Did consumption grow in Spain in Q2 2022? What the real-time data tell us

According to CaixaBank’s internal data, consumption grew by 2.2% in Spain during Q2 2022, despite the decline in consumer confidence due to the inflationary pressures and economic uncertainty.

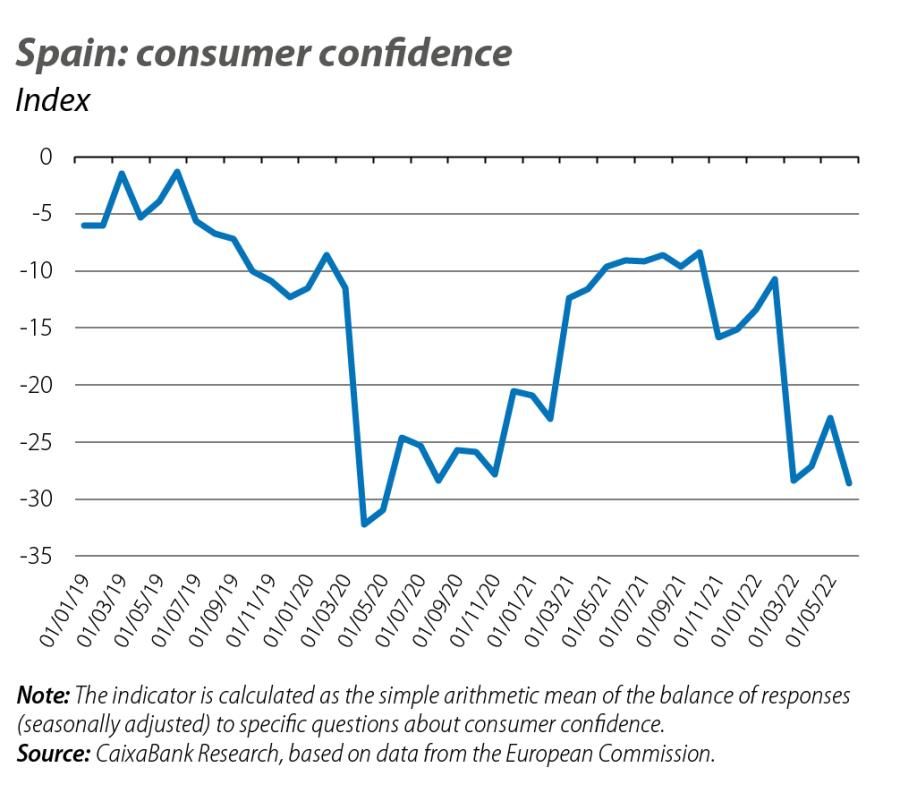

Evolution of consumer confidence

Inflationary pressures and the outbreak of the war in Ukraine have dented the confidence of Spanish consumers in recent months. Data published by the European Commission show that March saw the biggest drop since the outbreak of the pandemic. Since then, consumer confidence has remained significantly lower than the levels observed up until February 2022 (see first chart).

Has consumption recovered from the fall in Q1?

The deterioration in consumer confidence stands in contrast with the good dynamics in the labour market, with nearly a million workers more than in pre-pandemic times.1 During Q1 2022 the former factor dominated over the latter, and as a result real household consumption grew –2.0% quarter-on-quarter (1.5% in Q4 2021). The sharp rise in uncertainty severely reduced real consumption of durable goods, which registered quarter-on-quarter growth of –11.2% (6.4% in Q4 2021).

After June, the big question is whether, in the troubled times in which we are living, consumption will have recovered from the sharp fall of Q1 2022 or whether, on the contrary, it will have once again registered negative quarter-on-quarter growth. Some indicators suggest that consumption managed to get a second wind in Q2 2022; for instance, retail sales in real terms grew 2.6% quarter-on-quarter on average in April/May (–3.1% in Q1 2022), while domestic sales by large corporations (also in real terms) also performed well, up 4.6% quarter-on-quarter (–0.7% in Q1 2022). Vehicle registrations, meanwhile, grew by 26.5% quarter-on-quarter (–29.8% in Q1 2022).

These encouraging signs are also apparent in CaixaBank’s consumption indicator,2 which is particularly useful as it includes data for the month of June, thus offering a complete picture of Q2 2022. In particular, the internal data for Q2 2022 indicate a quarter-on-quarter growth in nominal consumption of 3.0% (see second chart), and we estimate that this will translate into a 2.2% advance in real consumption,3 placing it in line with the other indicators available up to May.4

- 1This decoupling between consumer confidence and the labour market is not unique to Spain. For example, in the US the unemployment rate stood at 3.6% in May, while the University of Michigan’s Consumer Sentiment Index in June registered its lowest level since the series began (in 1952).

- 2This indicator collects real-time information from payments and cash withdrawals carried out with CaixaBank cards (duly anonymised), so it is a good tool for approximating the final consumption expenditure of households according to the national accounting data.

- 3A consumption deflator of 7.3% year-on-year is estimated using an ordinary least squares regression. The explanatory variables included are the first lag of the consumption deflator, the CPI and a binary variable that captures the decoupling between the consumption deflator and the CPI from Q2 2021 onwards. The R² of the regression is 90.1% and the average residual in the last four quarters is 0.1 pps.

- 4It is important to mention that the internal data showed a higher growth in real consumption (3.4%) on average for April and May. In this regard, consumption slowed during June.

Consumption outlook for 2022

For the coming quarters, what happens with consumption will be determined by multiple factors. On the one hand, the inflationary pressures, the rise in interest rates and the uncertainty associated with the economic outlook are likely to continue to dent consumer confidence. On the other hand, however, after two years of pandemic the summer tourism campaign looks set to be strong, with consumers willing to part with some of their pent-up savings accumulated during the restrictions. Overall, for 2022 we anticipate real consumption growth of 1.5%.