Spain’s growth beats expectations in Q1

The indicators published in recent weeks confirm the good health of the Spanish economy, with growth in Q1 once again beating expectations and recording the highest rate among the major euro area economies.

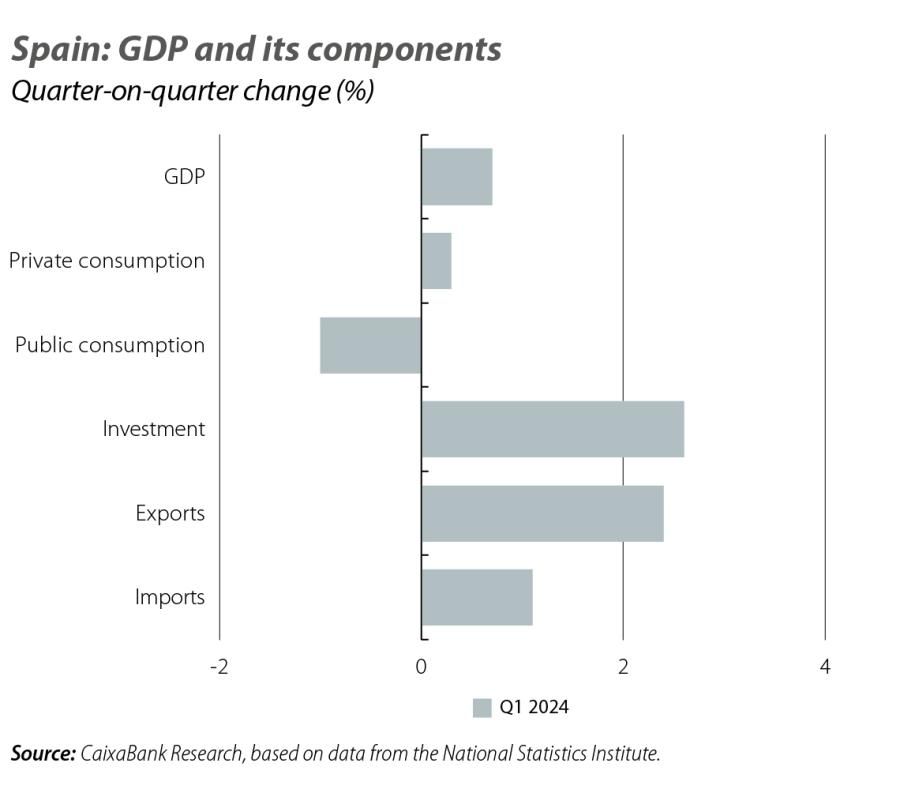

During Q1 of the year, GDP posted an increase of 0.7% quarter-on-quarter (2.4% year-on-year)

The figure published represents a similar level to that of Q4 2023 (revised, in turn, upwards by 0.1 pp from 0.6% quarter-on-quarter) and is substantially higher than the average growth of the euro area (0.3% quarter-on-quarter). Foreign demand emerged as the main driver of growth and contributed 0.5 pps to quarter-on-quarter GDP growth, thanks in particular to the strength of service exports. Growth in domestic demand, which contributed 0.2 pps to quarter-on-quarter GDP growth, was driven by investment – which following the sharp decline recorded during Q4 2023 (–1.6% quarter-on-quarter) rose by a significant 2.6% quarter-on-quarter – and, to a lesser extent, by private consumption, which maintained a moderate growth rate (0.3% quarter-on-quarter).

The economic activity indicators available for Q2 of the year indicate that the economy remains in good shape

The PMI for the industrial sector rose 0.8 points to 52.2 in April, representing its best level since June 2022. The PMI for the services sector, meanwhile, climbed 0.1 points, to 56.2, thanks to the growth of new orders. Finally, Spanish card activity ended the month of April with 3.2% year-on-year growth (3.3% in March), according to the CaixaBank Consumption Indicator.

