Portuguese real estate sector: gentle deceleration

The slowdown in the Portuguese real estate sector is proving less pronounced than expected, at least in terms of housing prices, and this has led us to improve the growth forecast for 2023.

The Portuguese real estate market began to slow in the second half of 2022 as monetary policy shifted gear. Although the ECB has raised benchmark rates by 425 bps between July 2022 and July 2023, the slowdown in the Portuguese real estate sector is proving less pronounced than expected, at least in terms of housing prices, and this has led us to improve the growth forecast for 2023. However, looking ahead to the coming quarters, we continue to anticipate a significant slowdown in the Portuguese property market.

The number home sales fell by 9% year-on-year in the cumulative trailing four quarters to Q1 2023, with a greater decrease in existing homes (–10.9%) compared to new-builds (+0.1%). Although sales have fallen from the record levels registered in 2022 (167,900), they are still 3% higher than those of 2019 (154,800). However, if we look exclusively at the figures for Q1 2023, sales during that period (34,400) were down 20.8% compared to the same period in 2022, with declines in both existing and new homes (–23.4% and –8.3%, respectively). In fact, we have to go back to a period heavily affected by the pandemic (Q2 2020) to find a quarterly sales figure lower than that of Q1 this year: 26,300.

As for where buyers are coming from, purchases made by people who are tax resident outside the country (mostly foreigners) are holding up considerably better than acquisitions made by those with tax residency inside the country (mostly Portuguese nationals). Specifically, the number of purchases by foreigners only decreased by 2.5% year-on-year in Q1 2023, compared to a 22% drop in home purchases by Portuguese nationals. Importantly, this resilient performance of sales to foreigners is occurring even after the strong growth of 2022 (20.2%) and after the heightened restrictions on access to golden visas through the purchase of residential properties. Even among acquisitions made by foreigners, those made by non-EU citizens continued to climb in Q1 2023 (+9% year-on-year). Despite this pattern, home purchases by people who are tax resident outside Portugal represent just 7.2% of the total transactions (i.e. 2,492 units in Q1 2023).

