The Spanish economy performs better than expected and than previously estimated

The foreign sector plays a key role in the National Statistics Institute’s upward revision of GDP for Q1 2023.

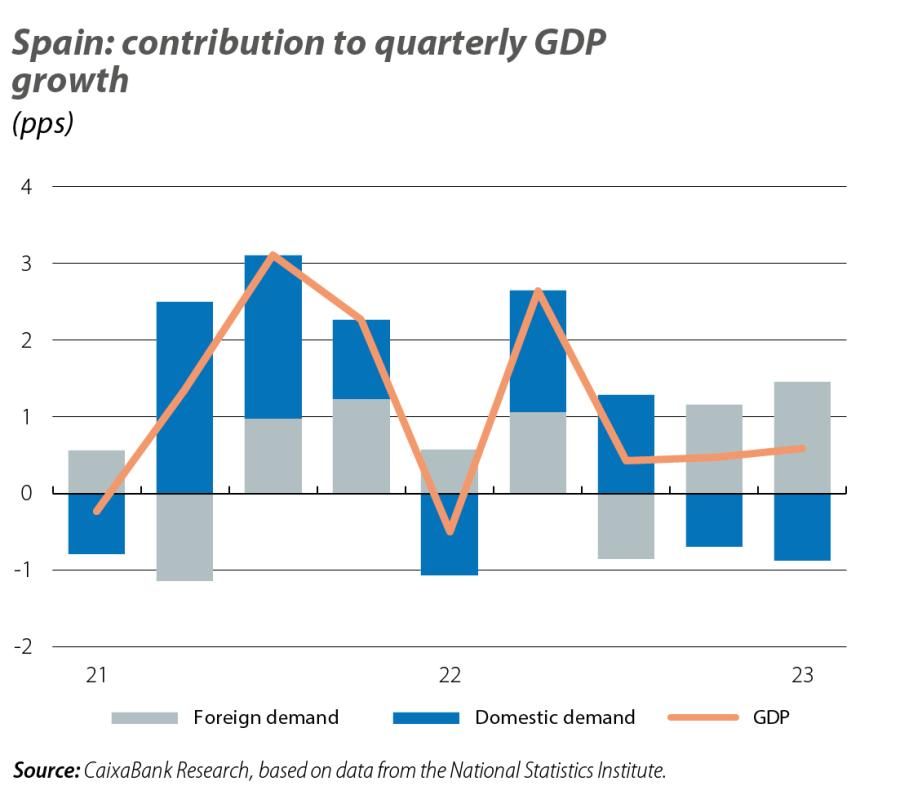

The National Statistics Institute has slightly revised up its GDP growth figure for Q1 2023, now placing it at 0.6% quarter-on-quarter, 0.1 pps higher than initially estimated. The figures for some quarters of 2022 have also been revised, although growth for the year as a whole has not changed (5.5%): while the fall in GDP in Q1 2022 was deeper (–0.5% quarter-on-quarter) than previously announced, the subsequent recovery was also greater, with strong growth in Q2 2022 (2.6%) and Q4 2022 (0.5%). With this new data, by Q1 GDP would have already exceeded the pre-pandemic level (Q4 2019), standing 0.1% higher, rather than 0.2% lower as originally estimated.

By component, the improvement in GDP in Q1 came exclusively from imports, the growth of which has been revised downwards, thereby increasing the contribution of net foreign demand to GDP growth. Indeed, the foreign sector is playing a key role in compensating for sluggish domestic demand, which is hampered by the impact of inflation and tighter financial conditions, although we can expect its positive contribution to GDP growth to be gradually diminished.

