Will the ECB meet its new inflation target?

Now, although the ECB has tightened the conditions required for an interest rate hike, there are more factors to support the idea that medium-term inflation could lie at 2%, and after more than a decade without doing so the ECB may finally raise interest rates.

In July, the ECB changed its monetary policy strategy for the first time in 18 years. Moreover, it did so by adjusting its inflation target, abandoning the ambiguous target of «below, but close to, 2%» in favour of a «symmetric 2%» target, which leaves much less room for misinterpretation. Furthermore, in order to address the asymmetric effect of the effective lower bound (the minimum interest rate that the central bank can offer is estimated to be around –1.0%), the ECB made clear that it will tolerate inflation deviating above the target rate. With this shift, it seeks to respond to structural changes of the framework in which it operates: the fall in equilibrium interest rates and inflation expectations.1

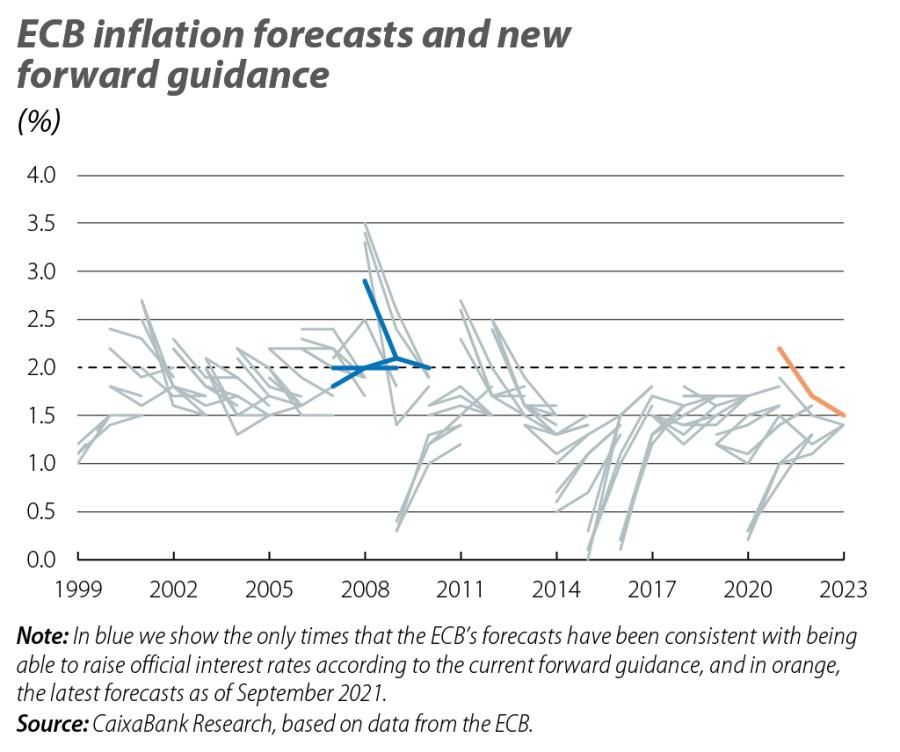

In addition to the alteration of the inflation target, the ECB also changed its forward guidance on interest rates. Previously, the ECB indicated that it would not raise interest rates until its projections (stretching three or four years into the future, depending on the quarter in question) showed convergence towards levels below, but close to, 2%. Now, with the new forward guidance, three conditions will need to be met in order for the ECB to raise interest rates: (i) inflation should be projected to be 2% in the year preceding the end of the forecast horizon, (ii) inflation should be projected to remain at this level until the end of the forecasts and (iii) underlying inflation (core inflation and wage increases, among other indicators) observed at the time interest rates are raised should be consistent with the medium-term inflation target. These new conditions required for raising interest rates are more demanding than the previous ones. In fact, since 2002 there have only been three occasions when inflation forecasts were consistent with these conditions, marked in blue in the first chart.

- 1For more details on the motivation for this strategic review, see «The ECB and the Fed: two mandates, one target» in the MR02/2020.

