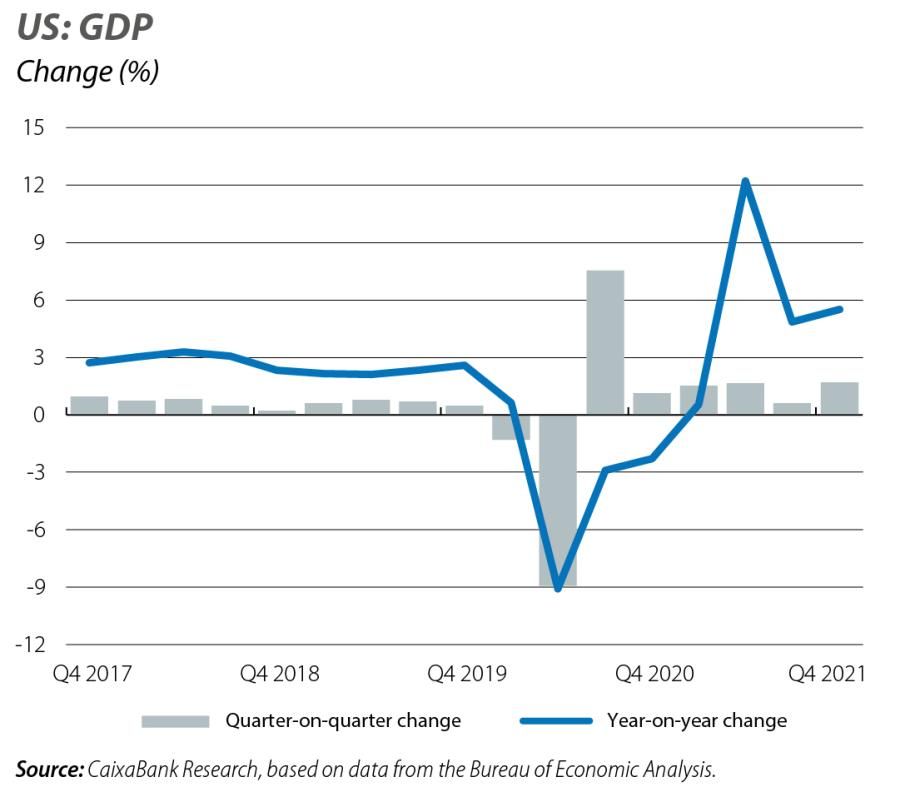

The US economy grew by 1.7% quarter-on-quarter in Q4 2021, a significant acceleration compared to the previous quarter’s growth (0.6%). In 2021 as a whole, US GDP thus grew by 5.7%, having shrunk by 3.4% in 2020 due to the pandemic. The euro area economy, meanwhile, grew by 0.3% quarter-on-quarter in Q4 (5.2% for the year as a whole), thus recovering the level of Q4 2019. However, the aggregate figure for the euro area hides significant disparities between countries. France consolidated its position in Q4 as the driver of the recovery in the euro area, growing by 0.7% quarter-on-quarter (compared to 3.1% in Q3). This places the country’s growth at 7.0% in 2021 as a whole, following the historic 8.0% fall in 2020. In addition to the strong performance of the French economy, Spain also registered significant quarter-on-quarter growth of 2.0%, while Italy registered 0.6% growth, thus consolidating the recovery of some of the economies that were hardest hit by the pandemic in 2020. On the other hand, the German economy was the major absentee in this phase of buoyant economic recovery in the last quarter of 2021. The German engine has shown signs of weakness, with GDP shrinking by 0.7% quarter-on-quarter in Q4 2021, having registered 1.7% growth in Q3. In 2021 as a whole, the German economy grew by a modest 2.8%, following a drop of 4.9% in 2020.

