Distribution of wealth in Europe’s large economies

Spain is the country where net wealth has increased the most since the pandemic: from Q4 2019 to Q3 2023 there was a significant increase of 25%, followed closely by Germany with 22%, France with 16% and, further behind, Italy with 6.0%.

The patterns observed in the aggregate data for the euro area are repeated, with varying degrees of differences, among the major countries of the bloc. Spain is the country where net wealth1 has increased the most since the pandemic: from Q4 2019 to Q3 2023 there was a significant increase of 25%, followed closely by Germany with 22%, France with 16% and, further behind, Italy with 6.0%. This disparate evolution of total wealth from country to country is explained by the uneven pattern followed by net wealth held in the form of housing.2 In Germany and Spain, net wealth in housing has increased by almost 25%, in France by more than 20% and, trailing somewhat behind, in Italy by less than 5.0%.

- 1By net household wealth we refer to the difference between the value of their assets (deposits, debt securities, listed shares, unlisted shares and other equity holdings, holdings in investment funds, life insurance policies, real estate and non-financial assets used for production purposes) less their liabilities (mortgage and non-mortgage loans).

- 2Wealth in housing net of mortgage loans.

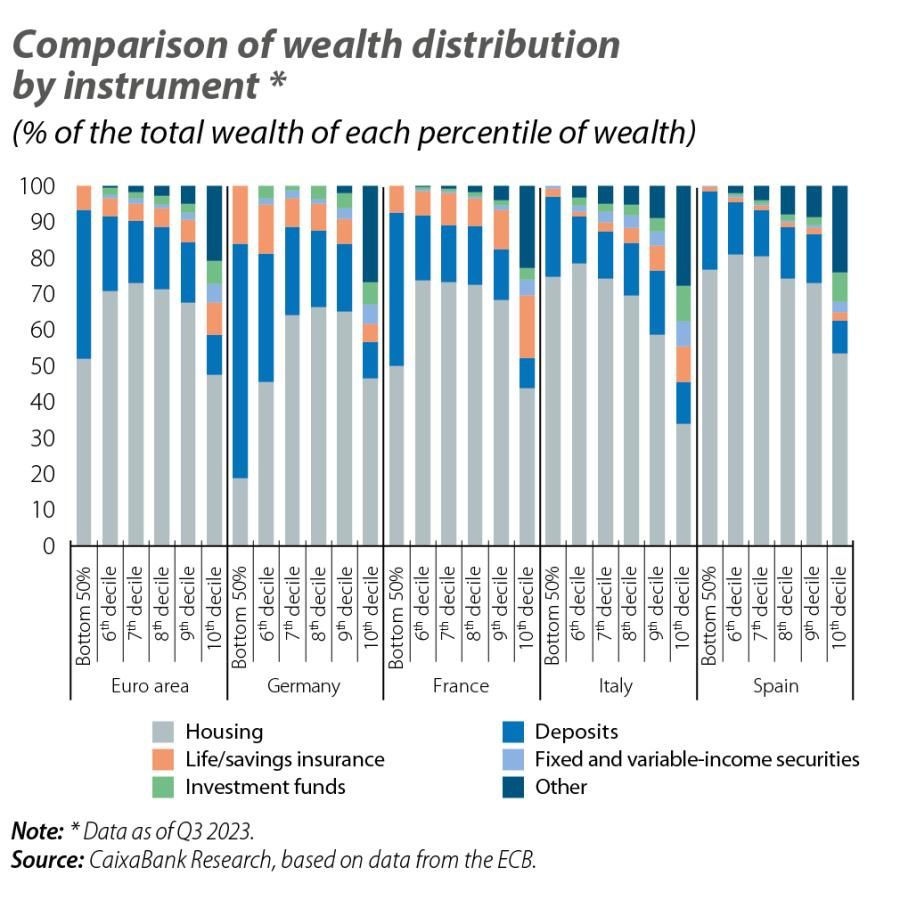

Thus, housing is reaffirmed as the main source of household wealth, and its relative weight within total wealth has been increasing since the outbreak of the pandemic in all countries, except in Italy, where it has remained fairly stable in the last three years around the level of 48.4% which it represented in Q3 2023 (50.5% in Q4 2019). Meanwhile, in Spain the portion of total net wealth attributable to housing climbed to 64.2% in Q3 2023 (61.8% pre-pandemic), while in France it rose to 55.5% (vs. 53.5%) and in Germany to 52.1% (vs. 51.0%).