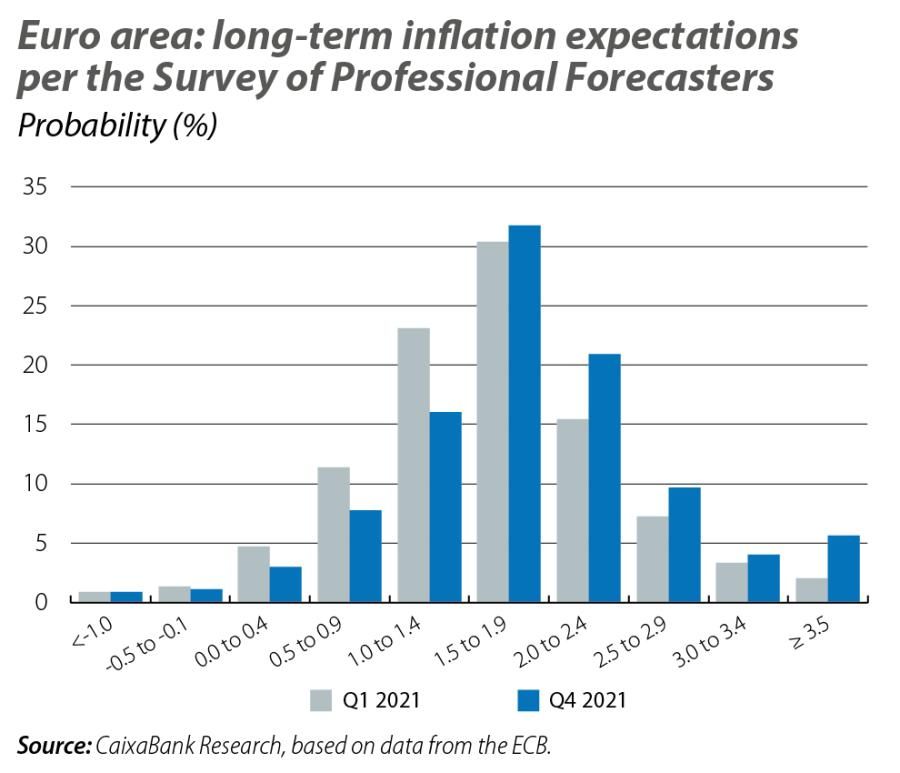

Despite this increased demand for rate hikes, the financial markets are already anticipating a rise in official interest rates in 2023 (according to implicit market rates), whereas prior to the announcement of the strategic review the first rate hike was not expected until late 2024.2 This movement has been accompanied by an increase in inflation expectations (both those based on financial instrument prices and those based on surveys), which in turn has been driven by a combination of the strength of the economic recovery, supply bottlenecks, the spike in energy prices and even the change in the ECB’s strategy itself. On the one hand, inflation expectations based on swaps traded in the financial markets already exceed pre-pandemic levels, and in the short section of this curve in particular they are above 2%. On the other hand, among those based on surveys, the ECB’s Survey of Professional Forecasters (SPF) assigns a higher probability to long-term inflation exceeding 2% (see third chart). But what factors could lead us to this scenario of higher inflation?

- 2At some points in the summer, implicit rates even placed the ECB’s first rate hike in 2026.

Some structural changes in the economy initiated in recent years are inflationary in nature (for instance, the potential reversal in globalisation or the transition to a decarbonised economy). However, there are also short-term elements that could lead the economy to this scenario envisaged by the SPF and financial instruments, and which could thus drive up inflation in the medium term. Specifically, the bottlenecks we are seeing in the production chains of various industries and the spike in energy prices could have second-round effects on inflation.

For the time being, the impact on euro area inflation is moderate in the case of the bottlenecks, and it is limited to the energy component in the case of the spike in energy prices. However, various analysts and the ECB itself consider that these elements, although transitory in nature, could end up persisting through second-round effects. For illustrative purposes, in the last chart we see how an increase in the production prices of non-energy goods similar to that seen in 2021 can push up the price of the services component (which accounts for 45% and 61% of the headline and core CPI, respectively) by as much as 0.8 pps in two years.3

- 3In the case of energy prices, we have performed a similar exercise and we see how the increase in the energy component of the CPI is also transferred to the services component, albeit to a lesser extent.

But it is not just two years from now that the ECB is interested in seeing inflation closer to 2% – it would like to see it in the medium term. It should be recalled that one of the fundamental problems of the European pre-pandemic economy was low inflation, so entering into a new scenario of higher inflation could even be desirable from the ECB’s point of view. Indeed, provided that long-term inflation expectations remain anchored at around 2% and the higher inflation rates are driven by a recovery in demand, the ECB could even welcome the news.

Furthermore, in recent years both participants in the financial markets and analysts have been somewhat hasty in anticipating the ECB’s first rate hike, postponing the anticipated date time and time again. With the Phillips curve half-asleep, there were few elements on which to support a rise in euro area inflation and the consequent rise in interest rates. Now, although the ECB has tightened the conditions required for an interest rate hike, there are more factors to support the idea that medium-term inflation could lie at 2%, and after more than a decade without doing so the ECB may finally raise interest rates.