Where has the fall in the temporary employment rate been concentrated?

The combination of restrictions on the use of temporary contracts, coupled with the push for the use of permanent discontinuous contracts to channel work that is intermittent but recurring, has contributed to the reduction in the temporary employment rate, one of the main handicaps of Spain’s labour market and addressing it was one of the objectives pursued by the last labour reform.

One of the pillars on which the resilience of the Spanish economy has been supported in recent years is the remarkable buoyancy of the labour market. Not only have record employment figures been reached, but major progress has also been made in bringing down the high rate of temporary employment. This is considered to be one of the main handicaps of Spain’s labour market and addressing it was one of the objectives pursued by the last labour reform approved in December 2021.1 The reduction of temporary employment has been widespread across different sectors, age groups and regions, although there are certain differences.

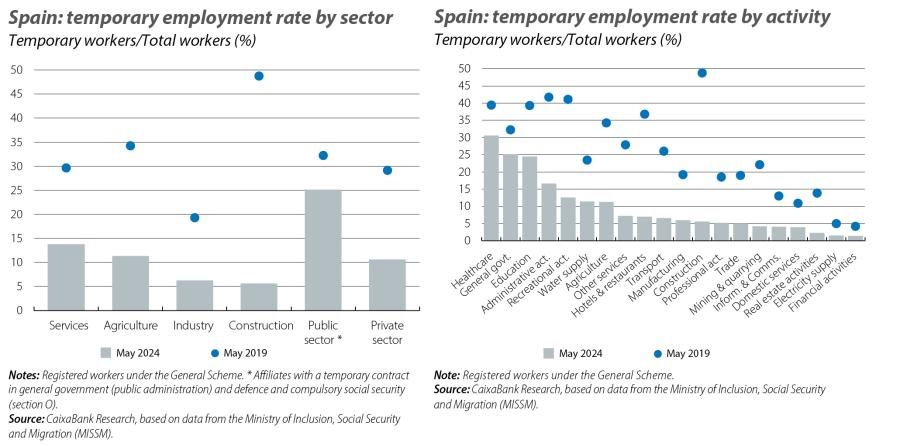

In May, the number of registered workers affiliated with Social Security reached a new record high, surpassing 21.3 million, which is 1.88 million more than in the same month of 2019: in the last year alone the number has increased by more than 506,000 affiliates. During this period the temporary employment rate has decreased significantly: of the total number of affiliates registered under the General Scheme in May, 12.7% were temporary workers, which contrasts with the 30% observed in the same month of 2019. This decrease in the temporary employment rate has been more pronounced in the private sector, with a decrease of 18.6 pps to 10.5%, while in the public sector this ratio has fallen to 25.1% from 32.2%.2

- 1Royal Decree-Law 32/2021 on urgent measures for labour reform, the guarantee of stability in employment and the transformation of the labour market. For more details, see the Focus «The labour reform: a balancing act with a focus on temporary employment», in the MR02/2022.

- 2Considering affiliates in the general government (public administrations), defence and compulsory social security categories (section O of the CNAE classification of economic activities), thus excluding public-sector workers in Healthcare and Education. In December 2023, the weight of public-sector registered workers in Education was 45.4% and in Health it was 61.0%.

Temporary employment by sectors and branches of activity

By sector and branch of activity, the fall in the temporary employment rate has been greatest in those which started from higher rates before the labour reform. These include construction, with a reduction of 43.2 pps, and agriculture, down 22.9 pps; on the services side the declines have been most notable in the cases of hotels and restaurants, recreational activities and administrative activities, with adjustments of –29.8 pps, –28.6 pps and –25.1 pps, respectively.