The worsening of the COVID-19 infection curve does not leave the global economy immune. January’s composite PMI flash indicator dropped to 50.8 points in the US (57.0 in December), the lowest figure in the last 18 months, affected by declines in both the manufacturing and the services indices. Across the Atlantic, the composite PMI also fell in the euro area, to 52.4 points (versus 53.3 points in December). The exception to this trend came, surprisingly, from Germany, where the composite PMI rose to a notable 54.3 points (49.9 in December), although the aggregate decline in the European bloc as a whole could not be avoided. The European Commission’s sentiment index confirms this trend, falling to 112.7 points for the euro area as a whole (113.8 in the previous month). In this context, the downward revision of the IMF’s global growth forecasts comes as no surprise. In particular, following a projected advance in the global economy of 5.9% in 2021, the Fund now expects growth to moderate to 4.4% for 2022 as a whole (–0.5 pps compared to October’s forecasts). This is a very similar outlook to CaixaBank Research’s forecasts (4.2% in 2022). The arguments supporting the revision of the IMF’s projections for 2022 include the persistence of inflationary tensions, the supply chain problems and the prolongation of the pandemic. The international institution’s downward revision has been particularly significant in the case of advanced economies, which are now projected to grow by 3.9% in 2022 (−0.6 pps compared to October’s forecasts). In the US the revision was –1.2 pps compared to the October forecasts, placing the US economy’s growth at 4.0% in 2022. The revision for the euro area has been somewhat smaller, placing the forecast for this year at 3.8% (−0.4 pps). The growth forecast for emerging economies is 4.8 % (−0.3 pps compared to October).

US inflation ended the year at 7%, the highest level in almost 40 years, while core inflation continued to rise to 5.5%. With price increases for a large portion of the components, the risks of more persistent inflation are by no means negligible, particularly given the potential impact the Omicron variant could have on the global economy. This impact could come

in the form of significant supply constraints, with possible factory or port closures in Asia, an increase in absenteeism in countries with a greater number of infections, or companies

in many sectors having difficulties in filling job vacancies (see the Focus «The Great Resignation: paradigm shift in the US labour market?» in this same Monthly Report). In this regard, the Fed has already taken steps to address this matter, indicating that it will begin the cycle of rate hikes in March and reduce the size of its balance sheet in 2022 (see the Financial Markets section). In the euro area, inflation reached 5.1% in January, and several countries have seen a substantial increase in their core inflation over the past few months. Thus, we believe that inflation will remain high for much of 2022, but will end the year below 2%. The major unknown, which is drawing the attention of the ECB and analysts, is what will happen with wages. If they grow by more than anticipated, this could accelerate the ECB’s monetary policy normalisation process and lead it to bring forward the first rate hike.

In addition to generating a major source of short-term geopolitical uncertainty, a possible Russian intervention in Ukraine would produce significant economic side-effects, particularly for the European economy. While high-level meetings between Russia, Ukraine and NATO countries are ongoing, the militarisation of the region and the continuous threats of economic sanctions also continue. In the face of these geopolitical tensions, there has been some instability in the financial markets and both countries’ currencies have depreciated. Although our central scenario remains one of de-escalation of the conflict in the short term through diplomatic channels, alternative scenarios such as a prolongation of the tensions for several months cannot be ruled out. This would lead to a rebound in gas prices to the highs of December (though with no pressing supply problems), which would prolong the inflationary tensions in Europe.

Chinese GDP grew by 4.0% year-on-year in Q4 2021, the lowest growth this century besides 2020. In 2021 as a whole, China’s GDP grew by 8.1%, a figure driven by the strong growth achieved in Q1 (with a rebound of 18.3%). However, a slowdown seems inevitable beginning in 2022, given the combined effects of the demographic factor, the onset of a real estate crisis and the maintenance of a rigid zero-COVID policy. According to our latest forecasts, the Chinese economy will see its growth rate slip to slightly below 5% in 2022. Indeed, the latest available economic activity data confirm this moderation (e.g. December retail sales or January PMI). In addition, the new outbreaks in several cities across the country and the subsequent restrictive measures imposed will continue to have a negative impact on economic activity. These factors are compounded by the sharp slowdown in the real estate sector, to which the People’s Bank of China has begun to respond with rate cuts (see the Financial Markets section). On the fiscal side, the Chinese authorities have announced a faster deployment of infrastructure spending and, at the local level, they are promoting measures to facilitate buyers’ access to the housing market.

The economic outlook for emerging economies will, among other factors, depend on the Fed. Higher-than-expected inflation in advanced economies, coupled with more rapid rate hikes, will lead to a tightening of the macro-financial conditions in emerging economies. Russia and Brazil in particular could find themselves in a delicate position. In the event of an escalation of the conflict with Ukraine and the adoption of tougher sanctions, Russia’s economic outlook will be particularly affected. On the other hand, Brazil is facing the prospect of high inflation in an environment of high levels of indebtedness, which could lead to further rate hikes as well as hindering domestic demand.