The indicators for Q2 offer mixed signals

The indicators for Q2 offer mixed signals and point to a slight loss of buoyancy. Overall, the indicator scoreboard suggests that the economy continues to grow, but at a more moderate rate than in the previous quarter. On the one hand, industry is showing new signs of weakness. These include the decline in the manufacturing sector’s Purchasing Managers’ Index (PMI) to 48.0 in June, which is below the level that delimits expansionary territory (50) and marks a six-month low, and the fall in industrial production in April-May (–0.5% versus Q1). Also, household consumption continues to weaken, as shown by CaixaBank Research’s consumption tracker, which notes 5% year-on-year growth in Spanish card transactions in Q2 (with data up to 21 June), falling short of the previous quarter (9%).

On the upside, the services PMI remains well above the growth threshold, standing at 53.4 in June. In addition, the tourism sector continues to show signs of strength, which leads us to anticipate a very good summer season: arrivals of foreign tourists in May exceeded 8.2 million, 3.8% above the same month in 2019 (+1.2% in April and –3.5% in Q1 2023), and the expenditure of these tourists was close to 8,500 million euros, exceeding the figure for May 2019 by 19.5%.

The labour market continues to perform well, although job creation is weakening

In June, the average number of workers affiliated with Social Security increased by 54,541 people, marking the weakest figure in that month since 2015. It also stands in stark contrast to the figure for June 2022 (115,000) and to the average for the month during the period 2014-2019 (74,000). In seasonally adjusted terms, employment registered a fall of 20,119 affiliates, the first decline since July last year; however, in Q2 as a whole, effective employment (seasonally adjusted affiliates not on furlough) grew by 1.4% quarter-on-quarter compared to 0.9% in the previous quarter.

Inflation continues to moderate

Inflation continues to moderate, and no longer just because of the energy component: the flash estimate for June inflation of 1.9% (3.2% in May) marks the lowest since March 2021 and was a positive surprise compared to our forecasts, mainly due to a greater than expected base effect in the energy 1component. Core inflation (excluding energy and unprocessed food), meanwhile, continued to ease, albeit at a more moderate pace than the headline indicator, standing at 5.9% (6.1% in May). Based on these figures, and in the absence of the breakdown by component, we see downside risks to our 2023 headline inflation forecast (3.9% for the year); the forecast for core inflation (6.2% for the year) also presents downside risks, albeit relatively more moderate ones.

The inflation gap between Spain and the euro area has been in Spain’s favour since September 2022. In June, with provisional data, the harmonised indicator for headline inflation (comparable with Europe) in Spain stood at 1.6%, 3.9 pps below the euro area average.

In the housing market, despite the fall in sales, the slowdown in prices is proving gentler than expected

Home sales fell by 3.4% in the first four months compared to the same period last year, while prices, according to the National Statistics Institute’s index, provided an upside surprise in Q1 2023 by growing 0.6% compared to the previous quarter (–0.8% in Q4 2022). This price resistance is more evident in the case of new housing (3.0% quarter-on-quarter) than in existing homes (0.2%), reflecting the shortage of new construction projects.

Spain’s foreign balance continues to show excellent figures

The current account balance registered a surplus in the first four months of the year of 12,167 million euros, an all-time high for a first quarter and a stark contrast to the deficit recorded in the same period of 2022 (–4,627 million). On the one hand, the tourism sector continues to produce very positive data, with a cumulative surplus up until April of 16,080 million euros, the highest figure of the series in that period. On the other hand, the trade deficit moderated to 10,954 million euros (–21,811 million a year ago): the energy deficit fell to 11,640 million from 16,155 million in the same period of 2022 and the balance of non-energy goods registered a surplus of 687 million, compared to a deficit of 5,656 million last year.

The boost from revenues facilitates the reduction of the public deficit in Q1

The consolidated general government deficit, excluding local government corporations, was 0.20% of GDP in the first three months of the year, down from the 0.35% registered in Q1 2019 and the 0.41% in the same period of 2022. Public revenues grew by a notable 9.3% year-on-year, driven by the strength of income and wealth tax collections as well as social security contributions. Expenditure, meanwhile, rose by 6.8% year-on-year, driven by an 8.5% increase in the social benefits component, which reflects the pension rise (8.5%) as well as the 5.5% increase in the total remuneration of public sector employees.