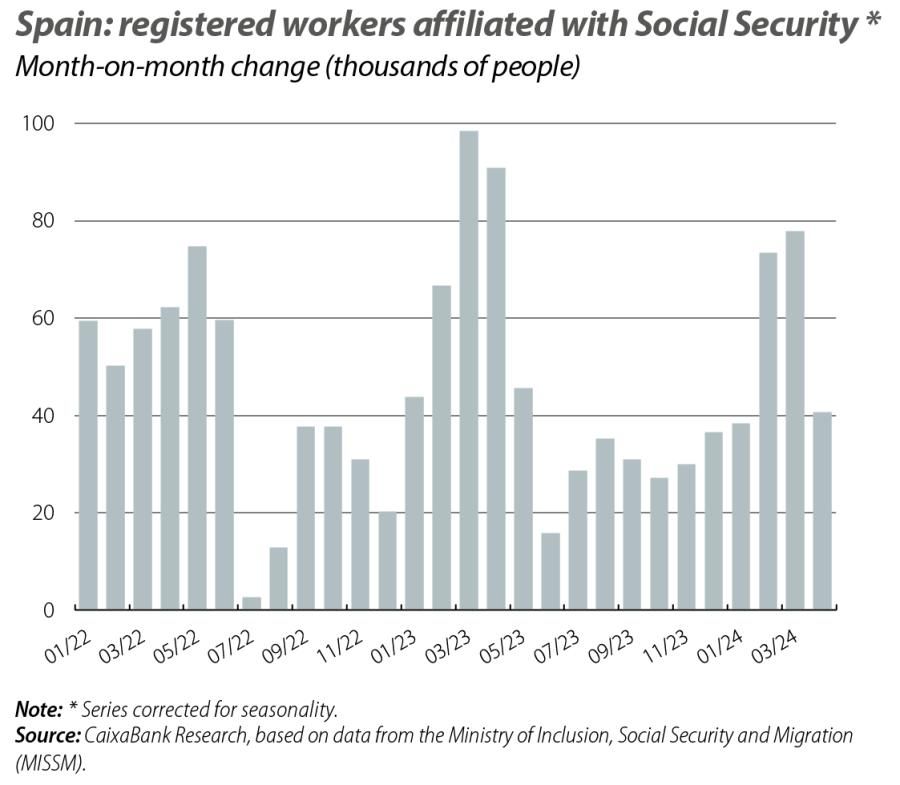

Job creation remains strong

The data on the growth of Spain’s economic activity during Q1 2024 were supported by a labour market which continued to grow at a steady pace and which has maintained that growth rate in the first month of Q2. In April, the number of registered workers affiliated with Social Security increased by 199,538 people, down from last year’s exceptional figure (238,436) when Easter fell in the first week of April, but above the usual level for the month of April (173,777 on average in the period 2014-2019). For the first time, the total number of affiliates now exceeds the psychological barrier of 21 million, specifically at 21,101,505 workers, which is 486,516 more workers than a year ago. In seasonally adjusted terms, employment grew in the month by 40,677 workers, which is still a high figure. As for registered unemployment, it fell in the month by 60,503 people, to 2.666 million, the lowest figure since September 2008.

