The income balance suffers at the hand of the rate hikes

The income balance in Spain shows a historical structural deficit, which is closely linked to the Spanish economy’s debtor position vis-à-vis the rest of the world. However, the deterioration it has suffered in 2023 is closely linked to the rise in interest rates.

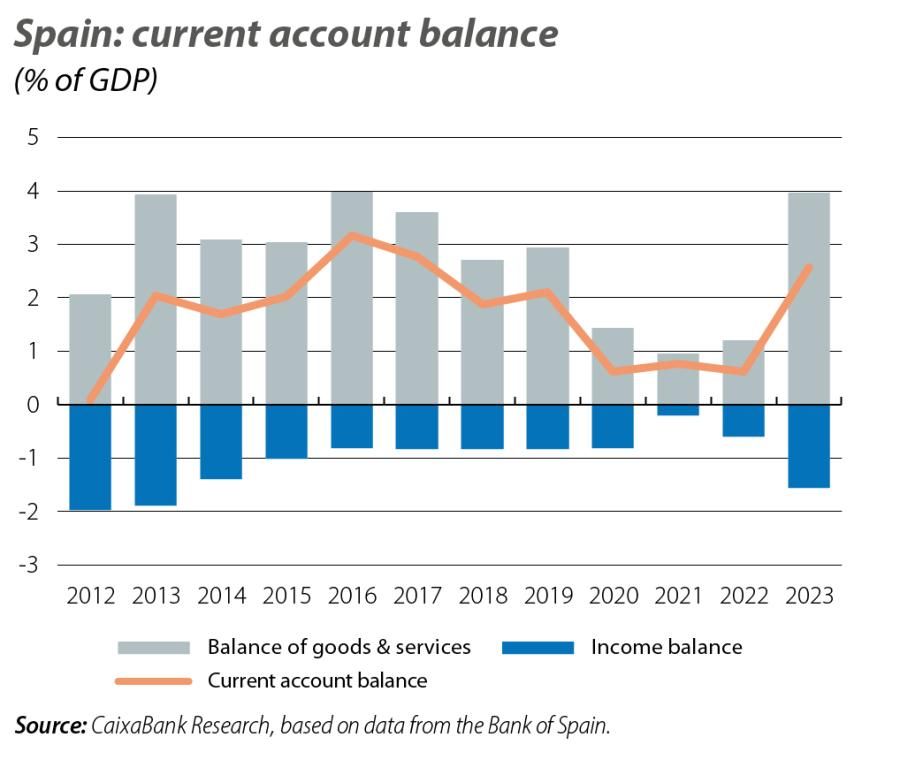

The current account balance showed significant improvement in 2023. After recording a surplus of 0.6% of GDP in 2022, in 2023 the surplus rose to 2.6%. All sub-balances contributed to this improvement, except for income, where the deficit widened to 1.5% of GDP, marking its highest level in the last 10 years. In this article, we will look into the detail of the income balance and analyse the reasons behind its deterioration in the last year. As we will see, the deterioration in the income balance has been closely linked to the interest rate hikes implemented in 2022 and 2023.

What does the income balance comprise?

The income balance is a component of a nation’s balance of payments that focuses on accounting for flows related to the remuneration of labour and returns on capital, as well as unmatched transfers.1 It is divided into two subcomponents:

• Primary income: comprises the income and payments related to the remuneration of a nation’s capital and labour employed abroad and vice versa. For example, primary income includes the wages of Spanish cross-border workers and the returns from Spanish investments abroad, which are recorded as incomes. On the other hand, the returns from foreigners’ investments in Spain are accounted for as expenses.

• Secondary income: records unmatched transfers, such as remittances by foreign workers to their countries of origin or public transfers made to international bodies, such as annual contributions to the EU budgets.

- 1For more detailed information, consult the Methodological Note (bde.es) published by the Bank of Spain.

Origin of the deficit in the income balance

The income balance in Spain shows a historical structural deficit, which is closely linked to the Spanish economy’s debtor position vis-à-vis the rest of the world. The magnitude of the deficit has fluctuated over the years, peaking at 4.2% of GDP in 2008. Since then, there has been a remarkable improvement and stabilisation, with an average annual deficit of 0.8% of GDP between 2014 and 2022. However, 2023 has concluded with a marked deterioration in the income balance, as its deficit has risen to 1.5% of GDP from the 0.6% recorded in 2022, contrasting with the exceptional performance of the balance of trade in goods and services.2

