consecutive quarter, in Q1 2024 the quarter-on-quarter change in the home price index slowed (0.6% vs. 1.3% previously), although prices still registered sharp year-on-year growth, at 7%. The number of sales fell by 3.1% in the quarterly rate and by 4.1% year-on-year, although the trend points to a stabilisation at around 30,000 homes/quarter (above the pre-pandemic average of 25,300/quarter).