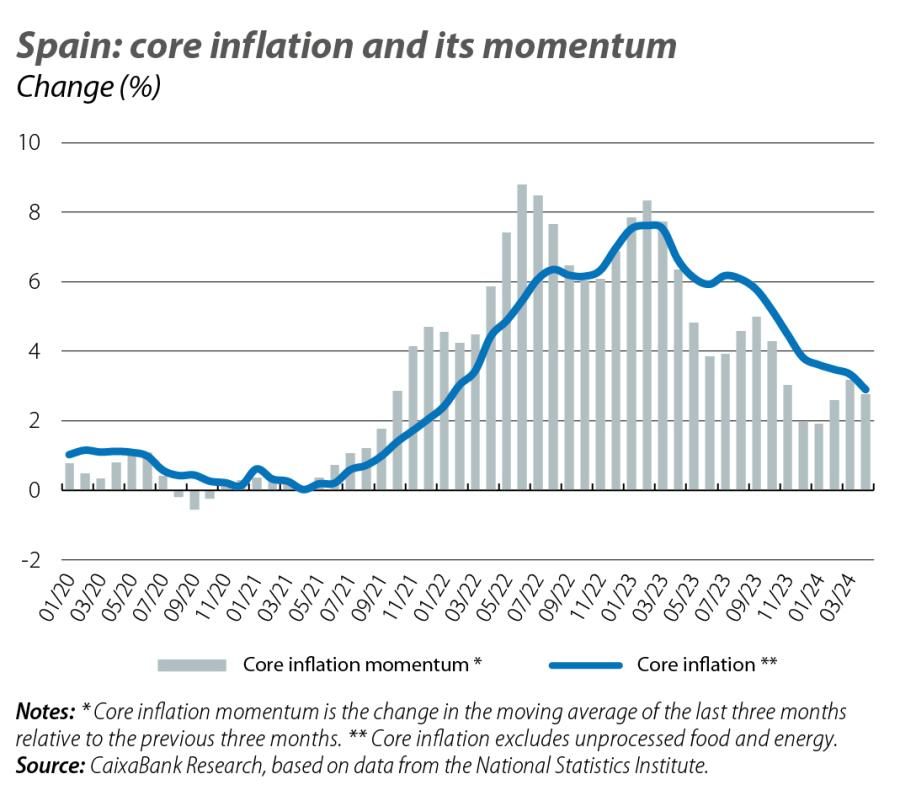

The VAT rise on gas and food keeps headline inflation above 3%

Headline inflation rose by 0.1 pp in April and stood at 3.3%, according to the flash estimate of the CPI published by the National Statistics Institute. However, this increase was driven by the rise in gas prices, given that on 1 April the VAT rate on gas, which had been reduced to 10%, returned to its usual level of 21%. In any case, the process of price moderation continued in the case of core inflation (which excludes energy and unprocessed food), as it experienced a sharp reduction, placing it at 2.9% (0.4 pps less than in March). The headline inflation figure is within the range anticipated by CaixaBank Research, while core inflation is lower than expected.

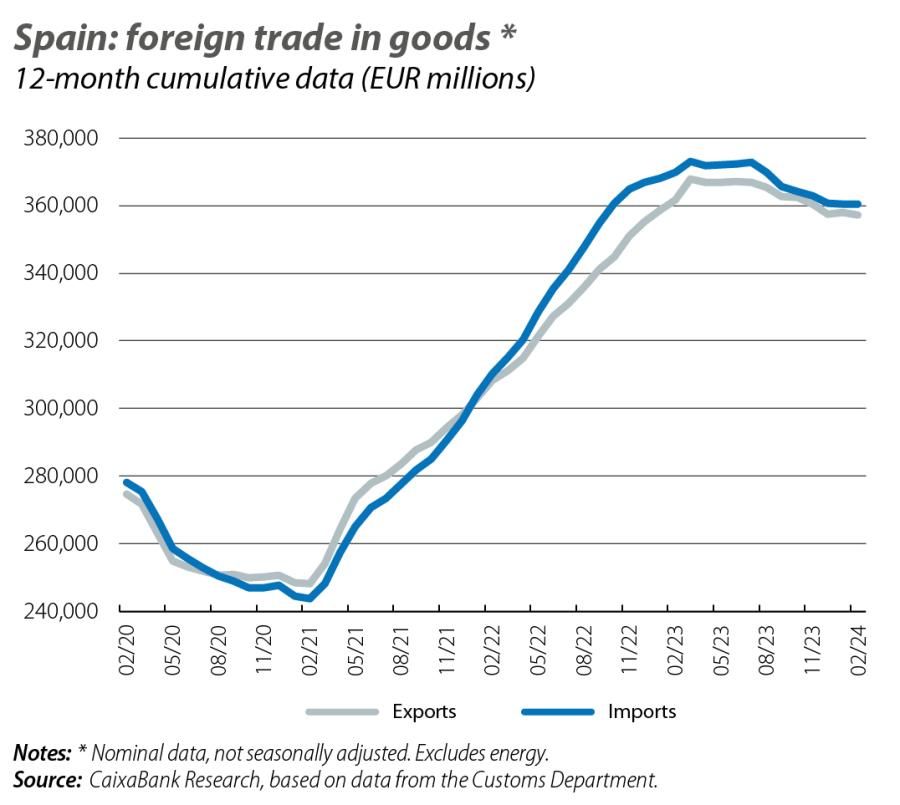

The improvement in Spain’s trade deficit consolidates a good start to the year for foreign trade

In line with the good data on foreign demand, the trade deficit decreased by 4.7% in year-on-year terms in February, thanks to a 27.8% year-on-year correction of the energy deficit. Non-energy exports, meanwhile, improved compared to the previous month, despite being below the level of February last year. In cumulative terms during the first two months of the year, the trade deficit showed a reduction of 5.6% year-on-year, corresponding to a fall of 17.3% in the non-energy deficit and one of 4.3% in the case of energy. The trade deficit with countries outside the euro area fell by 25% year-on-year, while the surplus with EU countries fell by 32% year-on-year.

