Tourism in Portugal: 2023 recap and 2024 so far

In 2023, the tourism sector in Portugal continued its path of recovery, exceeding expectations and setting new records in various parameters. For 2024, we expect this good performance to be maintained, albeit at a pace closer to cruising speed.

Several records set in 2023

It is difficult to point out a metric in which no historical records were exceeded last year. Starting with the number of overnight stays, these reached 77.1 million, while the number of guests exceeded 30 million. This latter figure is approximately twice that recorded 10 years ago and demonstrates the rapid growth that the sector is enjoying.

Portugal is one of the destinations that has shown the greatest capacity to recover pre-pandemic levels of international tourists. This strong performance in 2023 was also influenced by factors such as the buoyant growth of the US, which is a major source market, as well as specific events such as the World Youth Days.

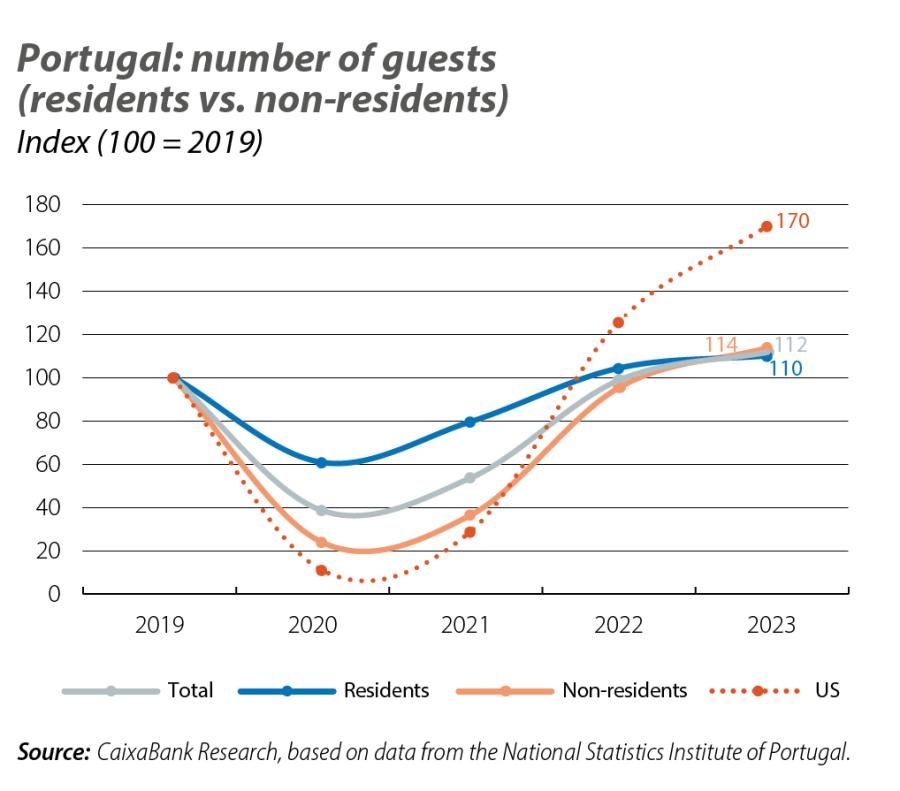

The increase in overnight stays was more pronounced among non-resident tourists (+15%) than among residents (+2%), in a return to pre-pandemic patterns (70% of overnight stays corresponded to non-residents and 30% to residents). Resident guests exceeded the pre-pandemic level by 10% (they had already done so by 4% in 2022) and non-residents did so for the first time by 14%.

Among non-residents, the growth of tourists from the US was exceptional, surpassing the pre-pandemic level by 70%, which made it the third largest issuing market.1 By type, around 82% of overnight stays were in hotels, although overnight stays in tourist rentals registered the highest year-on-year growth (+16%, compared to 10% in the case of hotels and 11% for rural tourism establishments). By region, the most intense growth in overnight stays was in the North (+15%) and in the Lisbon Metropolitan Area (+13%). It is noteworthy that in the Algarve, overnight stays by residents decreased both in comparison to the pre-pandemic period (–6%) and compared with 2022 (–7%), possibly due to price factors2 and competition with similar and geographically nearby destinations in southern Spain.