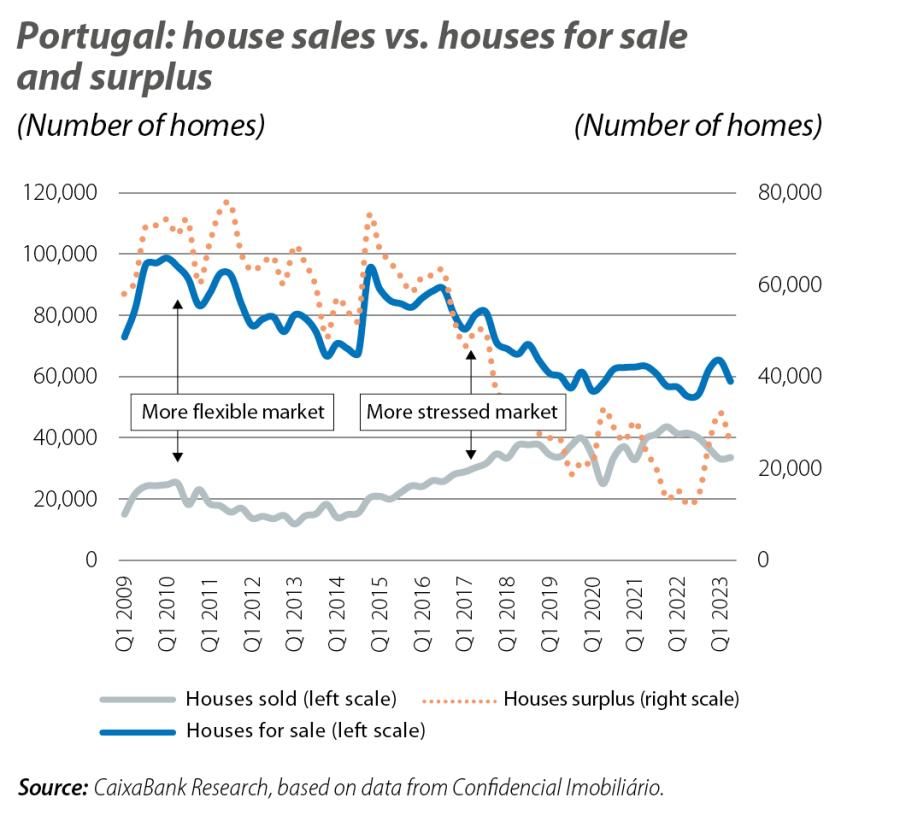

The housing supply remains limited to meet residency needs, taking into account demographic trends. The number of planning permissions granted for the construction of new housing in 2022 was 15,207, well below the average annual net household creation in 2021-2022 (34,000).1 This buoyancy in household formation also reflects significant migratory flows; since 2017 there has been a positive migratory balance, which reached 86,900 people in 2022. Indeed, the foreign population residing in Portugal increased in 2022 for the seventh consecutive year and reached 757,000 people. Another way to reflect this lack of housing supply is through the relationship between homes sold and homes for sale at any given time (see second chart, which includes both new and existing homes). The surplus of homes refers to the difference between the number of homes for sale and those sold: the lower the surplus, the fewer housing options are available to those wishing to buy, and this puts greater upward pressure on property prices. As is clearly apparent from the chart, this surplus has been decreasing over time – a trend which has intensified since 2015. Another factor limiting supply is the high residential construction costs. Although there has been a gradual moderation in construction costs in 2023 to date, in the trailing 12 months to May costs increased by 9.6%.

- 1. In comparison, net household creation prior to the pandemic was around 17,000 households per year on average in the period 2015-2019.

In 2023, we have seen a slowdown in the pace of house price increases. According to the index produced by the National Statistics Institute (see third chart), the year- on-year growth rate was above 10% for six consecutive quarters, before moderating to 8.7% in Q1 2023. From a more regional perspective, we see that the Lisbon metropolitan area and the Algarve were where the median sales value increased the most in Q1 2023 compared to the end of 2022 (+5.5% and +7.1%, respectively). This is partly because these regions have a higher proportion of foreign buyers. In the index produced by Confidencial Imobiliário (which has monthly data), a slowdown in the growth of prices is also evident and is more pronounced in Q2 of the year. In fact, in this index, home sale prices rose by 1.8% in that quarter compared to the previous quarter and registered the lowest quarter-on-quarter change in two years. We have to go back to Q1 2021 in order to find weaker quarter-on-quarter growth.

It is important to recall that there is a time lag between monetary policy action and its impact on the economy. In the case of the real estate market, this impact occurs through two channels. On the one hand, the higher cost of financing discourages a portion of potential buyers with less capacity to access credit, which leads them to seek necessarily cheaper homes. On the other hand, the update of indices for variable-rate loans occurs gradually over time, so the effort perceived by borrowers (as well as a potential decision to sell up) is also gradual. The second half of the year will be important for assessing the impact of the rise in interest rates in this market.

Despite this, in July we revised our 2023 house price growth forecast up to 4%.2 In this revision, we have taken into account the strength seen in price growth in Q1 (+1.3%). The resilience of demand, the short supply of new homes and the high construction costs will continue to support home prices, even in a context of sharp interest rate rises. Moreover, the labour market, with its low unemployment rate, is acting as a safety net for mortgages by limiting defaults, forced sales and price reductions.

For 2024, our outlook is not so optimistic: we anticipate a 2.1% decline in prices. One of the main factors behind this forecast is related to the sharp slowdown in demand. This year we expect that the number of sales will fall more than 20% short of the 2022 figure and that this low level will persist into 2024. Double-digit declines in demand for prolonged periods of time are compatible with price reductions, as we have observed in other developed-country markets.3

The particularities of the Portuguese market, as set out in this article, lead us to anticipate a more moderate reduction. Therefore, we consider it unlikely that we will see a significant correction in prices like that of 2011-2013, when the country was receiving financial aid and household debt was higher.

- 3. See parts I and II of the Focus «Advanced economy housing markets in a scenario of tighter monetary policy» in the MR04/2023.