Tourism, key to the good performance of the foreign sector

Tourism, which is key to the good performance of the foreign sector, also recorded rapid growth during the first quarter of the year. The provisional data from FRONTUR indicate that in the first three months of the year 16.1 million foreign tourists arrived in the country, representing a 17.7% increase compared to the same period last year. Also, according to data from EGATUR, spending by international tourists reached just shy of 22 billion euros in this same period, marking a 27.2% increase over the same period last year. These figures, in turn, represent a 5% increase in the average daily expenditure of international tourists compared to Q1 2023.

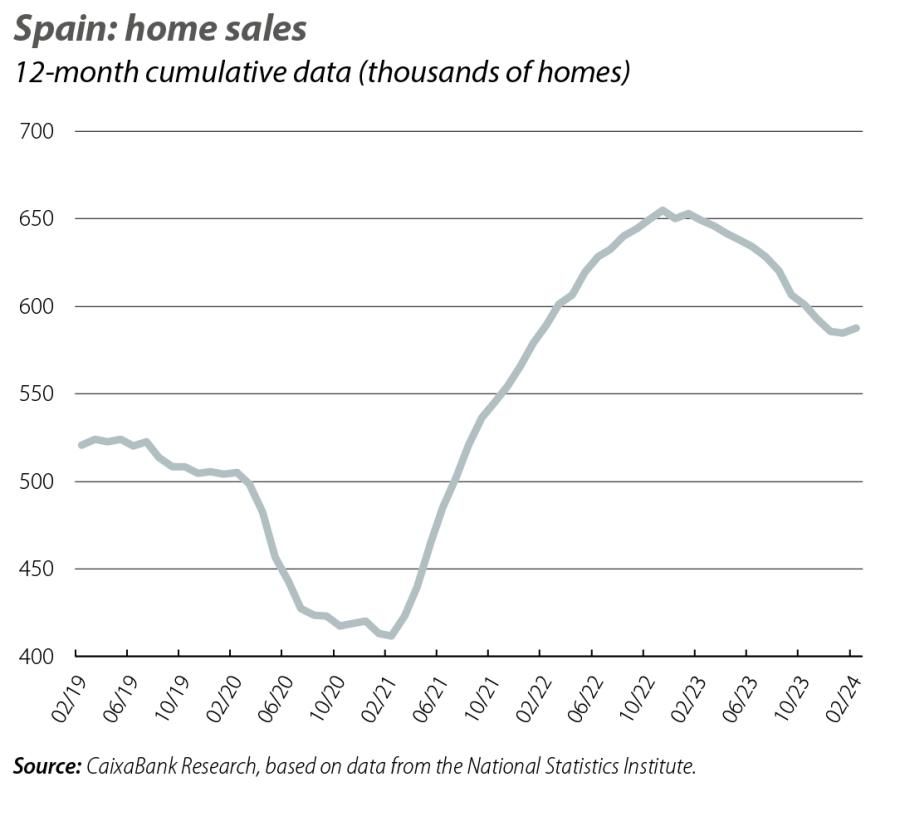

Home sales in Spain regain some vigour at the beginning of the year

In February, home sales rose 5.8% year-on-year, marking a significant improvement after falling at double-digit rates throughout the second half of 2023. The increase was widespread across the different types of housing, but was especially pronounced in the case of new homes, which recorded an increase of 20.8% year-on-year, compared to 2.2% in the case of existing homes. As for the pattern from region to region, the increase in sales was recorded throughout most of the country, except for in six autonomous communities which registered declines (the Balearic Islands, the Canary Islands, Andalusia, the Community of Madrid, the Basque Country and La Rioja). In cumulative terms, in the first two months of the year 107,000 sales were closed throughout the country, which is the best start to the year in terms of real estate activity since 2008.