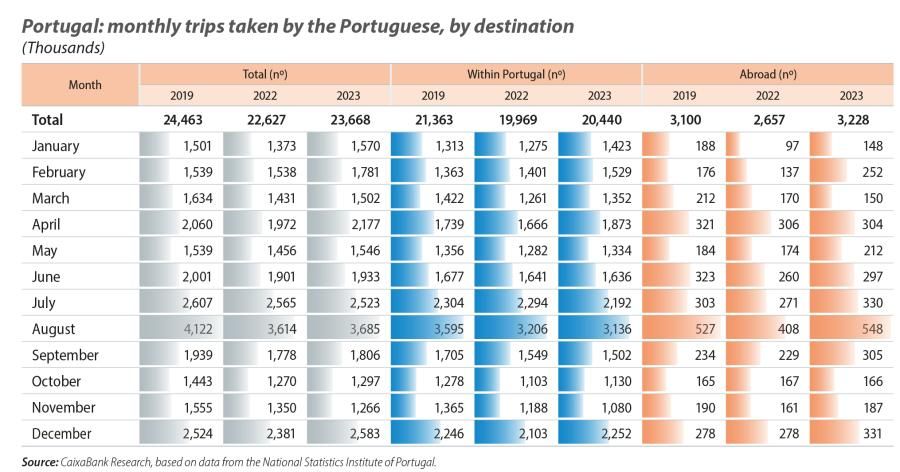

These figures resulted in total revenues in tourist accommodation establishments of 6 billion euros, representing a nominal growth of +20.1% compared to 2022, also evident in real terms (average annual global inflation in 2023 was 4.3% and inflation in accommodation services was 17.2%). In the balance of payments, the tourism balance in 2023 grew by 20.7%, with a surplus of 7.1% of GDP. However, it is interesting to note that in the strongest quarter for tourism (the third quarter), the year-on-year growth of tourism imports was more intense than that of exports, since the number of trips abroad by the Portuguese grew by 30.3% year-on-year in Q3 2023, compared with a 3.1% drop in travel within the country. Although domestic travel continues to dominate among Portuguese residents (accounting for 86% of all trips taken by residents), the growth of foreign travel in 2023 (21.5%) was greater than that of domestic travel (2.4%). The main destinations for foreign travel were Spain (41.6%), France (10.1%) and Italy (6.9%).

- 1See the Focus «The American friend: the boom of tourism from the US in Portugal» in the MR07/2023.