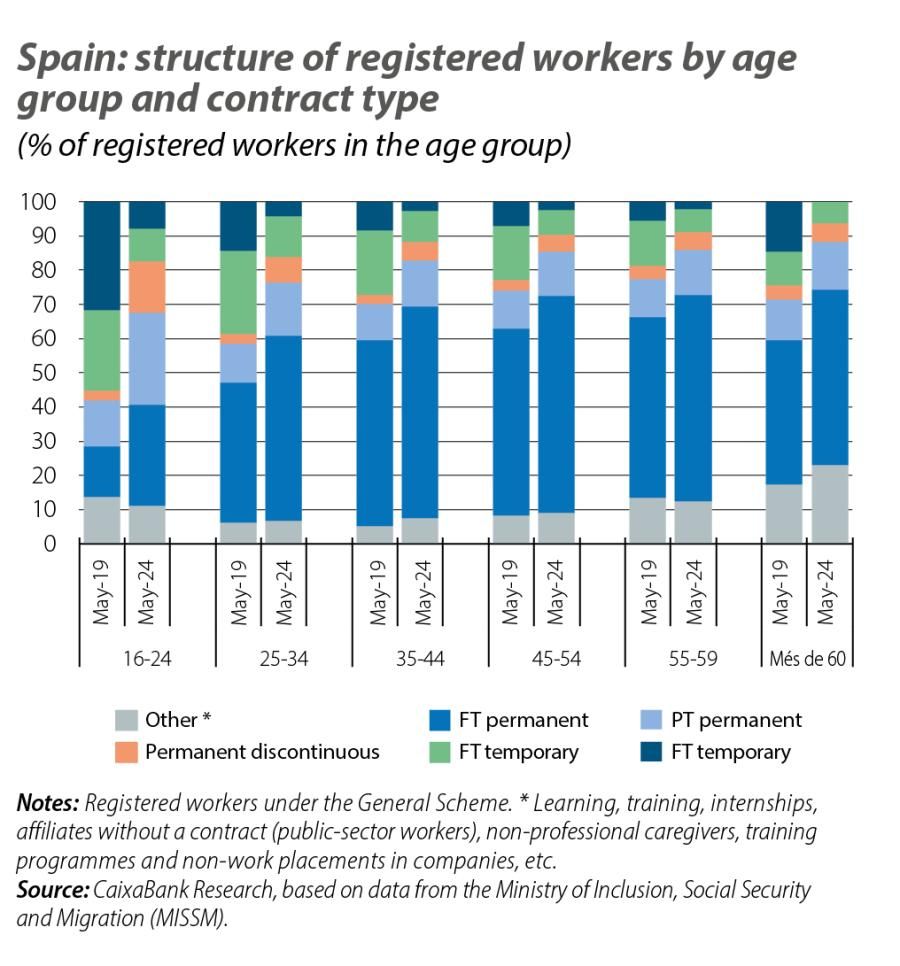

Temporary employment by type of contract

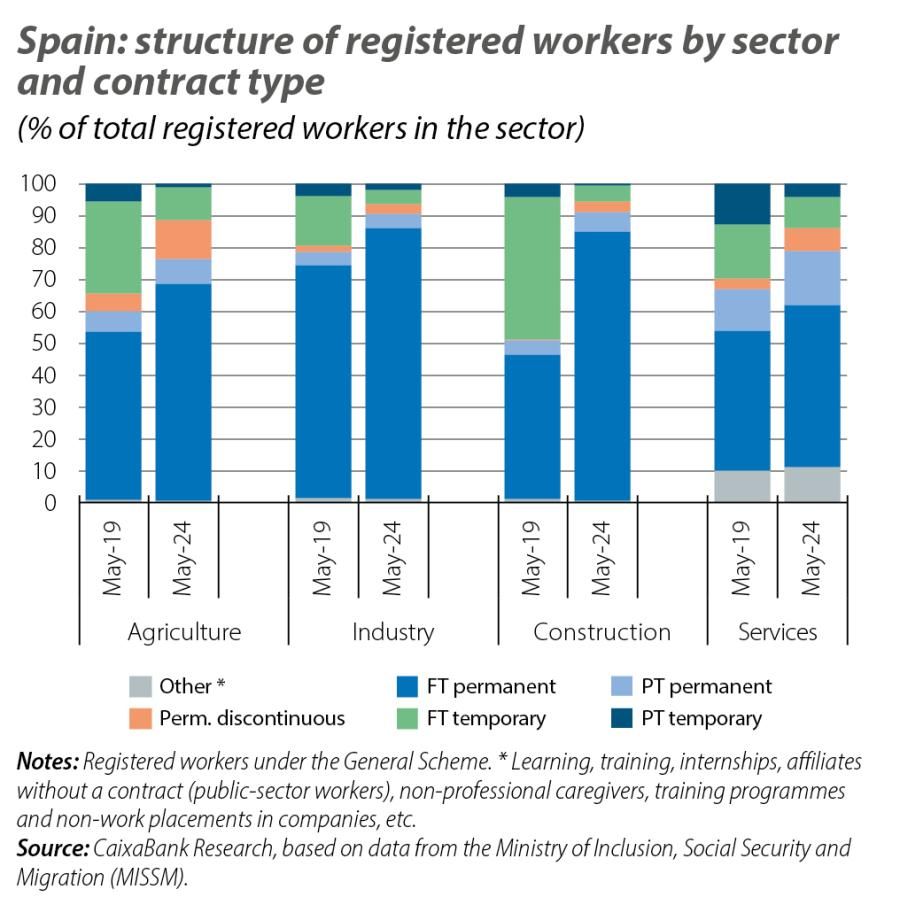

In the period under review, the proportion of registered workers with a permanent contract has increased from 61.7% to 78.0% of the total. Specifically, the number of full-time registered workers grew by 34.2% and 2.45 million people; those on part-time contracts, by 49.4% with an increase of 820,000 people, while those on permanent discontinuous contracts increased by 637,000 people to slightly exceed a million, a figure 2.4 times higher than in 2019. However, this increase in the number of affiliates with permanent discontinuous contracts is far smaller than the fall in temporary contracts, which were down 52.6%, representing a decrease of 2.38 million. Permanent discontinuous contracts have gone from representing 3.0% of the total in May 2019 to 6.5% in May this year, while permanent full-time contracts account for 56.9% of the total and part-time contracts, 14.7% (vs. 47.6% and 11.0% in 2019, respectively).

