Outlook for the economy and its sectors in 2024 and 2025

The outlook for the Spanish economy and its sectors is positive. We expect to see a higher growth rate in sectors linked to the digital transition, such as ICT and professional services, as well as in sectors where the Spanish economy is highly competitive, such as the pharmaceutical and tourism sectors.

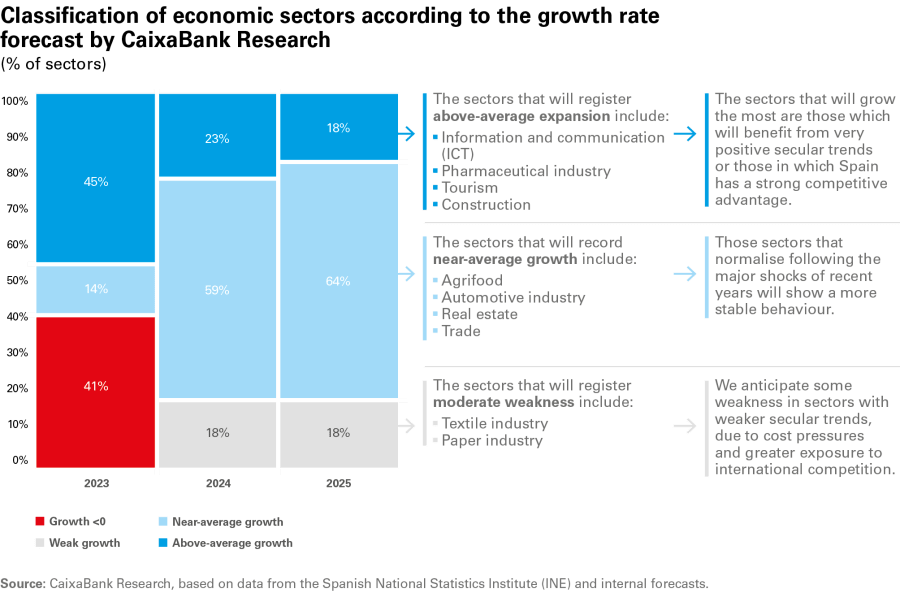

The outlook for the Spanish economy and its sectors in 2024 and 2025 is positive. Moreover, we expect the dispersion of growth rates between the various sectors to continue to reduce as the shocks of recent years (the pandemic, energy crisis, inflation rally and interest rate hikes) dissipate. While we do not foresee negative growth for any of the sectors considered, there are some branches of industry, such as textiles and paper, which could see their growth rates slowed by cost pressures and fierce international competition. We expect to see the highest growth rates in sectors linked to the digital transition (such as information and communication technologies, and professional services) and sectors in which the Spanish economy is highly competitive (such as the pharmaceutical and tourism sectors).