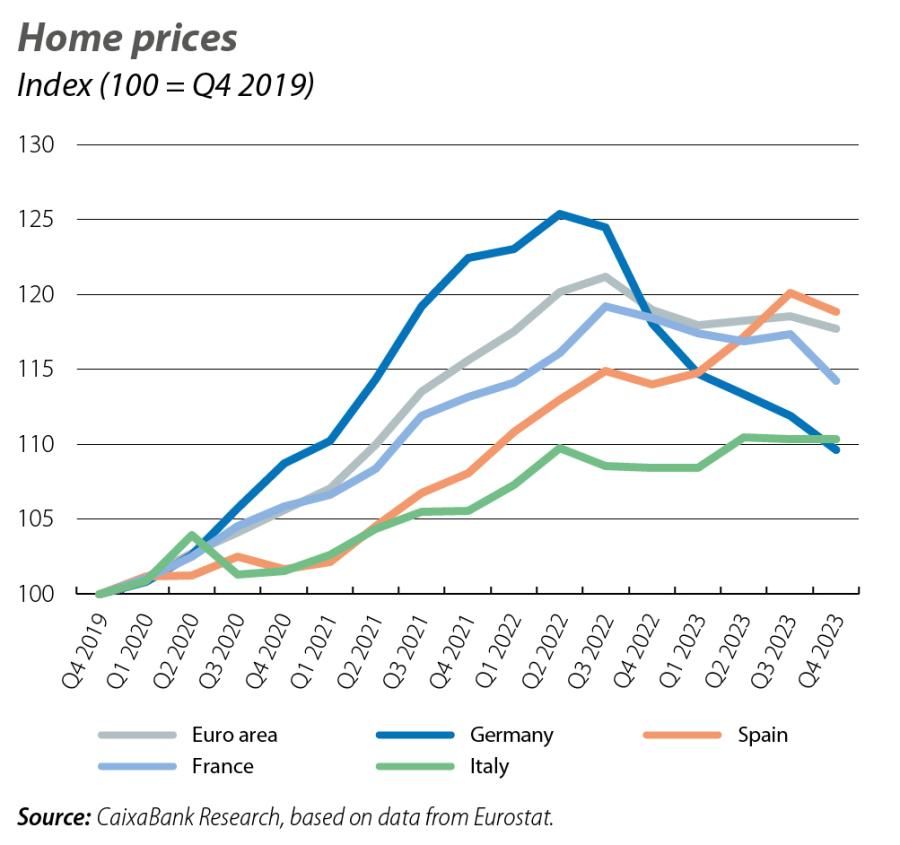

Much of the pattern shown by housing wealth is explained by the increase in home prices since the start of the pandemic throughout the region. In the specific case of Germany, prices in Q2 2022 were 25% higher than prior to the pandemic, marking the biggest increase in value that housing has experienced among the four major economies in the period analysed. However, the increase in home prices in Germany has experienced a notable correction since the peak and, in Q4 2023, they lay just 10% above the pre-pandemic level. In the other countries, the correction in prices from their peaks in France is very modest, in Italy prices have been quite stable, and in Spain not only has there been no correction, but real estate property has registered a new rally since Q4 2022, such that at the end of 2023 Spain is the country with the biggest growth in home prices since the pandemic among the large economies (19%).

With regard to deposits, they are confirmed as the second source of household wealth, although in Q3 2023 their role within total net wealth has reduced slightly compared to Q4 2019 in Spain (12.0% vs. 12.9%) and, more markedly, in Germany (16.4% vs. 17.6%); while in Italy their relative weight within total net wealth has remained practically stable (13.7%) and in France it has even increased slightly (13.3% vs. 12.4%).

The importance of life/savings insurance as an investment vehicle stands out in France, Germany and Italy,3 while in Spain this item is less relevant. However, since the pandemic the role of these policies within total net wealth has been gradually declining, especially in France (13.5% vs. 17.2%) and Germany (6.6% vs. 8.6%). As for other somewhat more sophisticated investment alternatives, such as stocks and investment funds, their role within total wealth has remained relatively stable in the study period, although as we have already seen in the aggregate data for the euro area, they are only relevant for households belonging to the richest 10%-20% of the population.

- 3In France and Germany, life insurance is not limited to covering a contingency in the event of the death of the insured person: upon reaching retirement age, the insured person can also access the accumulated funds. They thus act as savings tools similar to pension plans in Spain. In Spain, life insurance is a financial instrument that provides a payout to the insured person’s heirs after their death.