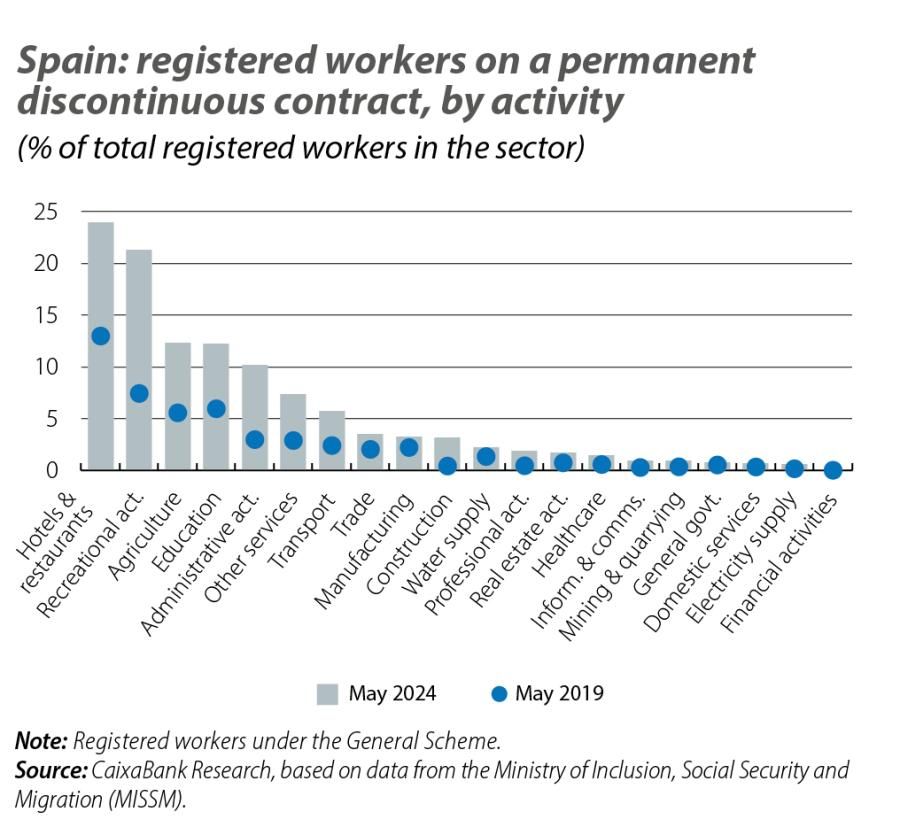

Permanent discontinuous contracts have gained prominence in all sectors, but especially in those where the work is more seasonal or intermittent throughout the year, such as agriculture, where they now represent 12.3% of the total compared to just 5.6% in 2019; in the case of construction they now represent 3.2%, an increase of 2.8 pps, and in services, 7.2%. On the other hand, in industry they have grown by just 1 pp, to 3.1%. By activity, permanent discontinuous contracts account for a very high proportion of the total in hotel and restaurants and recreational activities (24.0% and 21.3% of the total, respectively); moreover, this latter category has seen the biggest increase in this type of contract relative to the total (13.9 points), well above the increase recorded in hotels and restaurants (11 points).