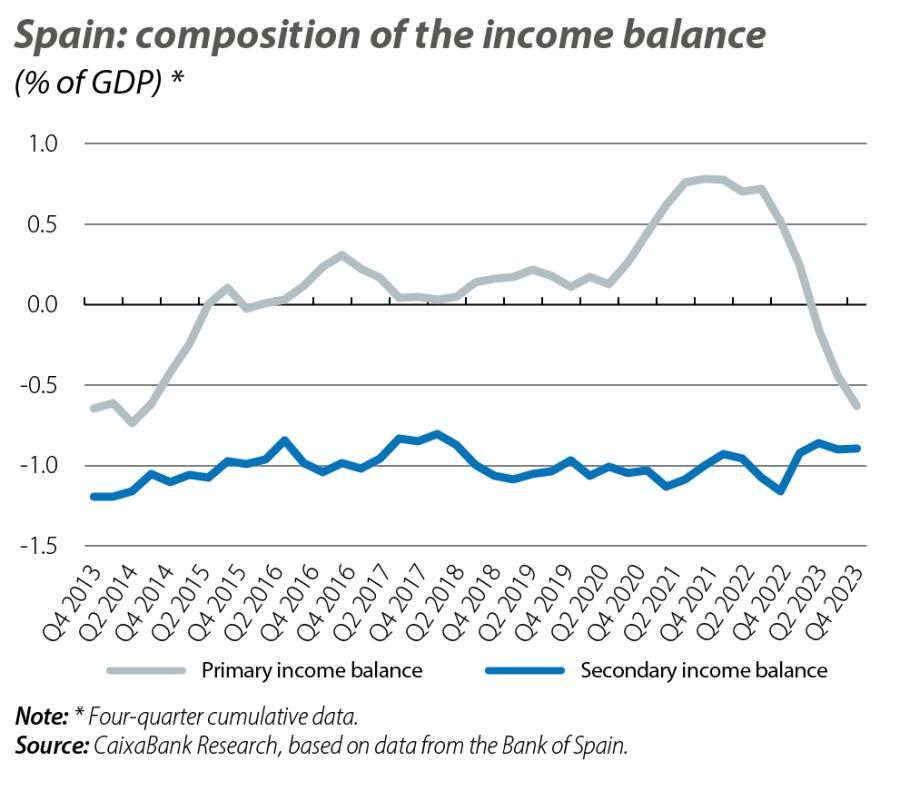

As the second chart shows, primary incomes are the main source of volatility within the income balance, while the secondary income balance has been very stable. Similarly, we note that the deterioration in the income balance in 2023 is attributable to the worsening of the primary income balance, which was negative (–0.63% of GDP vs. +0.5% of GDP in 2022) for the first time since 2016 and was responsible for the entire deterioration of the income balance.

- 2For more details on the performance of the current account in 2023, see the Focus «Spain’s current account balance in the European context» in the MR03/2024.

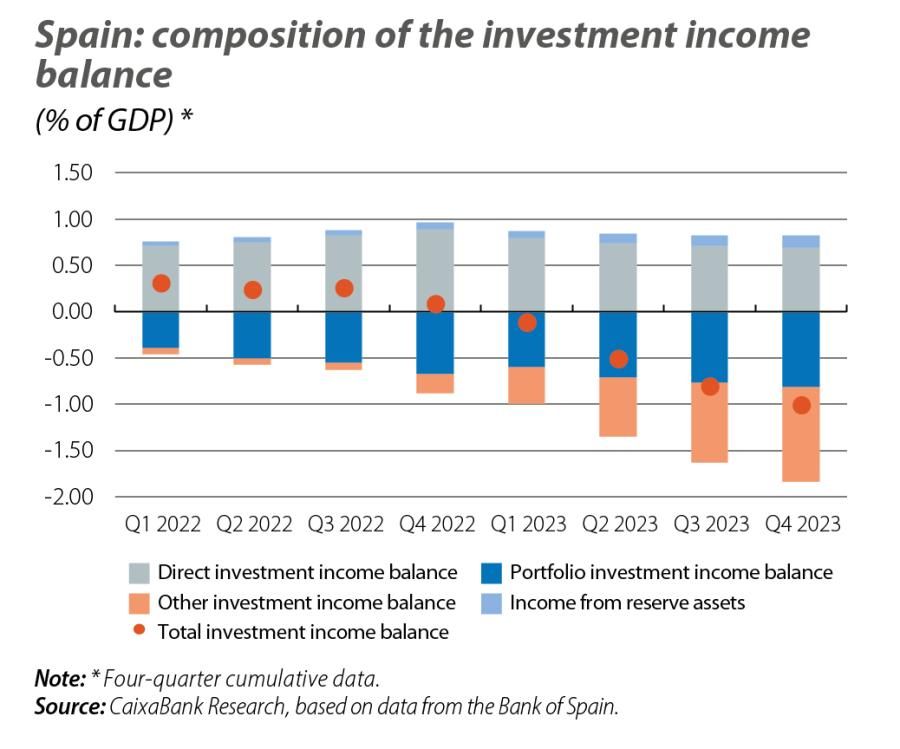

Focusing on primary income, this consists of three elements: investment income, remuneration of labour and other primary income. Investment income makes up the majority of flows in the income balance, accounting for 87% of all revenues and 95% of all payments (average in 2014-2019), and it is responsible for the deterioration of the primary income balance in 2023. Thus, the investment income balance has gone from 0.07% of GDP in 2022 to –1.0% of GDP in 2023.