A timid start to 2024, although the Easter holidays have helped

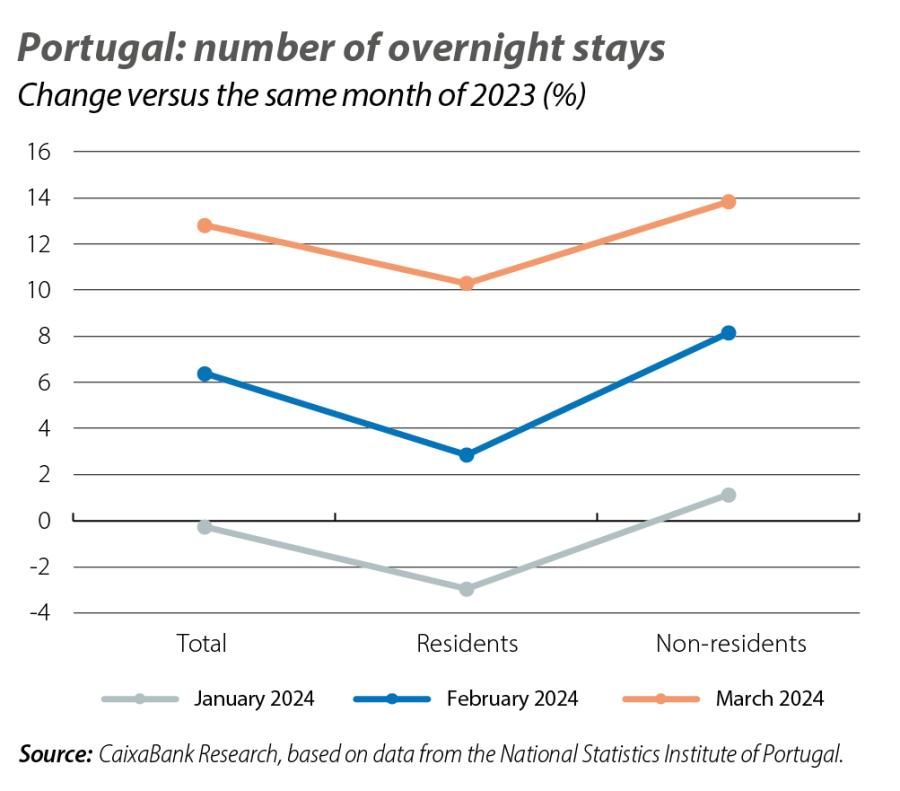

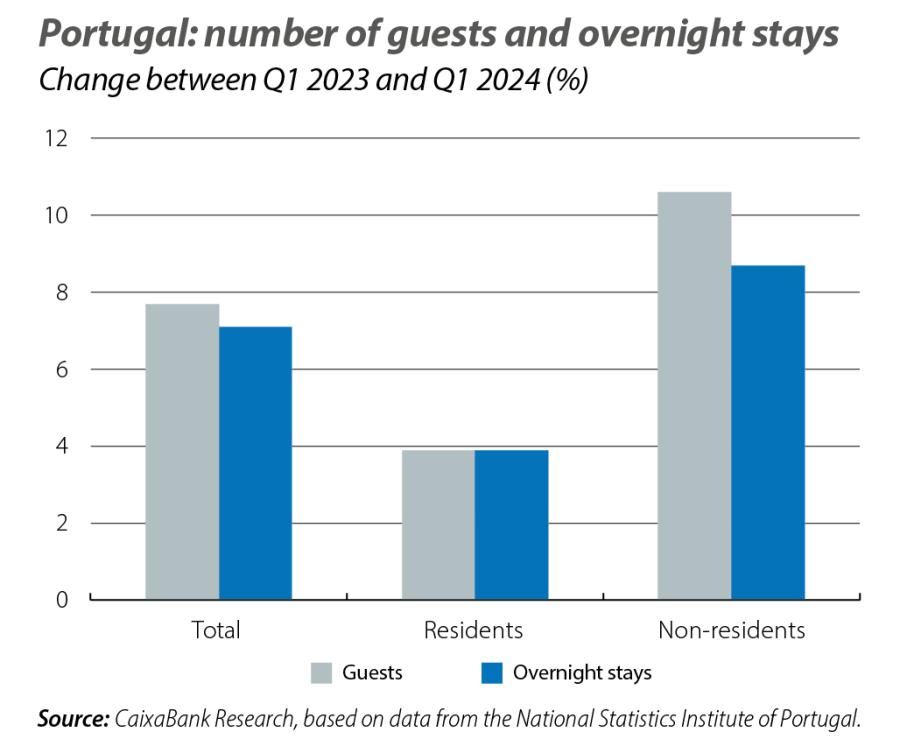

In Q1 2024, there was growth in both the number of tourists and the number of overnight stays compared to the same quarter of 2023 (+7.7% and +7.1%, respectively) – significant rates considering that the comparison is with an exceptional 2023. However, these figures hide some variations in the first three months of the year, as can be seen in the fourth chart, which shows the change in overnight stays in each of the first three months of the year compared to the same month of the previous year. In January, the performance was very modest, even falling compared to January 2023 (–0.3%), with a sharper drop in overnight stays by residents (–3%). The performance steadily improved throughout the quarter, and in March overnight stays by both residents and non-residents grew by over 10% year-on-year. Part of this good performance was due to the effect of the holiday period associated with Easter: this year the festive period was spread across March and April, whereas in 2023 it fell entirely in April. Naturally, this translated into a lower bed occupancy rate in January (and still in February), while March saw the highest record of the series in that month (42%).

By region and in terms of volume, the North and the Algarve recorded the greatest increase in overnight stays in Q1 2024 compared to the same period of the previous year. In terms of the rate of change, the West and Tagus Valley region stands out (+23%), as does the North (+10%) and the Central region (+10%). By source market, the greatest growth rates have occurred in places which represent a small proportion of the total, underlining the growing diversification of Portuguese tourism. Countries with growth of over 20% compared to Q1 2023 in terms

of number of guests include Ireland (23%), Denmark (25%), Poland (26%) and Canada (30%). At the opposite end of the spectrum we find that the number of guests from one of the most representative source markets, France, has plummeted (–71%). In volume terms, the US continues to stand out with 41,600 more tourists.

Overall, the figures for Q1 are in line with our outlook for the evolution of tourism in 2024, with an expected increase in tourists of around 5%. The post-pandemic rebound effect is running out of steam, the use of the installed airport capacity is approaching its limit and a degree of caution is perceived among travellers from central European markets who are closer to the conflict in Ukraine. On the other hand, the central macroeconomic forecast scenario, which rules out a recession in the euro area (the main source markets for tourists visiting Portugal), will continue to support the sector’s growth in the country thanks to a certain recovery in purchasing power derived from wage growth, falling inflation and declining interest rates. In Q2 2024, in April, the number of flights at domestic airports continued to exceed last year’s figures, which bodes well for the near future.

In short, while these first figures for the year are in line with our forecasts, it remains to be seen whether the strong trend observed in March will continue or whether the modest performance of January and February will prevail.