Sectoral trends in Spain: recent developments and future outlook

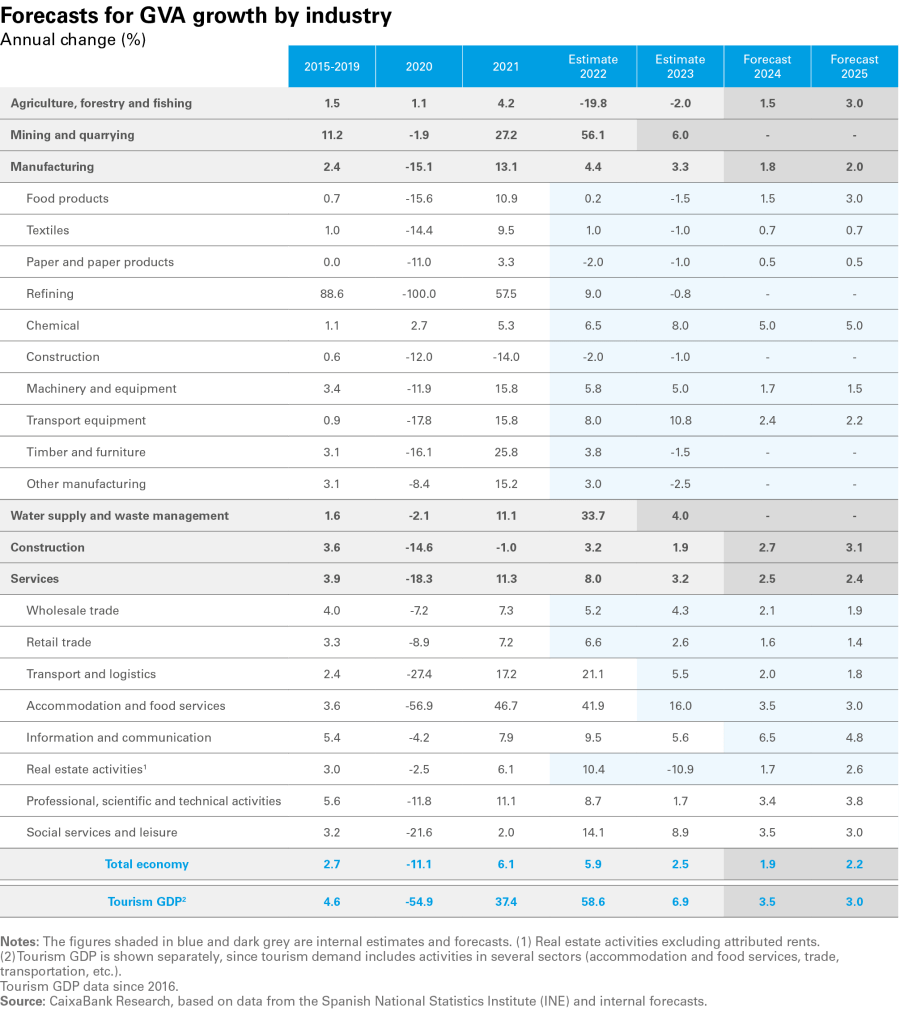

In 2023, the Spanish economy grew by 2.5%, a robust rate but below that registered in 2022 (5.8%). Analysing the breakdown of this growth by sector, we see a substantial dispersion of growth rates from sector to sector. This is a result of the ongoing dynamics generated by the absorption of the various shocks that the Spanish economy has endured in recent years. At the top end of the scale we find the tourism sector, with an estimated growth of 6.9%. This is a sector which in 2023 benefited from the arrival of more than 85 million international tourists, a figure that exceeds pre-pandemic levels.8 The gross value added (GVA) of manufacturing grew by a solid 3.3% according to the Spanish National Statistics Institute (INE), as a result of the good performance of the automotive and pharmaceutical industries.9 In contrast, other branches of industry, particularly the more energy-intensive ones, experienced a decline in industrial production.10 Similarly, data from the INE reveals that the GVA of real estate activities contracted by 2.5%, as a result of the decline in home sales in an environment of higher interest rates.11 The GVA of agriculture, forestry and fishing also contracted – in this case by 2% – following sharp decline already recorded in 2022 (–19.8%), due to the persistence of the crisis in the sector associated with the drought and high production costs.

The outlook for the Spanish economy for 2024-2025 is positive, although we anticipate a slight moderation in GDP growth. Specifically, CaixaBank Research expects GDP growth to fall from 2.5% in 2023 to 1.9% in 2024, before consolidating at a rate of 2.2% in 2025. In this scenario, we foresee a reduction in the dispersion of growth rates between sectors, as the impact of the rise in production costs and the interest rate hikes gradually dissipates. In fact, in these two years, we do not expect negative growth rates for the GVA of any of the sectors analysed. Also, the differences in growth rates between the various rates of growth in the various economic sectors will be determined to an increasing extent by medium- and long-term trends. In the table below, we classify sectors into four groups according to their expected growth rates in 2024-2025: sectors with negative growth rates, weak growth, average growth and above-average growth.

- 8See the Tourism Sector Report S1/2024.

- 9Internal estimates of the GVA by branch of industry in 2023, obtained using a series of indicators (registered workers, industrial production, etc.).

- 10See the article «Spain’s manufacturing industry gains traction despite the energy shock, the rise in interest rates and the slowdown in foreign demand» in this same report.

- 11The GVA of real estate activities includes the attributed rents of homes that are occupied by their owners. If we exclude this component (internal estimates based on the CPI for rents), we estimate that the GVA of real estate activities excluding rents contracted by around 10% in 2023.

1) Sectors with high growth

These are sectors with a high growth potential, which will acquire an increasingly prominent role in the economy over time. Among them we find:

- Information and communication technologies (ICT) and professional services: these sectors provide high-value-added services and benefit from high structural growth, given their increasing relevance in an environment in which digitalisation and new technologies are gaining prominence.

- Pharmaceutical industry: in the last 25 years, this sector has gained enormous importance, becoming a key driver of Spanish exports and of private investment in R&D. Its high degree of competitiveness in international markets and of specialisation suggest that the sector has room for for strong growth.12

- Tourism: although it has already surpassed pre-pandemic levels, this sector will benefit from the recovery of purchasing power in the main source countries for tourists visiting Spain, thanks to a decline in inflation and a moderate increase in wages. Spain’s greater geopolitical stability relative to that of competing countries will also continue to play in the sector’s favour. Nevertheless, the weak economic growth of the euro area and a greater willingness among Spanish tourists to travel abroad are factors that will limit its expansion.