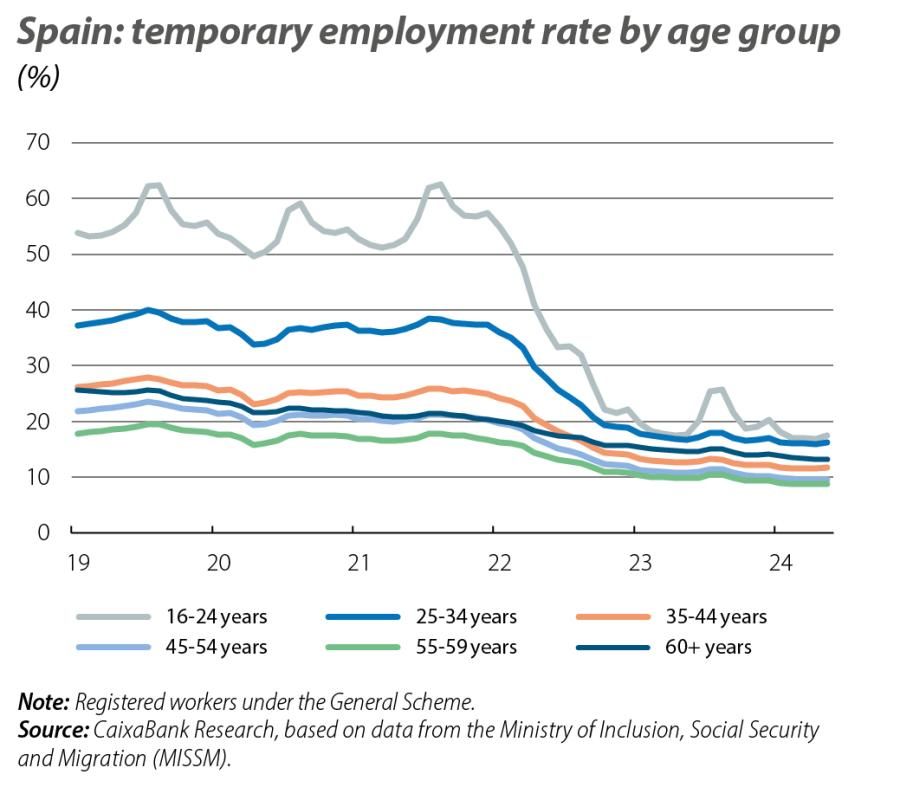

Temporary employment by group of workers’ age

Looking at the age of workers, the fall in the temporary employment rate has been much more intense among young people, specifically of almost 38 pps in the case of those between 16 and 24 years of age. Consequently, the dispersion by age group has been significantly reduced: whereas in 2019 the gap between the highest rate and the lowest rate (corresponding to the 55 to 59 age group) was 36.4 pps, in 2024 it was just 8.6 pps.

Although the type of permanent contract that has seen the biggest increase in its share of the total in all age groups is the full-time variant, this increase has been particularly pronounced in the case of workers under the age of 25, where their share has doubled to around 30% of the total; moreover, this is the age group in which permanent discontinuous contracts have seen the sharpest increase, specifically of more than 12 pps, to 15.0%.