Looking deeper into the analysis, in the third chart we show the investment income balance, as a percentage of GDP, broken down into its four components: income from direct investment, from portfolio investment, from reserve assets and from other investment.3

- 3Direct investment income includes the remuneration derived from foreign companies operating in Spain and vice versa. Portfolio investment income includes all foreign monetary flows of returns associated with shares and equity holdings in investment funds and debt securities.

While direct investment income and portfolio investment income usually constitute the bulk of investment income flows, the deterioration observed in the last year in the total investment income balance is not attributable to these components, as their balances have remained relatively stable. Rather, the deterioration in the income balance is almost exclusively attributable to the deterioration of «other investment income», which mainly includes interest payments and income arising on deposits, repos and loans, and which has gone from a deficit of 0.2% of GDP at the end of 2022 to one of 1.01% of GDP at the 2023 year end.

The deficit and interest rates

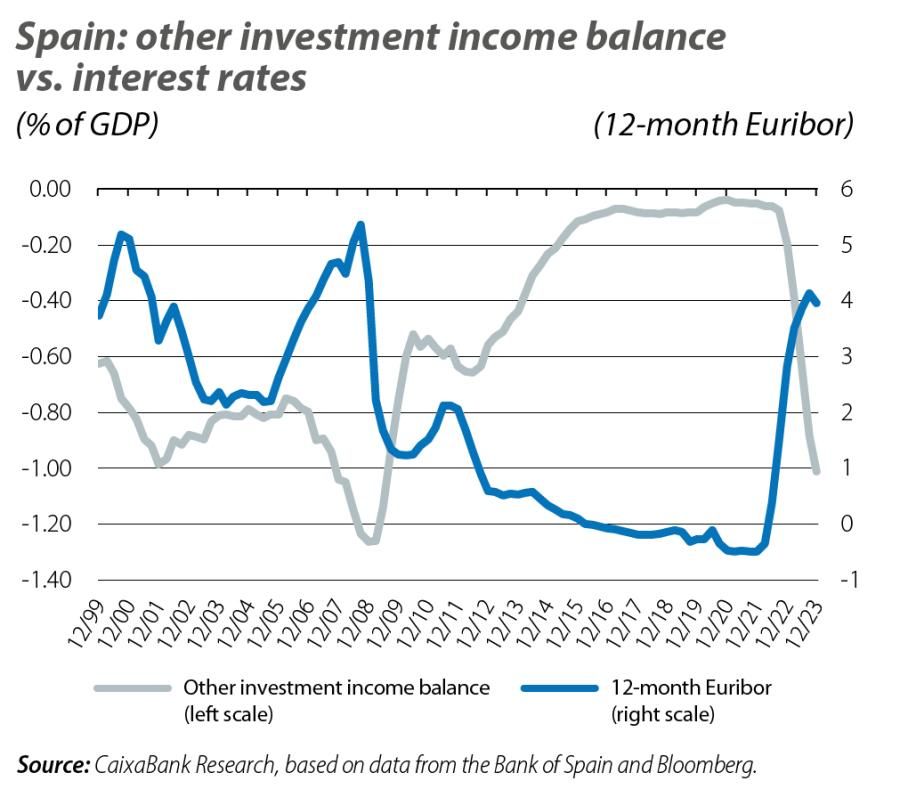

This deterioration in the balance of other investment income in the last year is closely linked to two factors: the change in European monetary policy in the last two years and the increase in the debtor position of Spain’s economy vis-à-vis foreign markets in other investment given the inflow of capital that occurred in 2023, as this has meant that the rise in interest rates has had a greater impact on outgoing payments than it has had on incomes.4

As can be seen in the last chart, the balance of other investment income responds inversely to changes in interest rates: when interest rates rise, the deficit of other investment income increases. This makes sense, as the items included within «other investment» are those that are most sensitive to interest rate changes, as they have an impact on the interest that is payable on commercial loans and deposits. It is also apparent that the impact of the rise in interest rates on other investment income has been quite rapid. According to our estimate, the balance of other investment income is affected by changes in the Euribor that take place in the year in progress and those that took place a year earlier, but the changes that took place two or more years ago no longer have an impact.5 A 1-pp increase in the Euribor would thus result in a gradual deterioration of the balance of other investment income, which would amount to 0.15 pps in the year following the increase in the Euribor. Thereafter, however, the balance would stabilise.

- 4For more information on the evolution of Spain’s net international investment position, see the Focus «The Spanish economy continues to reduce its foreign debt» in this same Monthly Report.

- 5We performed a regression analysis of the change in the balance of other investment income (four-quarter cumulative balance) against the change in the 12-month Euribor in the current quarter, with a four-quarter delay and with an eight-quarter delay. All coefficients are statistically significant except for in the case of the eight-quarter delay.

In short, the rate hikes implemented by the ECB during 2022 and 2023 have had a negative impact on the income balance of our current account. However, given the speed at which rate changes are translated to the income balance, and assuming the ECB begins to gradually lower rates from mid-2024, we can expect the deterioration of the income balance to stabilise in 2024 and a correction to begin in 2025.