To own or not to own a home... that is the question

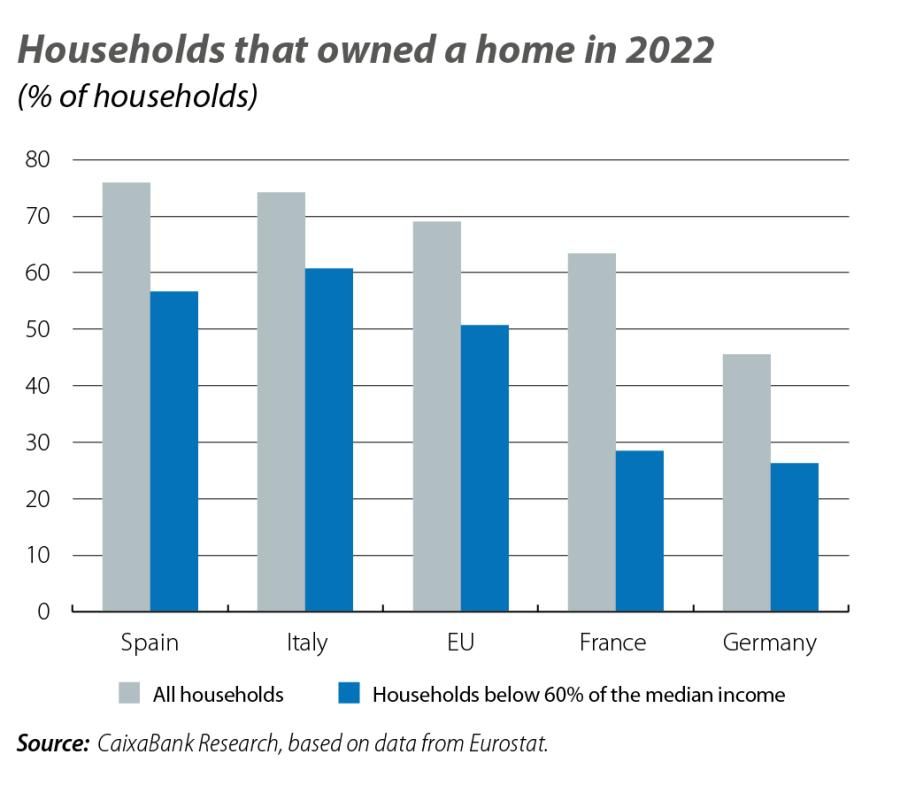

The aggregate data show that housing has been a determining factor in the increase in wealth in recent years. However, when we look at the detail of households classified into the different wealth tranches, we see quite different patterns from country to country. The case of Germany is particularly striking. In fact, in Germany only 47% of households own a home (compared to the European average of almost 70%), and this percentage falls to 26% for the lowest income brackets (50% on average across Europe). This constrains the pattern of wealth distribution in Germany: for the bottom 50% of the population in terms of wealth, housing wealth represents just 20% of their total wealth, whereas for the medium and medium-high wealth tranches it exceeds 60%; and it is just under 47% for the wealthiest group.

The relative weight of housing in the net worth of the bottom half of the population stands in stark contrast with the figure found in the other major economies, where housing accounts for over half of households’ wealth in the lowest tranches: 54% in France, 75% in Italy and almost 80% in Spain. On the other hand, deposits in Germany account for more than two thirds of household wealth for the bottom 50%, compared to 45% in France and just over 20% in Italy and Spain.

This composition of wealth no doubt explains the lag observed among the less wealthy part of the population in Germany relative to its counterparts in other countries. The wealth of a household belonging to the bottom half of the population stands at around 18,360 euros in Q3 2023. This figure contrasts with the 45,320 euros observed in France, 58,800 in Italy and 75,000 in Spain.

These figures help us to understand why Germany’s inequality in terms of wealth distribution, measured using the Gini index, is the highest among the countries analysed here despite the significant progress made since 2014, and why it is the only country where inequality has increased since the start of the pandemic. Spain, for its part, stands out as the economy of the big four with the lowest inequality and where the most progress has been made since the pandemic (see last chart).

Conclusions

The data show significant differences between household wealth patterns in the four major countries of the EU. One notable insight is the limited role of housing within the total net wealth of the least wealthy households in Germany, while in the other countries studied it is the main vehicle of wealth for this group of the population. A more consistent pattern from country to country is the fact that the net worth of less wealthy households is highly concentrated in low-risk assets (deposits and life/savings insurance policies) in all the countries, although in Germany these instruments player a bigger role in the wealth of this tranche of the population. This composition of wealth can help to explain why inequality in Germany is the highest among the large economies. The data show a mixed pattern among European households in terms of the composition of their wealth, and this will determine their response to the various economic shocks.4

- 4Dinner address by Peter Praet, member of the ECB Executive Board, ECB Conference on Household Finance and Consumption, Frankfurt am Main, 17 October 2013.