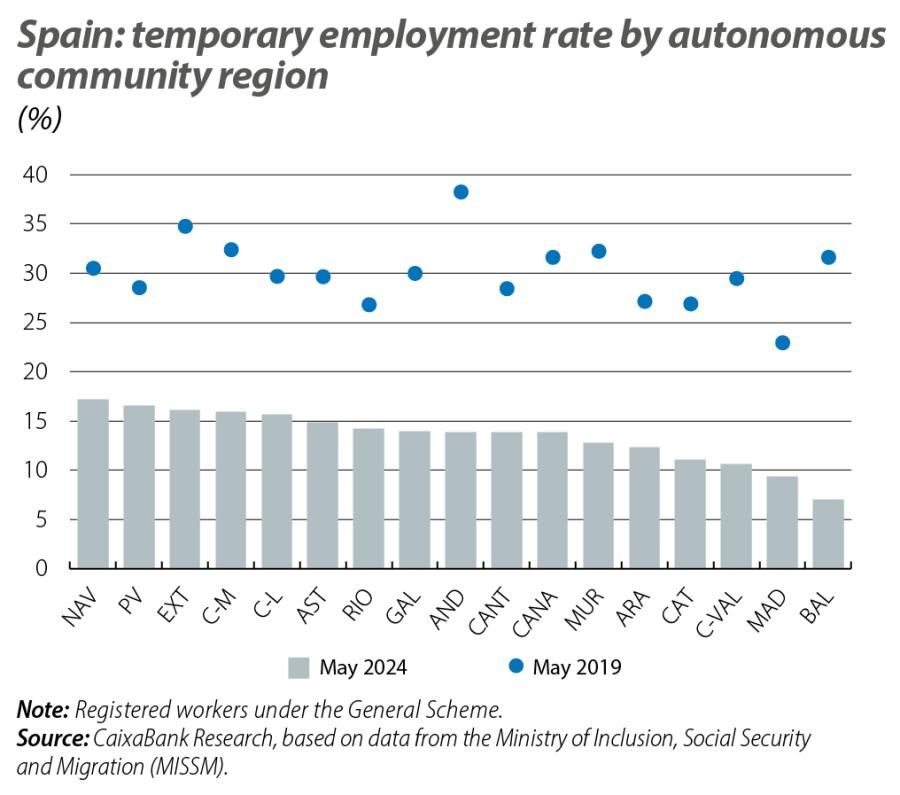

Temporary employment by region

By region, the autonomous communities most dependent on agricultural activities, such as Andalusia, Murcia and Extremadura, or on tourism, such as the island regions and the Community of Valencia, are the ones that have recorded the greatest falls in the temporary employment rate since 2019, of around 20 pps. This contrasts with the smaller adjustment recorded in the more industrial regions of northern Spain and Madrid.