- Construction: the supply of new housing (around 110,000 units per year) is much lower than the structural demand due to demographic changes (287,000 net households were created in 2023, according to the Labour Force Survey, due to the significant increase in migratory flows). In 2024, we expect the housing supply to enjoy somewhat more dynamic growth, despite the ongoing presence of short-term factors that are preventing a further revival in the supply (high construction and financing costs, although they are expected to decline over time). For 2025, housing production could increase more rapidly if the right conditions are in place (availability of land, greater public-private collaboration for the development of affordable housing, etc.). Furthermore, construction will benefit from the deployment of NGEU funds, providing a boost to both residential construction through support for the refurbishment of homes, and non-residential construction, thanks to infrastructure development projects such as those related to rail networks.

- 12See «The Spanish pharmaceutical industry» published in the Industry Sector Report 2022.

2) Sectors with near-average growth

There are several sectors for which we anticipate a similar growth rate to that of the economy as a whole, most notably:

- Agrifood: we anticipate that agriculture, forestry and fishing, after contracting by 19.8% in 2022 and by an additional 2% in 2023, could start to recover thanks to the stabilisation of production costs (energy, fertilisers and animal feed). However, the sector is still heavily impacted by the drought affecting much of Spain and its performance remains largely dependent on the improvement of weather conditions and on the sector’s ability to adapt to climate change. Food products will continue to enjoy a trend of recovery, in line with production in agriculture, forestry and fishing and the decline in the prices of its inputs.

- Automotive industry: it endured significant hardship after the pandemic, first due to the disruptions to global value chains and later due to the rise in production costs. This highly unfavourable situation was exacerbated by the structural challenges of a sector that is undergoing technological transformation in the context of the transition to electrification.13 In 2023, the automotive sector enjoyed strong growth (industrial production grew by 9.3%, although it still lies 5% below the level of 2019). We expect the sector to record more normalised but nonetheless significant growth rates in 2024-2025, slightly above 2%.

- Real estate activities: home purchases held up much better than expected in the face of the rise in interest rates, resulting in a stronger overall performance in 2023 than anticipated. We expect that the number of home sales will continue to decline in the first half of 2024. However, in the second half of the year, as the decline in interest rates takes hold and economic activity gains traction, we expect the real estate market to regain vigour and record new growth. Thus, 2024 will be a year of transition and in 2025 we expect the real estate sector to expand more substantially.

- Wholesale and retail trade: the outlook for consumption for 2024 and 2025 is favourable, thanks to falling inflation, job creation (closely linked to higher immigration flows) and a robust increase in incomes as a result of both employment growth (1.9%) and a recovery in the purchasing power of wages. Thus, we expect real private consumption to grow by 2.4% in 2024 and by 2.3% in 2025, up from the 1.7% recorded in 2023. These favourable dynamics will support the trade sector, for which we anticipate positive growth rates only slightly below the average for the economy as a whole.

- 13See «Spain’s automotive industry: strategic and undergoing a transformation» published in the Industry Sector Report of July 2021.

3) Sectors with weaker growth

We do not anticipate a decline for any of the economic sectors considered (in the absence of new shocks), but there are some sectors for which we forecast weak growth, below the average for the economy as a whole. These include certain industrial sectors, such as textiles and paper, which have less favourable secular trends due to fierce international competition and structural cost pressures relative to those competitors. While these industries will benefit from an environment of more stable energy prices, the structural challenges they face will likely continue to limit their capacity for growth.

Reduction of the dispersion of growth rates between sectors

One aspect that will characterise the evolution of Spain’s economic sectors in 2024-2025 is the reduction of the dispersion of growth rates between sectors. This lower variance in growth at the sector level is a consequence of the absorption of – and the adaptation to – the recent shocks that have affected the Spanish economy. Indeed, these trends have already begun to be observed in the first few months of 2024. In the following chart, we show the standard deviation of the annual growth rates between sectors, excluding the refining industry due to its high volatility.

Our forecasts point to a sharp reduction in the dispersion between sectors, especially in 2025, when the various sectors are expected to grow at rates more commensurate with their long-run potential. These forecasts are based on the fundamental assumption that no new major shocks will materialise in the economy and, therefore, that each sector will converge towards its potential growth rate. The state of the economy would resemble the pre-pandemic period, with sustained growth and a more homogeneous performance between sectors.

In 2025 the state of the economy would resemble the pre-pandemic period, with sustained growth and a more homogeneous performance between sectors