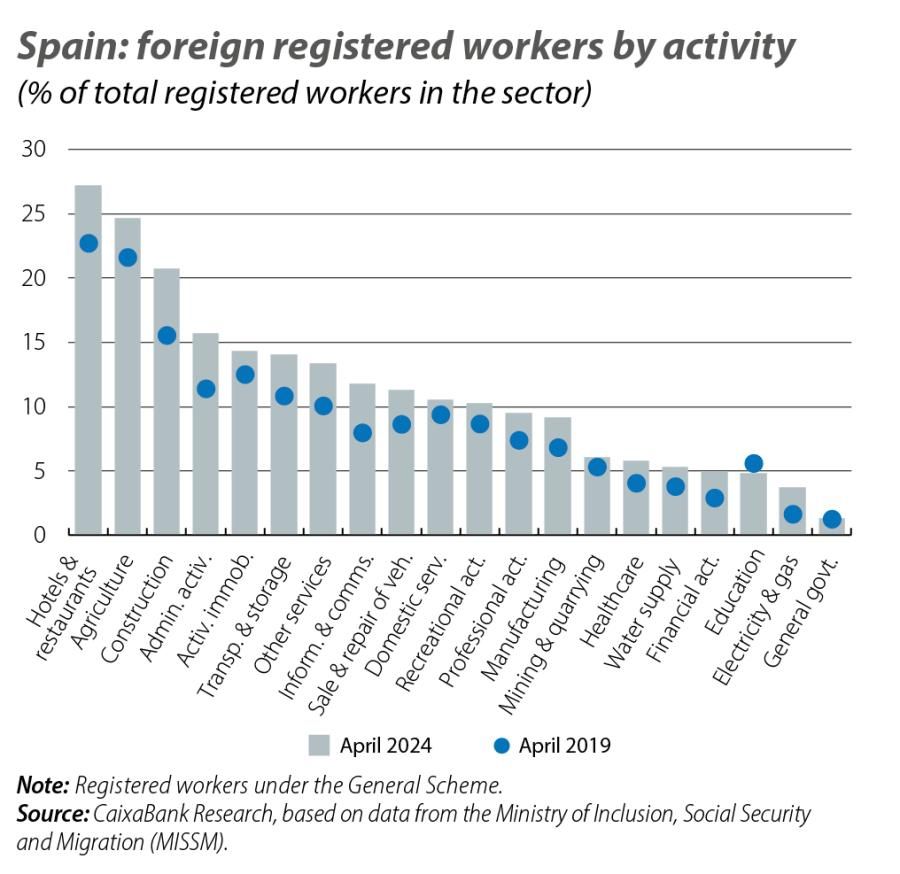

The importance of immigration in the Spanish labour market

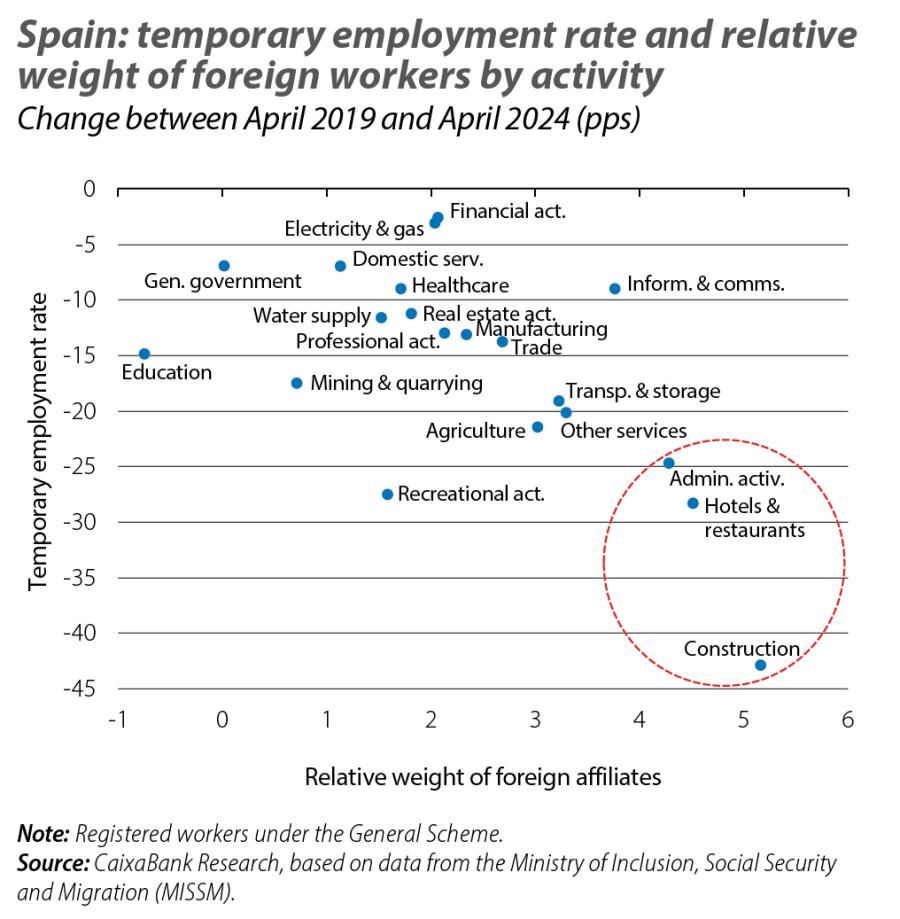

Immigration is playing a key role in cushioning the impact of the demographic dynamics, particularly the falling birth rate and the ageing of the population, by expanding and rejuvenating the labour force.3 In fact, the excellent performance of the labour market in recent years is largely explained by the contribution of the foreign population: between April 2019 and April 2024, 38.4% of new Social Security affiliates, some 719,000 people, are foreign, and as a proportion of the total they slightly exceed 13%.4

In recent years the increase in the proportion of foreign workers has been widespread across the different sectors, except in the case of general government, where it has stabilised at very low levels, and education, where it has fallen slightly. These two activities, along with health care, where the relative weight of foreigners has grown by just 1.7 pps, are the ones that present the highest rates of temporary employment.

- 3For more information, see the Focus «The changing composition of the immigrant population in recent years», in the MR07/2023.

- 4If we consider only the General Scheme of Social Security, the number of foreign affiliates has increased by 595,000, accounting for 31.3% of the total increase, while they account for 11.6% of all registered workers.

Although we do not have any data on the breakdown of registered workers by type of contract and nationality, the last chart shows that the increase in the role of foreigners has been sharper in some of the activities where the temporary employment rate has fallen the most, such as administrative activities, hotels and restaurants and, above all, construction.

In short, the combination of restrictions on the use of temporary contracts, coupled with the push for the use of permanent discontinuous contracts to channel work that is intermittent but recurring, has contributed to the reduction in the temporary employment rate – something which traditionally only happened in times of recession and job destruction, when temporary workers would be the first to suffer the cutbacks. Now, in contrast, the temporary employment rate has been reduced through a transformation of temporary employment into permanent employment. Although the growth of permanent discontinuous contracts has been significant, the increase in the number of registered workers on ordinary permanent contracts has been much higher, giving rise to greater job stability and a stronger link between workers and companies.